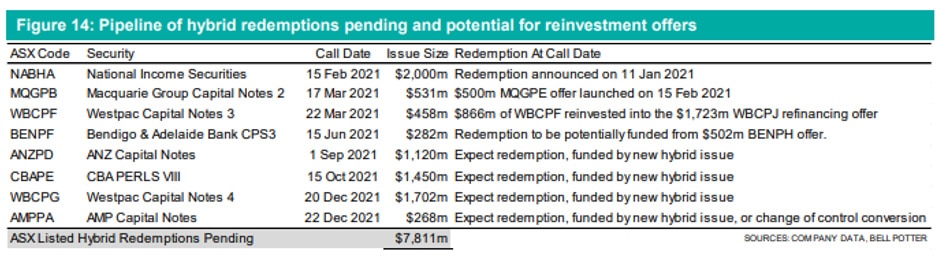

Macquarie Group Limited (MGL) has launched its Capital Notes 5 (MQGPE) to replace its $531 million Capital Notes 2 (MQGPB) ahead of that issue’s first optional exchange on 17 March 2021. The offer is for $500 million.

According to Bell Potter, new hybrid issues are increasingly aligned to maturing hybrids and it believes this could be the only new hybrid issue in the first half of 2021.

MQGPE should see strong demand as NAB’s old perpetual (NABHA) is due for repayment this month, putting $2 billion back in the hands of existing hybrid investors.

Existing investors in MQGPB have the opportunity to reinvest if they were holders as at 8 February record date.

Read Update: Macquarie Group Capital Notes 5 Swamped By Demand

Macquarie reserves the right to scale back applications and has stated existing investors in MQGPB will be given priority.

Macquarie Capital Notes 5 details

- Floating rate based on 3 month BBSW (0.1%) + 3.0- 3.2% bookbuild margin

- Assuming the hybrid prices at the low end, an initial grossed-up running yield of 3.01% – 2.57% franked at 40%

- First optional conversion September 2027 and mandatory exchange 18 September 2030

- Standard dividend stopper for non payment of hybrid distributions and capital trigger and non viability clauses

- Offer opens 23 February 2021 and closes 10 March 2021

- MQGPE due to list on 18 March 2021.

According to MGL, Capital Notes 5 are fully paid, subordinated, non-cumulative, unsecured, mandatorily convertible notes issued by MGL at an issue price of $100 per MCN5. Distributions are scheduled to be paid quarterly in arrears, subject to the Payment Conditions.

Macquarie Group has launched its Capital Notes 5 (MQGPE) to replace its $531 million Capital Notes 2 (MQGPB) ahead of that issue’s first optional exchange on 17 March 2021.

If you would like to invest, please contact your stockbroker.