From BondIncome Trading Desk

Overview

- Recently the RBA announced the extension of the Quantitative Easing program. The RBA will purchase an additional $100bn in federal and state government bonds following the completion of the current program due to finish in April-2021.

RBA Governor notes “The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The Board does not expect these conditions to be met until 2024 at the earliest”.

- Supported by a demand versus supply imbalance the desk expects credit margins to continue to contract over the next three months.

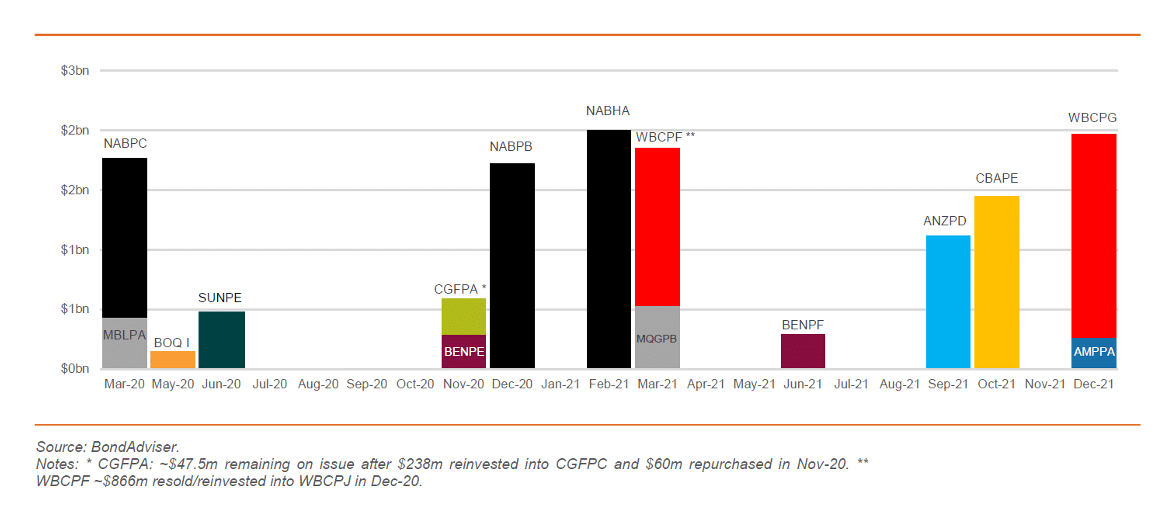

- The level of high yield bonds and generally higher returning securities approaching redemption over the next 3-6 months is likely to generate an investment gap for “re-investors”. The ASX listed legacy securities NABHA, an AUD$2bn issue, will be redeemed at the end of this month. As well as :

- $300mm David Jones high yield bond

- $100m ASX Peet PPCHA

- $56mm Centuria high yield bond

- A further circa $2bn in ASX listed hybrid redemptions.

So, there is a large pool of cash looking to for a higher yielding home. Redemptions and cash coming back to investors is set against a backdrop of relentless RBA liquidity support to Australian banks and corporates.

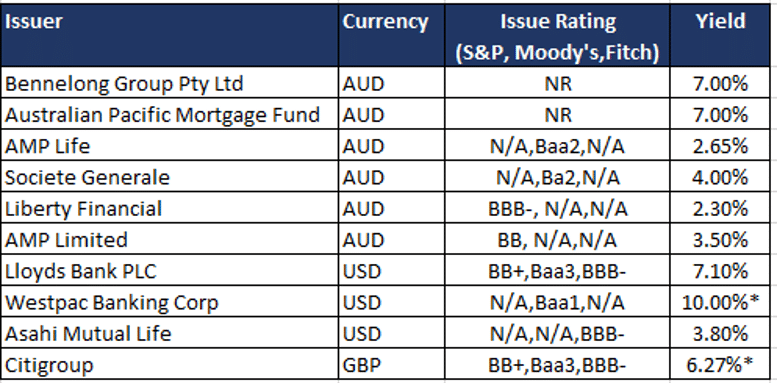

- Citigroup Upper Tier 2 securities are our top GBP pick. The legacy securities, issued in 2007, are one of two discount securities “Discos” remaining in the GBP market. Please see our issue in focus section for more detail on the Citigroup offer.

- Lloyds 12% Dec-24 (callable) securities in USD are attracting investor interest. Trading at 7.10% yield to call in December-2024 and a high 12%p.a coupon.

- ANZ and Westpac Discount Securities (Upper Tier 2) remain our most frequently traded issues in USD. If the issues are redeemed in the later part of 2021 or early 2022 investors stand to earn between 10%-17%p.a. Underlying our confidence in call is the recent redemption by NAB of the ASX listed NABHA legacy securities and continued rhetoric from offshore prudential regulators calling for issuers to repay the old style securities and issue Basel III compliant additional Tier 1 capital.

The Australian Pacific Mortgage Fund 7% July-22 (Bonnie Brook) issue remains a top pick in AUD with investors securing a 7% return to maturity. Additional Tier 1 Redemptions

2021 is a big year for ASX listed Additional Tier 1 security redemptions with upwards of $7bn in Australia dollar investor money due to be repaid. As we see in most years, many of these issues will be refinanced with the issue of a new AT1 deals to ensure the banks maintain their capital ratios. We expect the MQGPB deal to be refinanced in March to kick start the AT1 issuance for domestic banks in 2021.

