Liz Harrison, Fixed Interest Analyst – ESG at Janus Henderson, discusses how the change of government could see confident commitment to net zero targets and what that means for bond investors.

Key takeaways

- The new Labor government has committed to decarbonising the economy.

- Across federal, state and corporate Australia, initiatives to support action on climate change and decarbonisation will need to be funded.

- Rising levels of sustainable issuance are already evident, which should see additional momentum given the federal government’s strong commitment to change.

If there was any uncertainty about how Australians felt about climate change and the need to decarbonise the economy, the federal election was an informative poll on the matter. Lack of action on climate change has been identified as a key contributor to the Morrison government’s demise. With Labor’s ambitious targets and policies a key election platform, renewed support for climate change action will lead to more fixed interest investment opportunities across public and private sector issuers.

Labor’s decarbonisation policies supportive of the net zero transition

The newly-elected Labor government has communicated a clear focus on addressing climate change, committing to more ambitious goals than its predecessor, with a 43% reduction target for greenhouse gas (GHG) emissions by 2030. That said, pressure from minor parties and independents for greater reductions may even see these targets increased.

Beyond emissions targets, Labor has also committed to other policies, including a target of 80% renewable energy in the electricity mix by 2030. A lofty goal, the government aims to achieve this through community batteries, low-cost solar banks, the building of new electricity transmission infrastructure and improvements in existing industry’s energy efficiency. Assisting industries to decarbonise is also a key initiative, including through agricultural methane reduction, transitioning to low carbon fuel, supporting green hydrogen, waste reduction and the manufacturing of ‘green’ metals and clean energy. On top of this, tax incentives to buyers of electric vehicles and the potential for setting pollution limits on the country’s biggest polluters will also help to transform the business sector over the coming years.

State government initiatives put Australia on track

Outside of federal government activity, state governments had already put Australia on track for a net zero economy through their individual actions, with each making commitments to achieving this target using their own individual road maps.

New South Wales:

A leader on addressing climate change, it became one of the first jurisdictions in the world to set a net zero objective. They have the most ambitious plan, with a detailed energy road map declaring five Renewable Energy Zones that will deliver affordable, reliable energy and replace the state’s existing power stations as they come to their end of life.

Victoria:

The Victorian government has committed to reducing greenhouse gas emissions by 45-50% by 2030, with half of the state’s energy to come from renewable sources. All government operations, including schools and hospitals, are to be run on 100% renewable energy sources by 2025. Victoria is also looking to phase out natural gas and focus on innovations in renewable hydrogen power. The Victorian government also announced targets and subsidies for electric vehicle uptake.

Tasmania and South Australia:

These states are targeting renewable energy to supply more than 100% of their electricity consumption.

Corporate Australia committing to action

Pockets of the Australian corporate sector have been transitioning to net zero over the past five years, however, research suggests that only about half of Australia’s 150 largest companies have made a public commitment, with less than 10% of those having registered their commitments with the SBTI (Science based Target Initiative).

While the statistics are poor, through our engagements with issuers we have identified that many more companies actually do have sustainability targets and frameworks in place, and are in the process of having them formally reported.

Australia is still a long way behind Europe in terms of decarbonisation efforts, but it sets a benchmark and should provide corporate Australia with the confidence that a region can commit on climate action and net zero goals, while maintaining economic prosperity and stability.

Within our Australian Fixed Interest portfolios, we only invest in companies that are stable and sustainable in credit quality and Environmental, Social and Governance (ESG) risk forms an important part of our decision on whether to approve an issuer for investment. As it stands, approximately 25% of our investable universe are ‘un-investable’ due to ESG risks – which includes companies unable to transition. Given the push for change, we expect some destabilising in old assets and an elevation in stranded asset risk, whilst creating new opportunities for companies willing to pivot. We view ESG risk alongside business risk, financial risk and management risk and like many of our peers see companies without a credible decarbonisation strategy as un-investable. For those we do invest in, issuer engagement is vital to understanding how management are navigating the transition pathway and also enabling a forum where we can encourage better practices.

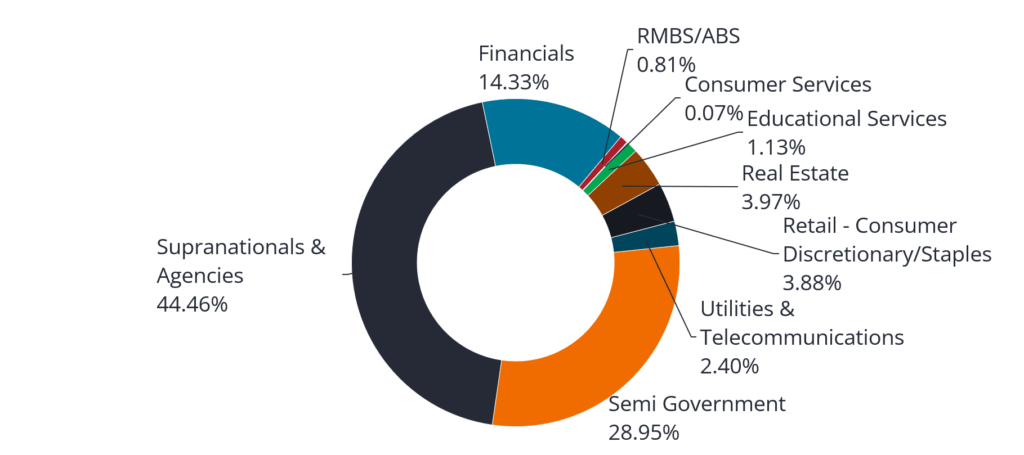

What does this mean for investors?

Across federal, state and corporate Australia, initiatives to support action on climate change and decarbonisation will need to be funded and this is already evident in the rising levels of sustainable issuance. In terms of the ‘labelled’ positive impact market in Australia, this has grown significantly in the past three years, with the majority of funding directed towards environmental projects/targets. This includes Green bonds, Sustainability-linked bonds and Sustainable bonds (issued off a sustainable bond framework).

Chart 1: Australian dollar sustainable issuance

Source: Janus Henderson Investors, Bloomberg, as at 31 December 2021.

Chart 2: Sustainable debt market issuance by sector

Source: Janus Henderson Investors, Bloomberg, as at 31 December 2021.

With a new government focused on climate action, we expect additional opportunities for investment to present themselves across a broad range of projects and initiatives. With the market for sustainable Australian dollar bonds maturing, this is facilitating capacity and the ability to capitalise on our position of influence as longstanding investors in order to support positive change.