Rising inflation fears and market uncertainty could boost the investment appeal of government bonds, an obvious safe-haven asset.

Retail investors comprise only a negligible value of direct holdings of Australian government securities, which includes government bonds, with around 60% held by non-resident investors, according to the Australian Office of Financial Management (AOFM). Most personal investors are allocated to Australian government securities in a more significant way through managed funds, including superannuation, according to AOFM.

In this article, I explain the different types of government bonds and how they work.

Australian Commonwealth Government Bonds (ACGBs) are considered ‘zero risk’ investments as the Commonwealth Government prints money and raises taxes, so investors in ACGBs will always be paid interest (known as a coupon) on time and principal at maturity. ACGBs have the top AAA or equivalent credit rating.

Both the Federal Government and all the states and territories issue bonds to help fund activities. While interest payments and the face value payment at maturity are guaranteed by the government issuing the bond, it is possible for capital gains or losses to be made if bonds are sold prior to maturity.

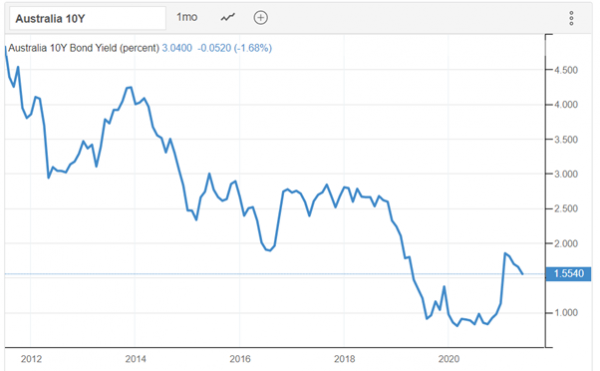

The Australian 10Y Government Bond yield was 1.56% on 28 June 2021.

Source: Trading Economics

The market price of fixed rate bonds will vary with interest rate expectations. If interest rates are expected to rise, the market price of a fixed rate bond will fall and when interest rates are expected to fall, the market price of a fixed rate bond will rise. Australian governments predominantly issue fixed rate bonds.

Australian Commonwealth Government Bonds (ACBGs)

The Australian Office of Financial Management (AOFM) issues ACGBs on behalf of the Australian Government.

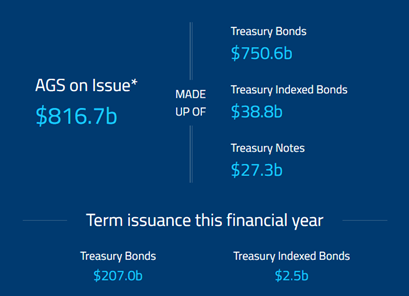

As at 25 June 2021, there were $816.7 billion of ACGBs on issue.

Source: AOFM

There are three types of Commonwealth government bonds:

1. Treasury Bonds

Are medium to long-term debt securities that carry an annual rate of interest fixed over the life of the security that:

- pays interest on a semi-annual basis at a fixed rate, based on $100 face value

- repays the face value at maturity

2. Treasury Indexed Bonds

Are medium to long-term securities where the capital value of the security is adjusted for movements in the Consumer Price Index (CPI). Interest is paid quarterly at a fixed rate on the adjusted face value of the bond.

At maturity the investors receive the adjusted capital value of the bond.

You can think of this series of bonds as having two interest components, the coupon which is paid to you plus an allowance for inflation which increases the capital value of the bond and is paid at maturity.

3. Treasury Notes

These are short term discount securities which pay face value at maturity.

ACGBs are largely traded in the over-the-counter bond market in minimum $500,000 parcels. However, some brokers/ dealers will sell in smaller parcels from $50,000.

Retail investors are able to buy and sell exchange-traded Australian Government Bonds (eAGBs) on the Australian Securities Exchange (ASX).

There are also dedicated government bond exchange traded funds (ETFs) and managed funds.

For more information, please visit the AOFM and the ASX.

State Government Bonds

State government bonds are known as semi government bonds or semis. They are also rated by the credit ratings agencies and are typically ‘high grade’.

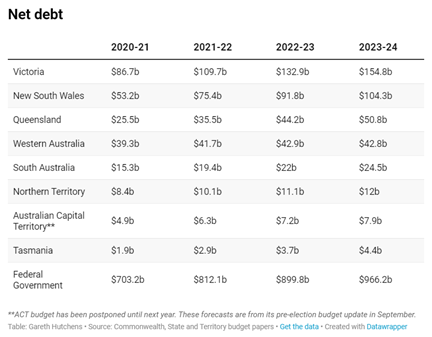

Victoria has the largest net debt of any of the states and territories, as shown in the table below.

Source: ABC News 3 December 2020

However, Victoria does not appear to offer investment direct to retail investors.

The Queensland Treasury Corporation (QTC) provides the corporate treasury services to the State of Queensland and manages financial risk.

Retail investors can invest in Queensland Government Bonds with a minimum of $5,000 ( then in multiples of $100) of differing maturities and differing interest rate earnings. Interest can be paid quarterly or half-yearly. These are sold through Link Market Services.

TCorp is the NSW Government bond issuer. TCorp offers four funds to investors with a range of strategies, from a cash fund that aims to beat the Bloomberg AusBond Bank Bill Index to a long term growth fund with a target of CPI + 3.5% p.a. (over rolling 10 years).

The Northern Territory (NTTC) offers bonds to retail investors from a minimum $5,000 investment (then multiples of $100) and a variety of terms from one to five years. Interest can be paid quarterly, half yearly or annually. Territory Bond issue 110 opened from 1 January until 31 May 2021 had interest ranging from 0.45%p.a. (paid quarterly) for one year until 15 June 2021 to a five year term with annual interest of 1.30%p.a. You can sell or transfer the bonds by completing a form on the website.