By Matt Simpson, Senior Market Analyst, City Index

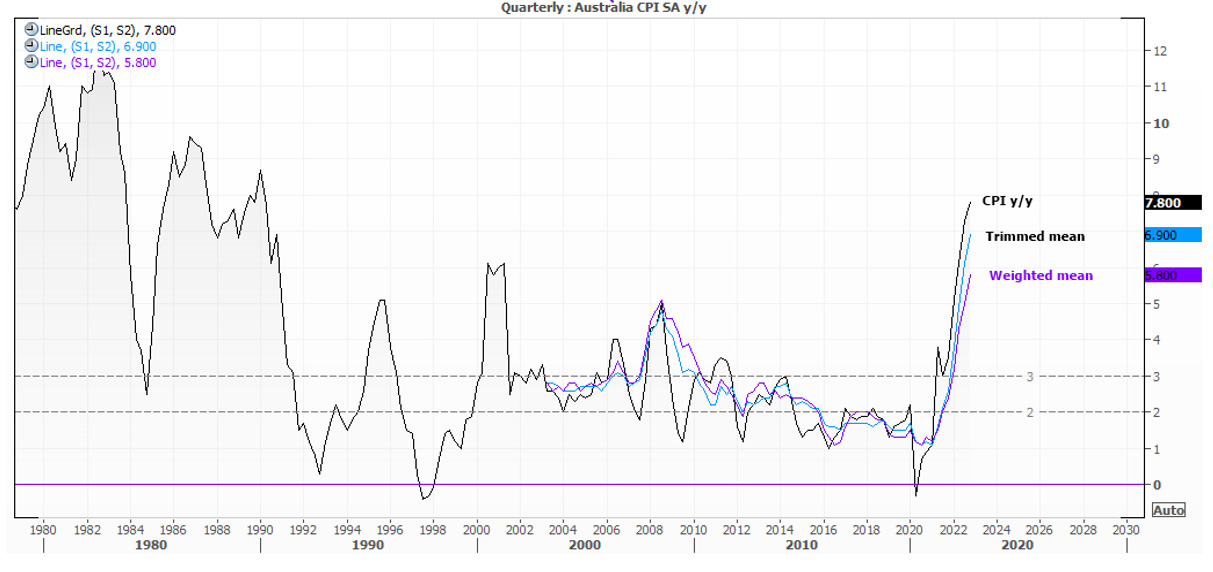

There’s no escaping the fact that Australian inflation continues to point the wrong way for the RBA and consumers alike. And today’s report should quickly eradicate hopes of an RBA pause in February.

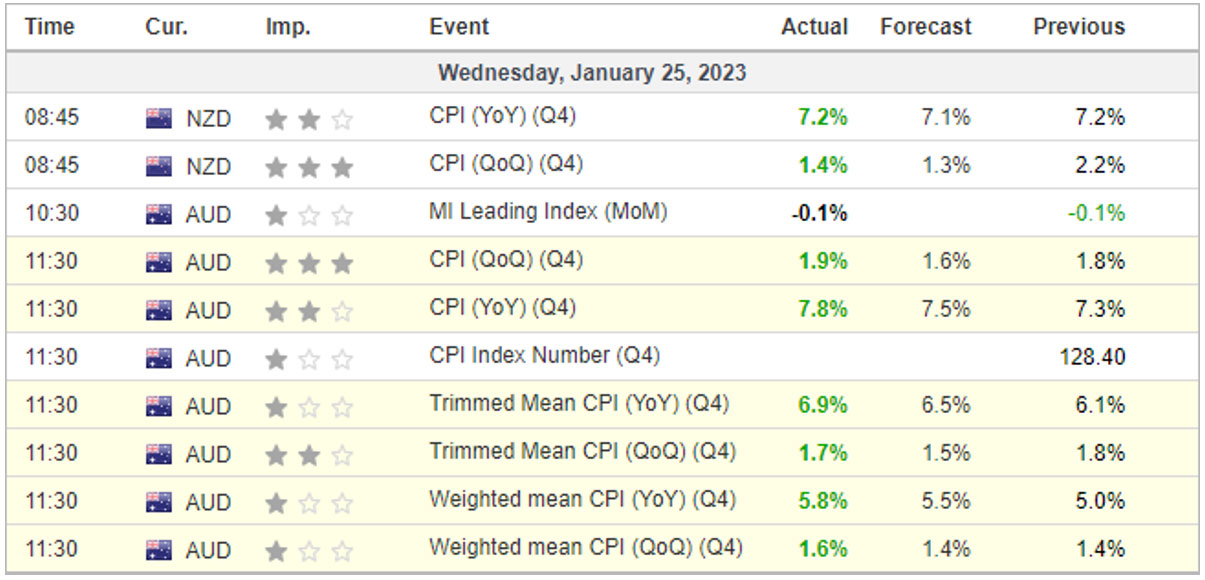

Today’s inflation report is one that matches Australia’s weather. Hot. Choose your flavour – core CPI, trimmed mean or weighted – they’re all above expectations with no obvious signs of a ‘peak’ in sight. And that has seen any hopes of an RBA pause at their February meeting evaporate, topple the ASX 200 from its arguably overbought highs and send the Aussie higher. With higher interest likely coming for Australia, China’s reopening and higher base commodity prices, the Australian dollar could be a tough currency to bet against.

Prior to the meeting there were some hopes that inflation could soothe following NAB’s business sentiment report, which cited easing pricing pressures. But with CPI at 7.8% y/y (and the new monthly annual read at 8.2% y/y) it is hard to get excited over peak inflation just yet. For comparison, US inflation peaked in July 2022 and the Fed are still hiking interest rates. And with inflation continuing to rise in Australia it is hard to see how we’ll see a peak rate at 3.6% as markets had been expecting. The Overnight Interest Rate Swap (OIS) curve is higher across the board following the inflation report to underscore the potential of a higher terminal rate.

Market response in a nutshell:

- AUD broadly higher

- ASX 200 erased most of yesterday’s gains

- GBP/AUD touched a 15-week low

The ASX 20 has erased all of yesterday’s gains, and today’s inflation report could be the trigger which prompts an arguably needed correction. It’s had a great start to the year and has seen little in the way of a pullback.