Janus Henderson Investors Portfolio Manager Jason England and Global Head of Fixed Income Jim Cielinski explain why investors should prepare for “high for longer” rather than positioning bond allocations for an imminent dovish pivot.

The market has framed the last few Federal Reserve (Fed) meetings as “does no increase mean skip or hold?” Having studied the painful lessons from a generation ago of pivoting too early, Fed Chairman Jay Powell reiterated that an additional rate hike remains on the table should inflation’s downward path not meet the central bank’s expectations.

We believe this is another step in Fed’s well-communicated strategy, which prioritizes moving slowly and analyzing economic data from meeting to meeting. Importantly, the Fed continues to weigh the totality of data when making decisions. And in the months since the Fed’s last release of its Summary of Economic Projections (SEP), there has been much data to digest.

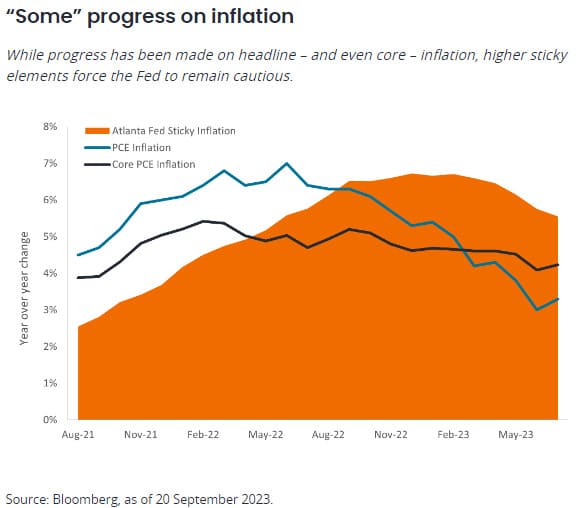

Although the headline year-over-year personal consumption expenditure price index has fallen to 3.3% and its core component to 4.2%, other, more granular measures are likely providing ammunition to the Fed’s hawkish camp. The Atlanta Fed’s annual sticky consumer price index still sits at 5.3%. However, the same series’ 3-month annualized rate has slid to a more palatable 3.6%. With conflicting signals – and a still growing economy, despite 525 basis points (bps) of hikes already – we believe the Fed is justified in staying vigilant.

Maybe too resilient of an economy

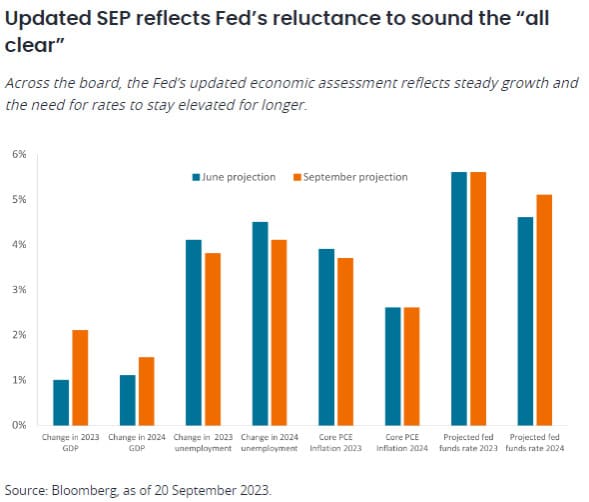

Underpinning the Fed’s circumspect tone was the newly updated SEP. Rate increases are typically effective in lowering inflation insofar as they act as a headwind to economic growth. Yet, with the median projection for 2023 gross domestic product (GDP) growth having been adjusted upward from 1.0% to a much healthier 2.1%, it shows that the long and variable lags of monetary policy may be longer and more variable this time around.

We don’t think the Powell Fed will take the risk that existing cuts will be sufficient. The perhaps surprising resilience of the U.S. economy is evident in the Fed having modified its assessment of growth from “modest” to “moderate” and now to “solid” over the past three meetings. While this supports the notion that the elusive soft landing may be possible this cycle, the hawks are not likely to rest on their laurels.

We don’t think there is a true “dovish” camp in the current composition of Fed voting members. However, the centrist group can point to 2023 core inflation expectations being downwardly adjusted to 3.7% (from 3.9%) as evidence that existing cuts are working their way through the system and that more time is needed for additional progress. This is why we view the Fed’s “skip” tactic as a prudent compromise between the two camps.

The Fed upwardly revising its own expected path of rate hikes more than anticipated left no doubt that this was a “hawkish skip.” While it still expects one additional hike in 2023 (and the market does not), the central bank reduced the number of 25 bps cuts it foresees to be necessary in 2024 and 2025 by two, with the fed funds rate expected to now finish those years at 5.1% and 3.9%, respectively.

Implications

Markets by nature are forward looking, and anticipating inflection points in rate regimes and the economic cycle presents opportunities to harvest excess returns. We are not yet at such a point. We believe there are too many variables at play, including continued labor market tightness and notable geopolitical risks.

As seen by the yield on the 2-year Treasury sitting above 5.0%, the market has come to terms with a Fed that is laser-focused on ending this bout of inflation. But with the end of hikes likely on the horizon, shorter-dated bonds present attractive opportunities for yield that did not exist two years ago. Investors won’t need a pivot to generate returns at these points on the curve, as we believe “elevated for longer,” regardless of the end level, is the order of the day.

Within credit, securitized instruments – e.g., asset-backed securities, mortgage-backed securities, and loans – have priced in more economic softening than have corporate credits and, consequently, may appear attractively priced should a soft landing, or even a shallow recession, materialize.