There are plenty of scams around, but be warned, they are getting more sophisticated and look the part. This week, we were made aware of a scam offering a CBA bond with a 9% yield.

This looks like a very attractive deal, but CBA debt is not going to trade at 9% when the cash rate is 3.60%. If a yield looks too good to be true, it probably is. If you are thinking of investing with a new entity or bond broker, you must do your research.

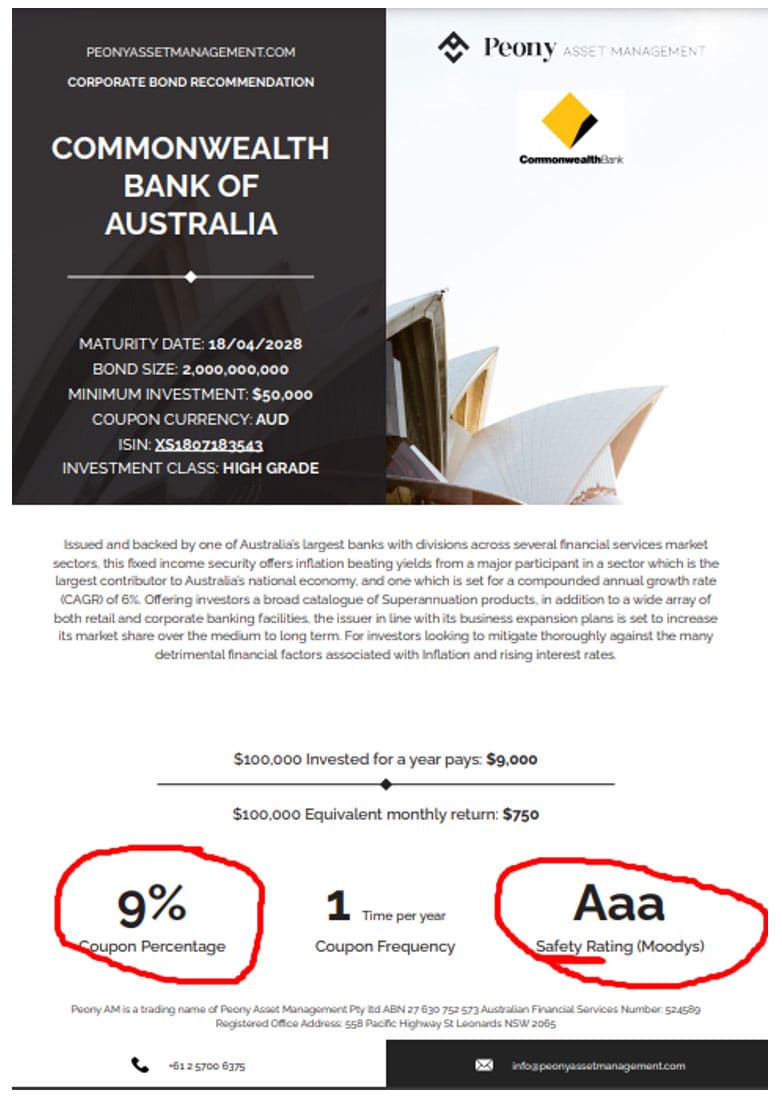

Peony Capital is not a legitimate financial entity even though the brochures look authentic. See samples below.

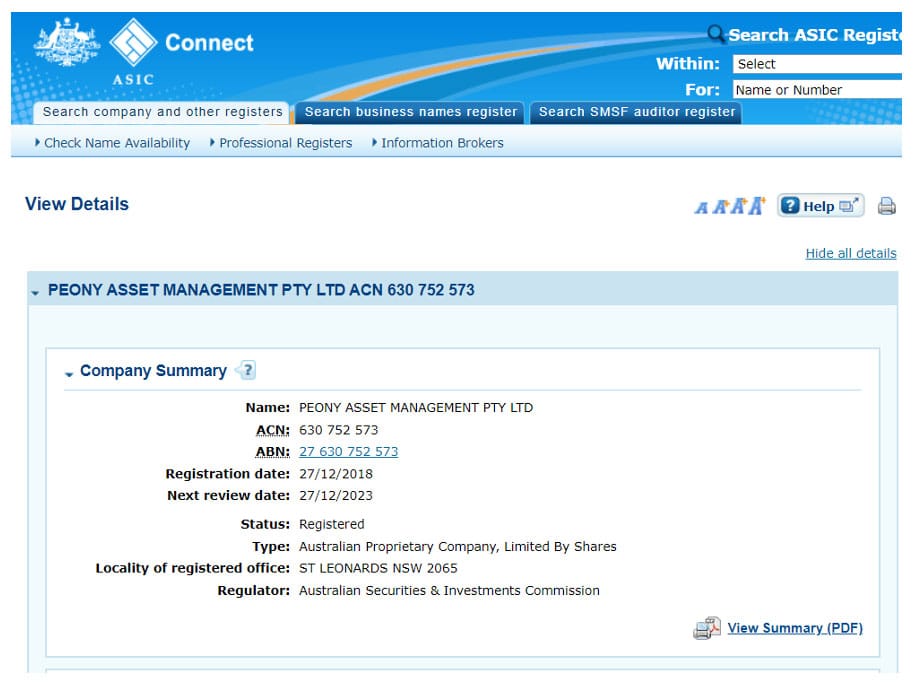

The first thing I would do is read all of the information and check if the financial institution is licensed with ASIC.

