Readers of the financial press recently will have noted the term “US debt ceiling” popping up frequently in the market narrative. It is one of those potential events in markets where there is a very, very small probability of a really bad thing happening, but if it does, oh Lordy, step back and fear the market’s wrath! To assist with setting the tone, the following is from the US political drama series, “The West Wing”, a junior staffer asks: “so this debt ceiling thing is routine, or the end of the world?” White House press secretary Toby Ziegler replies: “Both.”

What is the US debt ceiling?

The US debt ceiling is a legislative limit on the amount of national debt that can be incurred by the US Treasury. It was first created in 1917, and is arguably outdated and similar limits are very rare amongst peer nations. The current limit is set at US$31 trillion, triple what it was after the financial crisis in 2009. Because the US Federal Government runs budget deficits – meaning it spends more than it brings in through taxes and other revenue – it must borrow sums of money to pay the bills. These debt obligations include funding for social security programs, interest on the national debt and salaries for government employees. The US Treasury reached the ceiling in January 2023 and has had to take extraordinary measures to manage the books. These measures are expected to be exhausted by June 1st.

When the US Treasury spends the maximum amount authorized under the ceiling, Congress must vote to suspend or raise the limit on borrowing. While Congressional leaders in both parties have publicly recognized increasing or suspending the limit is necessary, congressional brinkmanship over the issue in modern times has increasingly led to disruption, including government shutdowns, and the spectre of default that has threatened to push the US economy into crisis.

Since 1960 Congress has acted 78 times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents. So, there is form here, increasing the limit, although the 77th and 78th times, in 2011 and 2013 respectively, did not come without a struggle. Politicking took the debate in these two instances right down to the line, and the political circumstances haven’t improved.

What happens if the limit isn’t increased or suspended?

The US government would declare it can no longer pay its debts, and effectively default, an outcome that is historically inconceivable. Predictions on such a turn of events vary in their severity, all of which are grim. Moody’s stated should the US default on its debt “GDP would fall by close to 4%, six million jobs could be lost, mortgage and business interest rates would spike, and US$15 trillion would be wiped off the value of assets markets.” US Treasury Secretary Janet Yellen has described this sequence of events as “catastrophic…and…failure to meet the government’s obligations would cause irreparable harm to the U.S. economy, the livelihoods of all Americans and global financial stability.”

What are the broader ramifications of a US government default?

Such an eventuality would wreak havoc on global markets, likely dwarfing the financial crisis triggered by the Lehman Brothers collapse. The creditworthiness of US treasuries has long supported demand for US dollars, contributing to their value and prevailing status as the world’s reserve currency – around 60% of the world’s foreign currency reserves are held in US dollars. Accordingly, any hit to confidence in the US economy, whether from actual default or the rising uncertainty surrounding its potential, could cause investors to abandon US treasuries (yields spike higher) and thus weaken the US dollar. US assets in general would come under immense selling pressure.

What is priced into markets here and now?

Before going into any detail, it is worth noting that historically there have only really been two periods where an agreement to increase the debt ceiling has gone right down to the wire. Accordingly, lessons from the past are scratchy. Starting with stocks in general, and the S&P 500 in particular, the index is up +6.1% since the debt ceiling was reached (the ASX 200 is off, -3.0%). At face value stock markets are ignoring the situation. Arguably, other global events have occupied investor’s attention, namely inflation, monetary policy, credit crunches and recession risk and then toward the end of Q1, US regional bank failures. Stock market volatility has been elevated through this period, but nothing more than what we have observed in the past year or two. While the debt ceiling is gaining real estate in the broader narrative, its impact on markets has been muted thus far.

What about bond markets?

Similar to stocks in that other factors are likely influencing sentiment and trends, again it is inflation, recession risk and monetary policy settings as the unholy trinity right now. No signs of concern in bonds either. Although, toward the very front of the curve we’re seeing signs of concern. Yields on short-term money-market instruments such as 1mth, 2mth and 3mth T-bills have already shot up over the past few weeks on concern that the X-date — when the Treasury will have exhausted all its special accounting manoeuvres — is drawing closer. For instance, 1mth T-bills have seen their yields surge more than 100 bps this month alone to a cyclical peak of 5.46% (since back at 5.20%).