Legacy Tier 1 Securities – Regulatory Arbitrage Trade

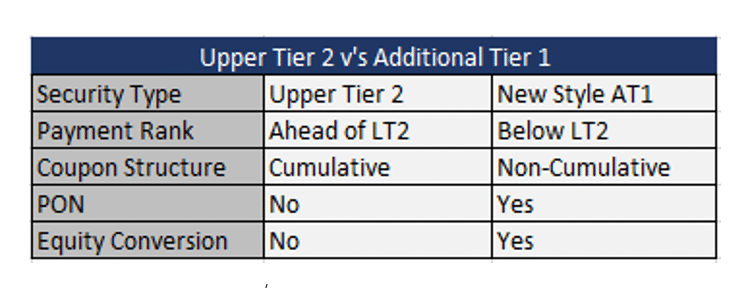

Discos are legacy capital securities from a now redundant in a bank’s capital structure – they used to be called Upper Tier 2 securities. Banks issued them globally including our four Australian major banks, before the introduction of Basel II and Basel III. As regulators transition bank capital towards being Basel III compliant and as the grandfather period ends for the legacy securities, it is our view these old-style capital securities, that have very little of the new style additional Tier 1 issuance structural features, will be tendered or repaid at par value ($100).

In GBP there are currently only two of these old-style Upper Tier 2 securities left, with all other issues having been repaid or tendered. The two outstanding issues are:

- STANLN LIBOR + 0.1875% perpetual security – £12mm remains of a £150mm issue

- CITIGROUP LIBOR + 0.8875% perpetual security – ~£100mm remains of a £500mm issue.

The structural differences between the Disco’s and new style Tier 1 securities are many as noted below.

PON – Point of non viability clause

The old-style capital securities do not have the structural loss absorbing features prudential authorities demand in new capital securities today. Additionally, these securities rank ahead of new style Lower Tier 2 or subordinated debt issued by banks globally.

Legacy Capital Developments – Supportive of Repayment

Over the last two years we have seen developments in the legacy capital markets as both global and domestic regulators push for issuers to retire old style issues by market buy backs/tenders or calling issues at par ($100).

Developments include:

- NAB Treasury retiring the USD NAB Legacy Perpetual securities via OTC market buy backs. Over the last twelve months NAB have bought back upwards of USD$50m of the issue in the low USD $90’s taking the total outstanding volume on issue to USD$15.05m from an issue volume of USD$250m.

- The ASX listed NABHA securities (issued in 1999) are being redeemed at $100 (par) this month. That’s AUD$2bn repayments.

- ASB/CBA bank redeemed legacy Tier 1 securities at par.

- The European Banking Authority (EBA), Europe’s APRA equivalent, released a paper noting the EBA does not want legacy securities and that issuers either redeem, buy back or amend the issue’s conditions to align with new style Tier 1 issues.

CITIGROUP LIBOR + 0.8875% Perp – GBP Legacy Capital Security

The CITIGROUP LIBOR + 0.8875% Perp is an Upper Tier 2 issue trading in GBP. The bond was issued in 2007 for an issue size of £500m. Through tenders and buy-backs, there is now £99.9m remaining outstanding. As with all of the legacy capital securities, we believe Citi will move to retire the debt in the coming year when the capital ceases to count towards CET1 ratios.

Most Traded Securities

*WSTP/Citi yields quoted are to BondIncome assessment of call.

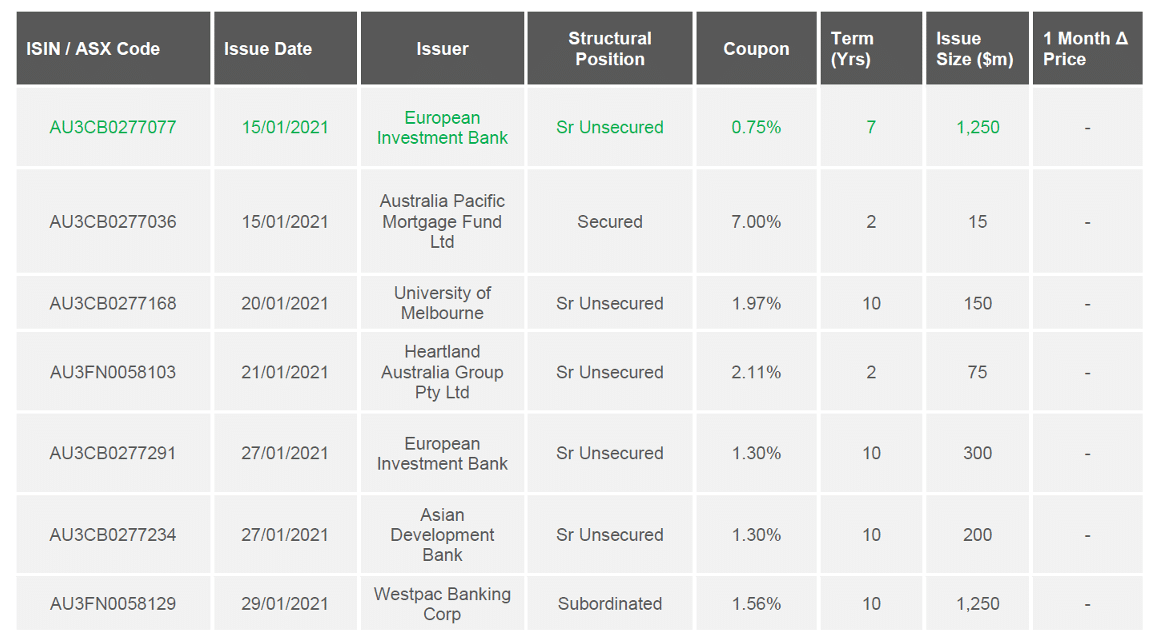

New Issue Monitor

*Source: BondAdviser Monthly Report – January