The front page lists an ABN and Australian Financial Services Number. I looked up the company using the ASIC register and there is a Peony Asset Management with an ABN that corresponds to the front page of the brochure.

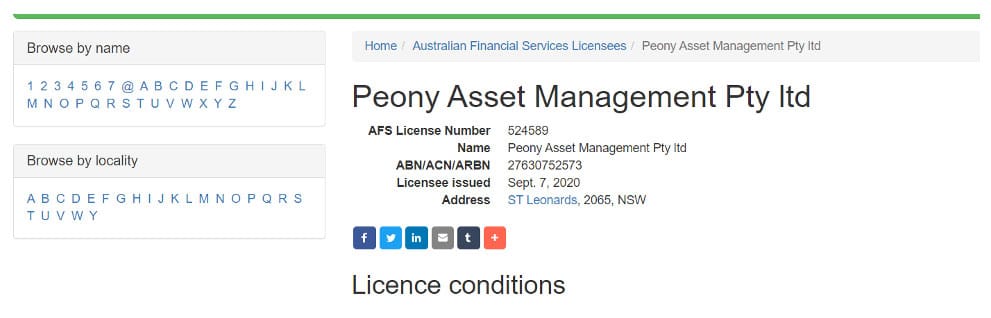

The company passes this hurdle, so I then looked up its Australian Financial Services License Number known as an AFSL. Note the brochure uses Australian Financial Services Number, which is not the right term, but close. This is what I found.

It lists the company and the AFSL as 524589 and the brochure’s number is the same. This is not good. It’s easy to see why investors are fooled and invest but there are other checks you can do.

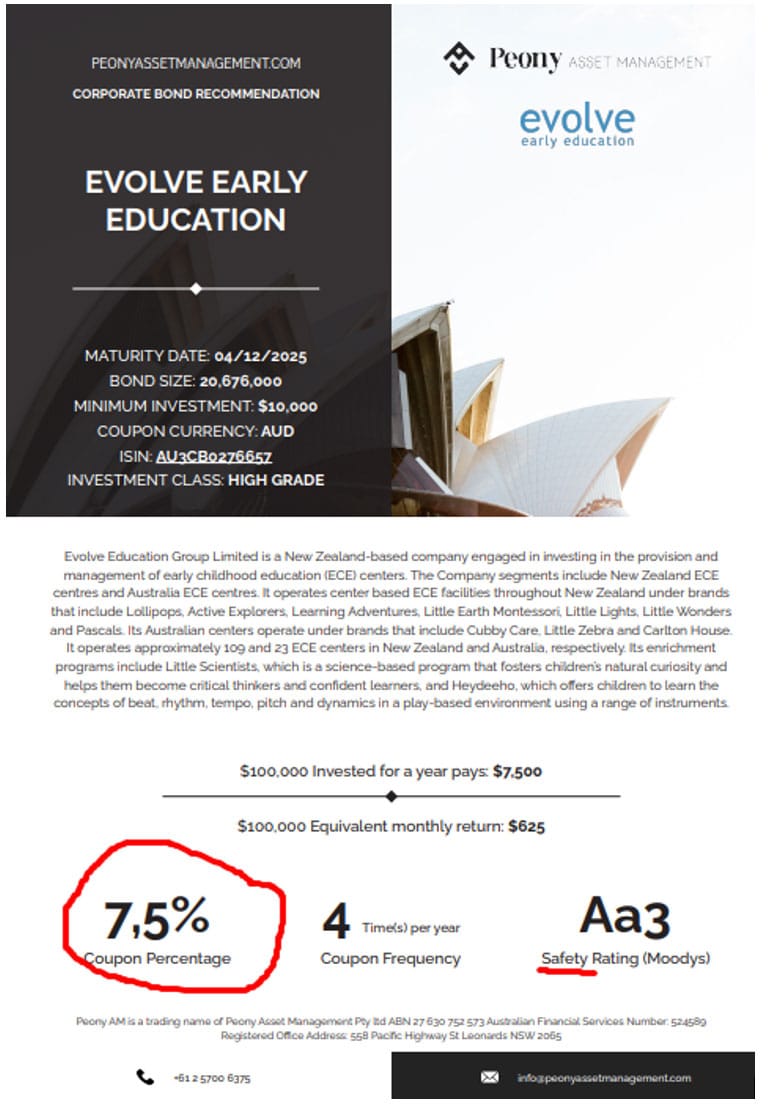

Usually, there are errors in the document itself. Note the comma in the listed coupon, this isn’t how Australian companies would show a yield. Further, the credit rating is listed as a ‘safety’ rating. Safety is a word authorised financial institutions are not allowed to use.

The biggest red flag in the Peony Asset Management brochure is on this page, which offers the CBA bond at 9% and states it is AAA rated. While CBA’s covered bonds may be AAA rated, the vast majority are not. The closer a security is to a AAA credit rating, the closer it will be to a government bond of a similar term.

The yield itself is just not realistic. But you wouldn’t necessarily know. Read widely. Just searching the Fixed Income News website for CBA shows two recent issues, one paying 4.75% and the other 6.704%.

I’d suggest if you are interested in bonds, call one or more of the companies listed on the Fixed Income News Website under the Bond Portfolio tab. Ask them if they’ve got any CBA bonds, or whatever has taken your eye and the yields available. Bond brokers are looking at markets every day and can help you identify a scam, but also show you what’s available and the yields on offer.