Recently, I’ve been looking at funds that have returned 10% plus in the last 12 months in the articles Two Fixed Income Funds Return 10%+ Over Last Year and More Fixed Income Funds Join The 10%+ Return Party.

Concurrently, I’ve been doing some research on emerging market investments, using our ETF Finder, and thought I should check the high yield ETFs to see if any were sitting on 10% plus returns. To my complete surprise, the iShares Global High Yield Bond (AUD Hedged) ETF (ASX:IHHY) has joined the party.

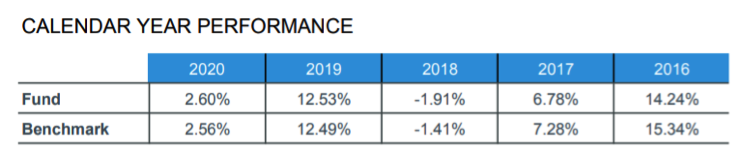

The fund returned 10.69% for the year to 31 May 2021 which is high, but never the less, underperformed its benchmark, the Markit iBoxx Global Developed Markets Liquid High Yield Capped Index which returned 12.34% over the same timeframe.

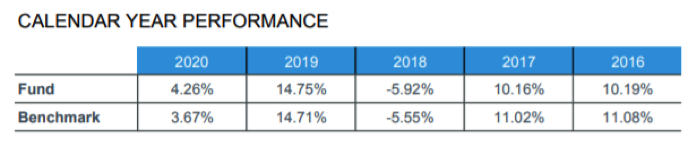

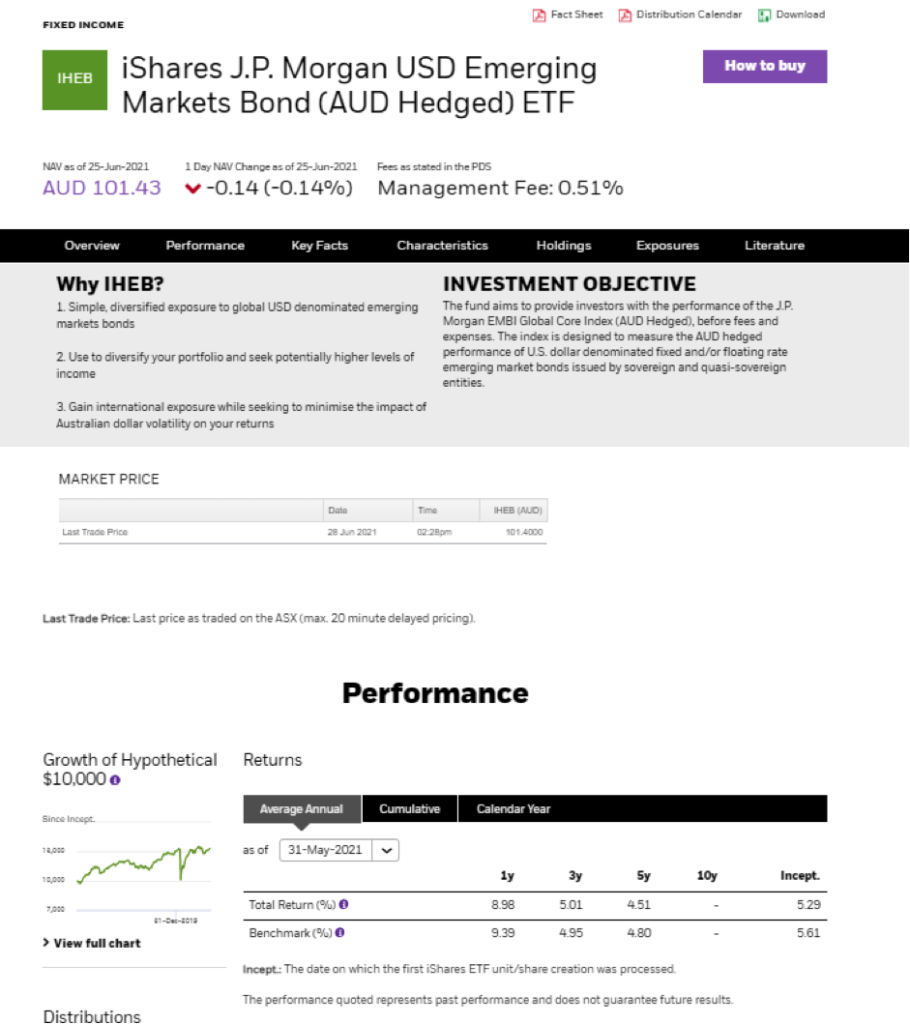

The calendar performance over the last five years demonstrates the underlying volatility of investing in high yield markets, with the fund returning double digit returns of 14.24% in 2016 and 12.53% in 2019, but a negative 1.91% in 2018. Investors should expect increased volatility when they invest in high yield securities.

