Australian investors sharply reduced their subscriptions to managed funds in 2022, according to the latest Fund Flow Index from Calastone, the largest global funds network. Inflows fell significantly across all asset classes, with fixed income funds seeing the sharpest decline.

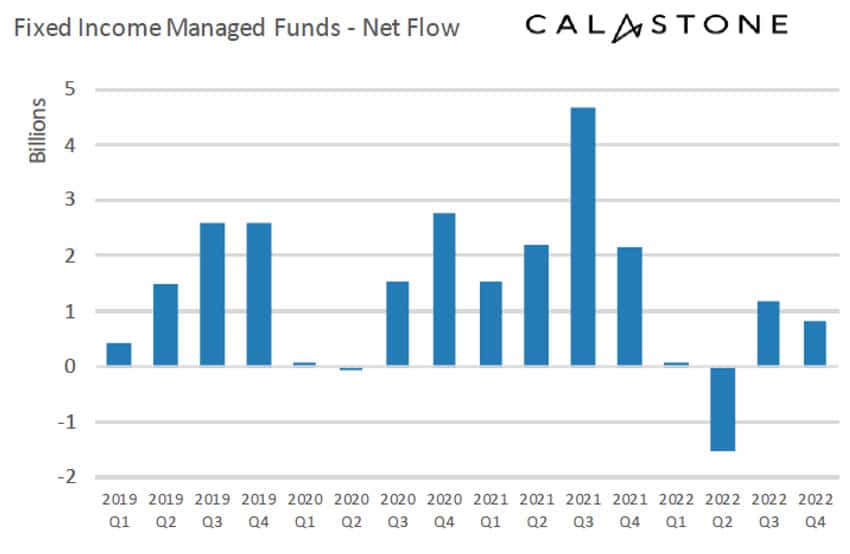

Figure 1: Calastone net fixed income fund flows, all AU domiciled

Fixed income fund inflows shrank 95% to A$562m in 2022

As inflation took hold and central banks both here in Australia and around the world moved belatedly to choke it off, the prices of both corporate and government bonds fell. In the first half of the year, Australians withdrew A$1.45bn from fixed income funds. Premature optimism in July and the first half of August that saw a big recovery in inflows quickly turned sour when global bond markets were hit by a surge in yields in the latter part of the third quarter.

By October, sentiment had begun to improve again, however, and investors added A$824m to their bond holdings in the fourth quarter.

Over the full year, inflows to fixed income funds were down 95% from A$10.54bn in 2021 to A$562m.

Teresa Walker, Managing Director of Australia and New Zealand at Calastone said: “Yields on fixed income funds are looking significantly more attractive in the wake of 2022’s bond market declines. Investors have also recently begun to hope that the interest interest-rate tightening cycle may be nearing its peak both in Australia and overseas. These two factors have tempted them back into fixed income funds in the last few weeks of 2022. There is enormous uncertainty over the future course of interest rates and of economic growth around the world, however, so we may yet see sentiment turn bearish again in the coming months.”

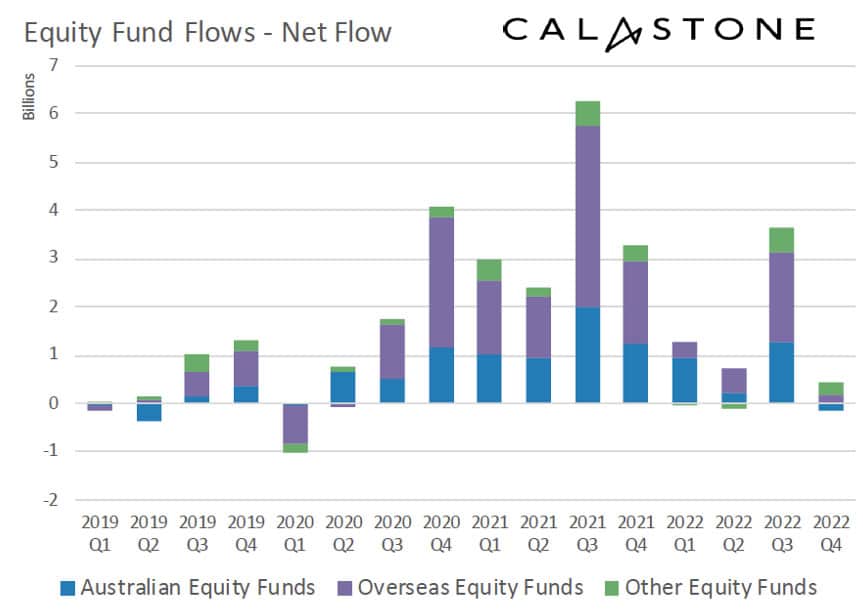

Figure 2: Calastone net fund flows across selected equity categories, all AU domiciled

Equity fund inflows fell by three fifths in 2022 to A$5.74bn, but Q4 was down 90% year-on-year

2022 saw investors add far less cash to their managed equity funds – down 62% to A$5.74bn, though this decline was from the exceptionally high level seen in 2021. The drop in the net inflow was driven much more by a dearth of buyers (orders fell by 15%) than an increase in selling (orders rose only 7%). Turnover, the value of all buy orders and all sell orders added together, was very similar in 2021 and 2022, however, so the large decline in the net inflow indicates much greater uncertainty in 2022 among investors over the likely direction of equity markets.

The third quarter accounted for almost two thirds of the year’s net inflow as Australians bought heavily into the bear market rally in July and the first part of August. But following the bond market volatility that ended the rally, they became much more negative and net inflows fell to just A$296m in Q4 in consequence, the weakest reading since Q1 2020 and down 90% year-on-year compared to Q4 2021. In October and December investors were net sellers of equities.

Teresa Walker added: “The improvement in sentiment among bond investors in Australia has not been matched by equity holders. Indeed, the much greater loss of confidence in equity funds in the fourth quarter compared to fixed income suggests investors are looking at bond funds as a relative safe haven. Q4 was the first time since Q1 2020 that fixed income funds have attracted more cash than equities.

“The outflows from domestic equities are particularly notable. The ASX had a much worse December than its peers in the US, UK and Europe and this has prompted investors to turn net sellers of domestically focused equity funds for the first time since the pandemic began.

“The Treasurer, Jim Chalmers, expects Australia’s economy to slow this year as the cost of living squeeze tightens. Other economies are already in recession, while the China Covid-19 resurgence is negative for regional growth and Australian business interests. Asset values have repriced in the last year owing to the higher rate environment but it’s not yet clear how hard the corporate profits shoe will drop and this will be key to sentiment on equity funds in the months ahead.”