Credit markets, or specifically Credit Default Swaps, or CDS markets appear to be most sensitive to the situation. At the beginning of the year, US Government one-year CDS premiums were trading at 15 bps, which reflects default probability of approximately 0.25%. CDS spiked to 77 bps with the debt ceiling being reached, and then spiked again mid-April to 176 bps as the urgency of messaging from the US treasury grew. Default probability is now at 3.0%. For comparison, Australia’s sovereign CDS is steady at 21 bps, albeit up from 17 bps at the beginning of the year. Cash credit spreads have been more focused on primary activity, which I expect will continue. Back in the day, during the 2011 experience, we observed no meaningful weakness in cash spreads.

During the 2011 impasse, spreads reached a peak of about 80 bps, and during the 2013 re-run, the market reaction was similar, with the spread touching about 78 bps. Stocks during the 2011 impasse showed similar apathy to the matter that we’re now experiencing, right up until the death nell. The date at which treasury would run dry was July 31st, 2011. Two weeks before this date, the S&P 500 was up +7.0% YTD, and then with no progress in debt ceiling discussions, the S&P 500 proceeded to fall -17.0% in three weeks. Eventually an agreement of sorts was met and stocks rallied into year-end, +14.4% from their intra-year lows. There was some collateral damage though, the government was downgraded from AAA to AA+ just days after agreeing to increase the debt ceiling.

Still in 2011, as the July 31st deadline approached, bond yields plummeted, both in US and AU, in fact more so in the latter. US 2Y treasury yields fell -26 bps in the week leading up to the deadline, while ACGB 3Y yields fell -81 bps. The cyclical trend in yields was lower, so the debt impasse just accelerated the move – note, official cash rates were unchanged through these events, but two rate cuts came in the latter quarter of 2011. Yields ended the year lower again. In the case of US treasuries, a perverse reaction given growing risk that theoretically these were the instruments potentially defaulting and as such did occur, the consensus view is investors would abandon US treasuries if they defaulted.

Going forward

If the debt ceiling goes down to the wire, the closer we get to said wire, the more volatility we’re likely to see. If it plays out like 2011, equities will come under selling pressure toward the back half of May (assuming no agreement to increase the ceiling before-hand), while bonds will see yields decrease (price higher), as crazy as that sounds. Cash credit spreads should prove resilient, and at worst range trade. Synthetics will be volatile, moving in step with any equity market volatility. All told, the surge in CDS pricing and money-market bills shows investors aren’t willing to assume that common sense will prevail at the end of the day. But, should the worst happen and the US defaults, it will likely be cured in quick order once the politicians recognise the error of their ways. Unfortunately, the degradation of US prestige from their actions will likely linger.

Note…. for some local context, Australia did have a debt ceiling, introduced in 2008-2009 in response to the financial crisis. Thankfully, it was short lived with the ceiling abandoned almost 10 years ago.

[1] A CDS is financial derivative that allows an investor to swap or offset their credit risk with that of another investor. Investors can buy credit risk synthetically, or sell it. If an investor has concerns about the underlying credit quality of an issuer, they can buy a CDS that essentially protects them in the event of default.

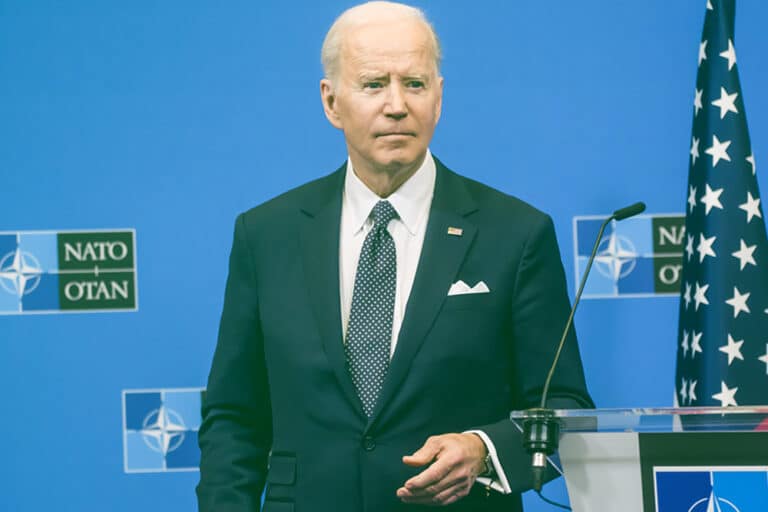

Image: ©coffe72/123RF.COM