The cumulative and annualised performance smooths out the volatility, giving a better indication of returns over time.

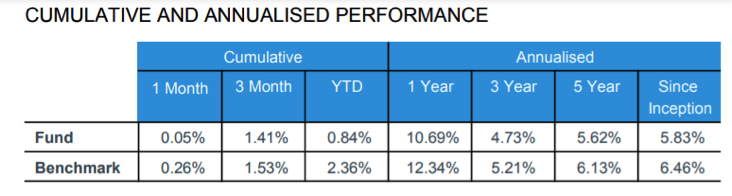

The fund invests in another that is quite diverse with the top ten underlying holdings equating to just 3.82% of the portfolio.

Source: iShares

The majority of the investments (56%) are US based, with exposure to Italy (9.42%) and Germany (5.9%) making up the top three countries.

Practically all the funds are allocated to sub investment grade securities – 71% to BB, 21% to B and 7% to CCC rated investments.

Fees are low at 0.56%p.a. and being an ETF, there is no minimum investment, unlike the funds covered in earlier articles, so great for smaller investors or those wanting to diversify high yield investments. Income is paid tri-annually.

What can new investors expect?

New investors should look at ‘Yield to maturity’ and ‘Running yield’ when investing in fixed income funds to get an idea about future returns.

Yield to maturity (YTM) includes the capital gain or loss on the bond price, as few bonds trade at the par value of $100 except at first issue, plus the interest until maturity. IHHY has a weighted average YTM of 3.27% as at 25 June 2021. Traditionally, this is a low yield for the asset class and there is potential for yields to increase, and the net asset value of the fund to fall.

Running yield (RY) is the expected income if you buy a bond and hold it for a year and is dependent on the price you pay for the bond in the market. Running yield is similar to dividend yield. RY is higher at 4.26% for the fund.

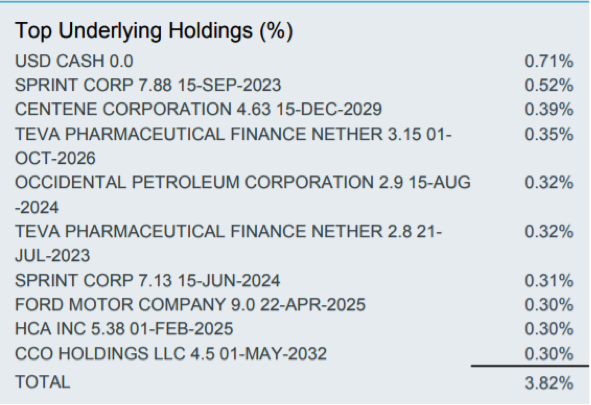

High yield investments are not traditionally defensive assets. iShares shows the growth of the fund since inception and you can see the significant drop in March 2020.

