Including fallen angel bonds in a diversified portfolio may provide an attractive opportunity for Australian investors to increase returns and reduce risk. Yet options to invest in them are very limited as few exchange traded funds (ETFs) offer exposure, raising the need to engage active fund managers, who are also better positioned to reap these potential returns.

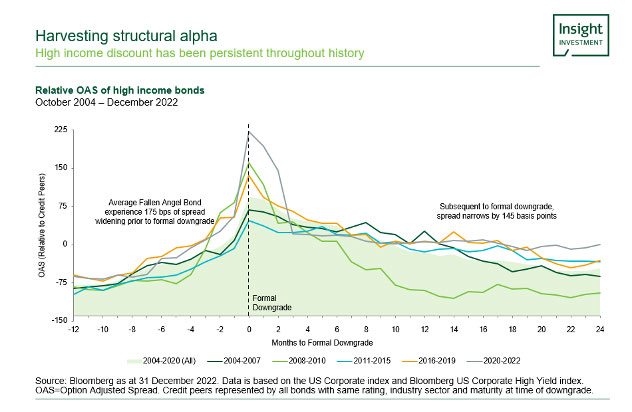

Fallen angels are bonds which have been downgraded from investment grade or BBB status and now sit at the top of the high yield market with a BB credit rating. These bonds are often sold off shortly after a credit rating downgrade; many institutional investors are forced to sell them to adhere to their investment grade credit guidelines. Given the level of forced selling, spreads typically widen on the bonds, creating an attractive buying opportunity at supressed prices. Over the subsequent 12 to 24 months, many fallen angels will often recover in price, potentially delivering strong returns for investors. This is essentially a ‘structural alpha’ opportunity, and a big reason why fallen angel bonds should return more than the wider high yield bond market. The chart below illustrates the opportunity to harvest alpha from fallen angels, with spreads narrowing sharply after a ratings downgrade.

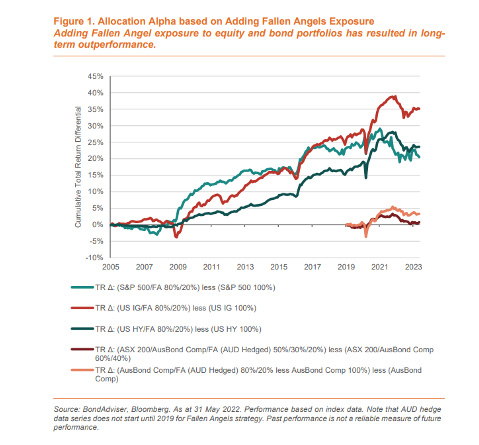

Given this opportunity to reap alpha, adding a fallen angel exposure to equity and bond portfolios can result in long-term outperformance. Going back to 2005, outright total returns on the Fallen angel asset class have been superior to high yield bonds, leveraged loans, investment-grade corporate bonds and equities, as the chart below shows. Such strong performance often comes with higher volatility, but importantly, much of this is positive upside volatility. Even so, time and patience are needed so investors can move through the ups and downs to achieve a strong risk-adjusted medium to longer term outcome.

Also read: Reassessing The Outlook For Yields

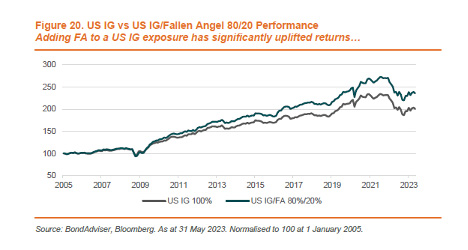

The potential long-term outperformance is supported by other analysis. If we examine an example of a portfolio invested entirely in US investment grade bonds, a weighting to fallen angel bonds can provide a significant uplift to historical returns, whilst offsetting the increase in the volatility involved. The chart below illustrates this.

Given the potential opportunity to boost risk-adjusted returns, investors must then decide on the most appropriate investment vehicle. Active management offers clear advantages over ETFs. Fallen angel bonds possess unique characteristics which mean active management is essential to leveraging bond price movements. Due to the short-lasting nature of excessive selling when a corporate bond is downgraded, an active manager is in a stronger position than an ETF to benefit from this and generate excess returns.

In contrast, an ETF or index typically has a monthly rebalancing frequency and has little-to-no discretion over the timing of a purchase or the credit selection. This limits the rate at which investors can change investment allocations with an ETF and precludes the ability to capture most mispricing opportunities in credit markets.

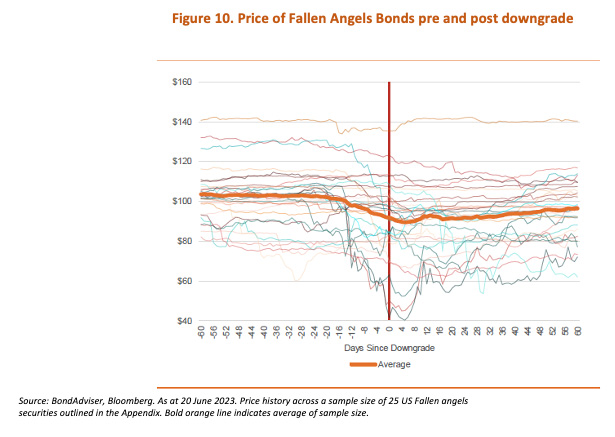

Another problem is that some ETFs are governed by asset allocation rules which may prohibit them from investing in a bond that has been downgraded by just one credit rating agency, which means the ETF may miss an opportunity to invest in bonds which have fallen in price as a result of one credit rating downgrade. Here, a skilled fund manager with greater flexibility can exploit the opportunity to drive greater performance This is illustrated by the graph below which shows price behaviour 60 days pre and post a single rating agency downgrade. Historically, an active approach that can invest one trading day after a downgrade has made 3.1% additional return relative to a rules-based approach that only allows investment 21 days post downgrade.

Options for Investors

Access to the fallen angels opportunity is very limited for Australian investors; in fact, there are no ETF options for Australian investors in a Fallen angel’s strategy. Of the 566 ETFs investing in fixed income across the Australian and US markets, there are just two that invest in Fallen angels, both of which trade on the New York Stock Exchange, rather than locally.

Even then, there exist drawbacks to investing in bond ETFs. Some ETFs can trade at a significant discount to their Net Asset Value (NAV), which can lead to beyond fair-value losses for investors if purchased at a higher price. Other drawbacks include tracking error and an ETF’s lack of control over individual bond selection which may not align to investors’ risk preference.

Alternatively, there are more options to invest in Fallen angels through active fund managers, which have more flexibility to take advantage of the alpha such bonds offer. For a portfolio that is biased to Australian assets, our research suggests that the greatest improvements to portfolio returns would be from allocating a portion of an existing traditional fixed income allocation to Fallen angels. For example, the inclusion of a 20% allocation to Fallen angels to the AusBond Composite Index portfolio only slightly increases credit risk but results in superior risk adjusted returns and clear diversification benefits. The optimal choice for fixed income investors is clear: Fallen angels can deliver real portfolio benefits and superior risk-adjusted returns.