Earlier this year, Australian Bond Exchange set up a joint venture with trading platform IRESS to allow financial advisers to transact over the counter bonds on the platform on behalf of their clients. In this way, advisers can track total portfolio holdings and benefit from the reporting being in the one place.

Here, FINA editorial director, Elizabeth Moran interviews Michael Cori, senior business development executive about his career and the service.

1. Tell me a little about yourself and your career?

I have always had a love of cycling and racing. After school, I wanted to move to Belgium with my coach and train for a professional career. But my dad thought I should get a degree first, so that I had something to fall back on.

When I graduated at 21, it was almost too late and I fell into finance as an accountant for E&Y in audit. That role only lasted a year before I joined Ord Minnett as an industrial analyst. From there I joined SBC Dominguez Barry (now UBS) as a fund manager across several asset classes – I really enjoyed the challenge of managing money. One of my fondest memories however was a secondment to New York where I sat on the Latin American desk for James Capel – I never quite understood how I got that gig other than having a Chilean background and being fluent in Spanish!

I spent the next eight years working for Deutsche Bank in Derivatives and Hedge Fund Sales in Sydney and Hong Kong after which I spent four years building the Hedge Fund sales desk at Citigroup in Sydney. I had always wanted to build my own business and was approached by an old colleague from Austock who suggested I build a hedge fund business under their umbrella.

One of the other Citi directors and I moved across in Mar 2007 to build out the business. The timing was impeccable, a few months later the GFC hit but the business lasted for 15 years.

My role as the Business Development Manager at The Bond Exchange is perhaps my greatest, and most rewarding position. What we’re doing is truly unique and has the potential to revolutionise the bond market and to be part of this is truly exciting.

2. What is ABE’s Strategy?

The Australian Bond Exchange was created in 2015 by Brad McCosker with the purpose of opening the OTC bond market and making it accessible to investors of every type and size. The idea was essentially to level the playing field and create a fluid and transparent market for an asset class that has been largely hidden from everyday investors. ABE fractionalise $500,000 bond parcels, making them available in $10,000 lots, to increase accessibility.

3. Tell me about ABE’s vision?

ABX would like the over the counter OTC bond market to mirror the equity market as we know it today. By this we mean full price and volume transparency and transactional liquidity. While it may create some waves initially, we think in the end the market will be better for it. Our partner IRESS has brought us one step closer to achieving this goal. We now can list any bond on our IRESS portal and have anyone with an IRESS or related terminal transact digitally in an OTC bond.

4. How can financial advisors be involved?

We are giving wealth managers access to $1.8 trillion worth of bonds!

There is going to be an element of education to bring them up to speed, but once they get more comfortable with bonds as an investment, they will have the gateway to access this market instantly through IRESS.

5. How much do investors need to spend to be able to trade?

The minimum transaction amount has been set at $10,000 which we feel is manageable for most investors, given the average term deposit is around $40,000.

[Also read: Should You Go Direct Or Indirect When Investing In Bonds?]

6. How does the trade work?

We have made investing incredibly simple. There are two possible channels. Clients can either sign up directly with ABE or via a wealth manager that has signed up with IRESS, giving clients the ability to trade bonds directly through their investment advisor.

7. Do investors need to be wholesale clients or just clients of brokers who use the payment system?

It can work either way but depends on the issue. Seasoned bonds (in the market for more than 12 months) are accessible to most investors but private issues are generally only available to wholesale clients. We currently manage accounts for retail, corporates, wholesale and institutional clients, so certainly not limited to those on the payment system. That said it is very easy to set someone up. Through our digital system, you can be up and running in 5-10 minutes.

8. How many bonds will be available?

The number of bonds in our model portfolio is around 30 but this is constantly changing as we evaluate alternate opportunities. In theory, we could list every bond in the OTC market on our digital platform but focus more on the higher yielding corporate space which is a little more concentrated than government bonds.

9. What’s the future of the bond market?

Income is a big issue and investors are panicking about very low term deposit rates and how they will make ends meet. They have enough in equities and do not want to increase exposure to risk assets.

One possibility is structured products, which are slightly riskier but offer that higher income. These investments are not new just not what investors are used to.

For example, high-end first mortgage products are available offering 7.5-8%p.a.

Switzerland has had negative interest rates for 10 years and 40% of their market is structured product. Culturally they are used to the investments, in Australia, were just a bit behind the international market.

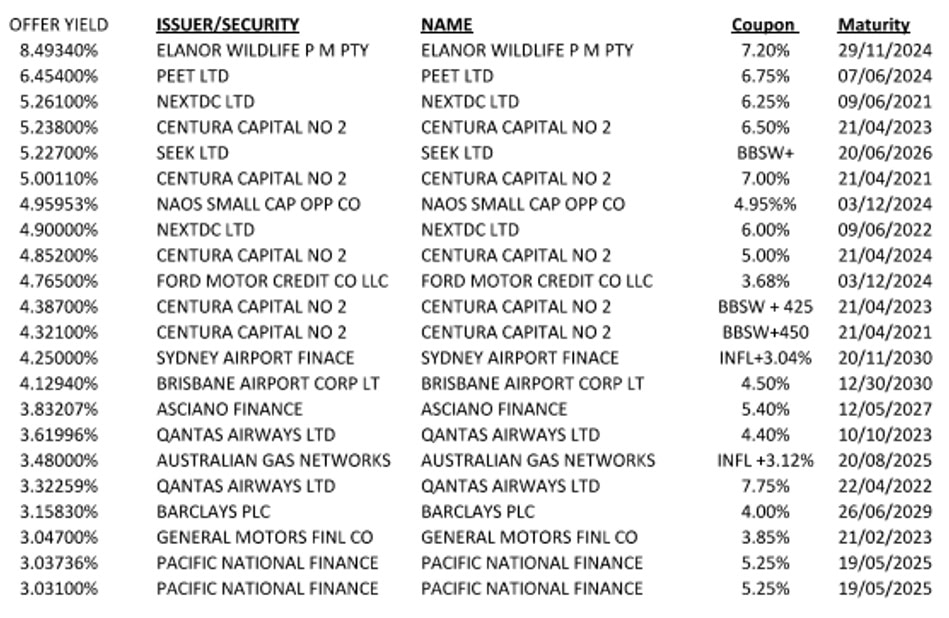

Australian Bond Exchange sample investments

Below is a list of sample ABE investments with yields of 3%pa or higher. Prices are accurate as at 26 October 2020 but subject to change.