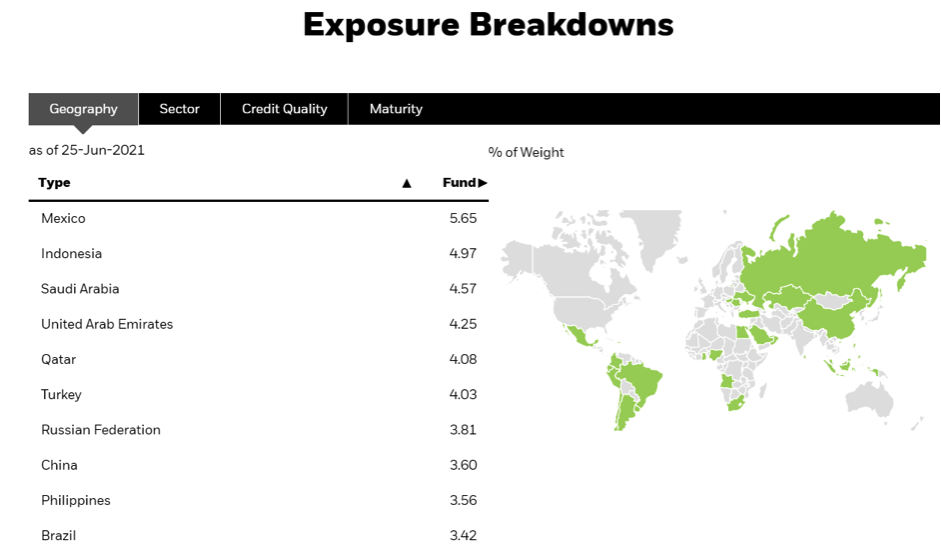

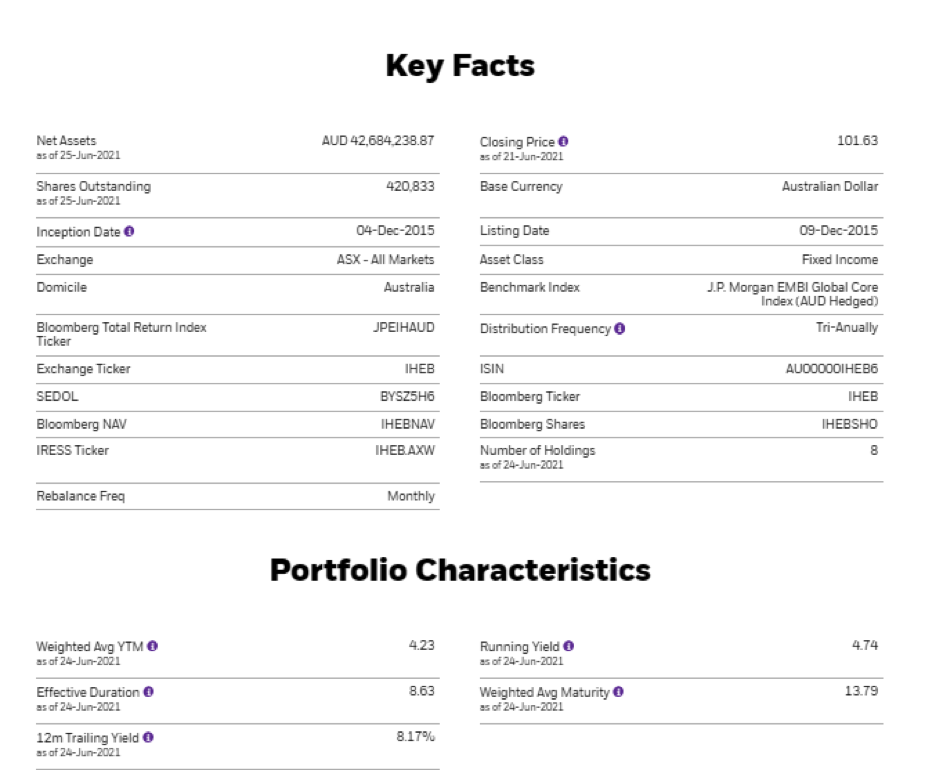

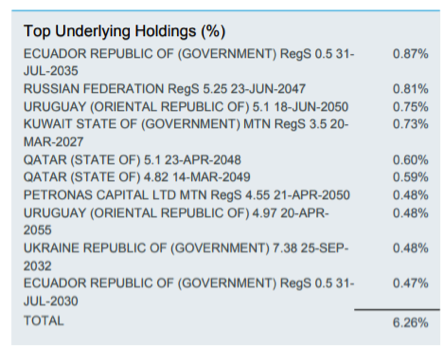

An honourable mention – iShares J.P. Morgan US Emerging Markets Bond (AUD Hedged) ETF (ASX:IHEB)

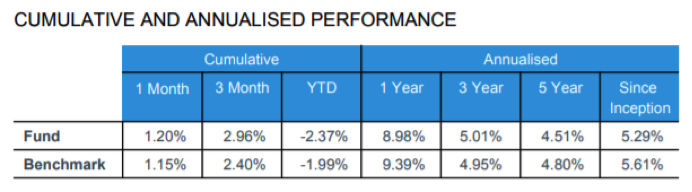

This fund deserves a mention given an 8.98% return over the last year until 31 May 2021. Not quite 10%, but very high for an ETF. Emerging market investment is typically more volatile than developed country high yield and the fund’s most recent worst performance was -5.92% in 2018, more than double that of IHHY.

Source: iShares

Weighted Average YTM is 4.21% and RY is 4.73%. The fund is very long dated with a weighted average maturity of 13.73 years, with many of the government bonds likely to be long dated and fixed rate.

While the fund appears to be more volatile, it is higher credit quality with more than 50% of the bonds rated investment grade.

Source: iShares

For more information, see the FINA ETF Finder and the iShares website.