By Steven Spearing – portfolio manager Apostle funds management.

Why incorporating floating rate securities as part of a fixed income portfolio can help investors manage interest rate risk and improve capital stability.

Central banks around the world have been raising interest rates in 2022 to bring high levels of inflation under control, leading many investment managers to start repositioning portfolios to favour bonds. But, like many Australian mortgage holders how do you choose between fixed or floating?

The key differentiator is that floating rate securities have lower sensitivity to interest rate movements, unlike fixed rate bonds, providing investors three key benefits:

- Floating rate securities provide a natural hedge against inflation – as central banks raise interest rates to address higher inflation, the income generated by these securities will increase and help to protect the level of an investor’s real income.

- Floating rate securities are a natural hedge against rising interest rates – as central banks raise interest rates; the price of floating rate securities will be less impacted than longer dated fixed rate bonds that are likely to experience higher volatility and mark-to-market capital losses.

- Floating rate securities offer enhanced capital stability and protection across interest rate cycles. For the reasons described above, their price tends to remain stable across rising, flat and falling interest rates.

High yield senior loans are an attractive source of floating rate exposure for high yield fixed income investors.

High yield floating rate loans aka senior loans, leveraged loans or bank loans, are simply floating rate loans to sub-investment grade companies. Companies in the U.S. senior loans market are generally familiar household names such as Delta airlines, Athena Healthcare and Hilton Hotels. Most issuers are significant in size and issue loans for recapitalisations, acquisitions, and general refinancing purposes.

So what can high yield loans offer?

Enhanced capital protection

Loans represent a senior layer in an issuer’s capital structure. They are secured by all or part of the issuer’s assets, for example accounts receivables, inventory, plant, and/or equipment, and are first in line for repayment in the event of the issuer defaulting. This provides significant capital protection for noteholders as they are supported by the assets of the company, as well as the underlying debt and equity tranches in their capital structure.

Long term historical default rates in senior loans are around 3%, and recovery rates in event of default are around 80%. Currently, interest coverage ratios are very high amongst loans issuers, and most companies do not have major debt payments until 2024. Thus, there is no sign of near-term defaults rising markedly. The current default rate sits at around 0.28%.

Capital stability across markets cycles

Senior loans are all floating rate securities, and as described previously, they provide capital stability across all interest rate cycles. Figure 1 illustrates how U.S. high yield senior loans have performed year-to-date this year as interest rates have risen sharply, compared to other U.S. fixed income and equities indices.

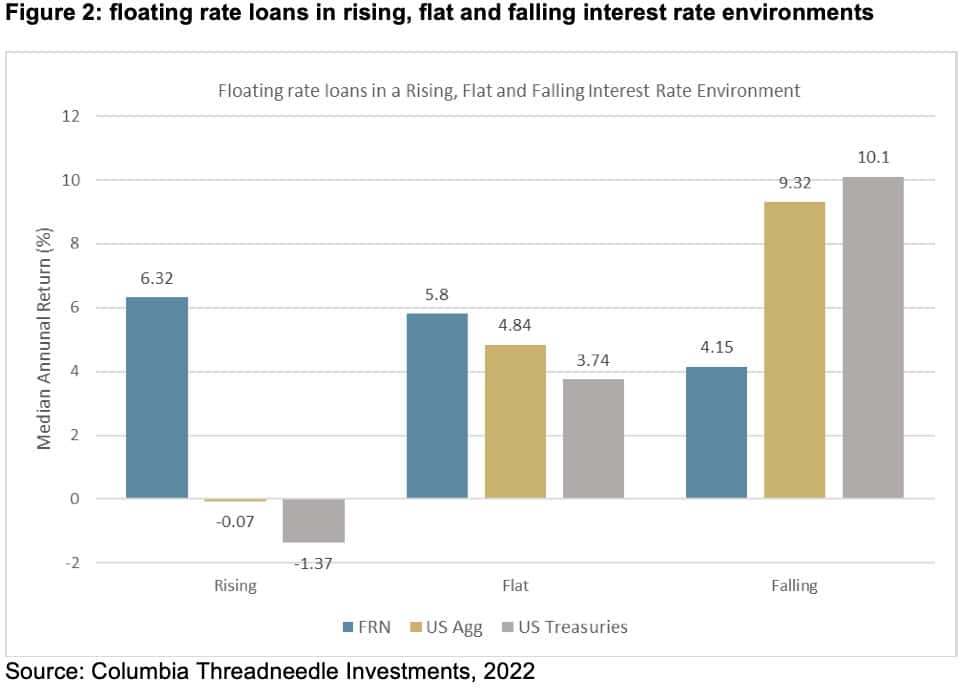

While floating rate securities have negligible interest rate risk and are attractive during a rising interest rate environment, they can also offer benefits for investors across all market cycles.

Flows into floating rate securities rose sharply at the start of the year as investors moved out of longer duration exposures and added floating rate protection. The selloff in the second quarter of the year has been driven by widening credit spreads as investors more broadly exited riskier assets because of growing fears of an economic slowdown.

However, it is evident that because of their negligible interest rate sensitivity, loans have significantly outperformed other major comparable indices.

Historically, loans have outperformed in rising and flat interest rate environments. However, they also offer attractive returns in a falling interest rate environment because their credit spreads are such a significant part of their total return.

Fixed rate bonds will benefit from a falling interest rate environment more than floating rate securities, but floating rate securities will generally maintain a more stable capital price.

Portfolio diversification

Bond indices generally get a significant proportion of their yields from interest rates. U.S. high yield bonds on average derive 34% of their yields from interest rates. As the credit rating of a bond increases, the proportion of its total yield derived from interest rates will generally increase.

Senior loans on the other hand derive on average over 80% of their yields from credit spreads. Because of this, loans and investment grade fixed income have sensitivities to different risks and generally have a low correlation. Loans have a very low correlation to treasuries and global investment grade bonds, and a low positive correlation to riskier assets like high yield bonds and equities.

Moving forward, expect corporate credit to offer less potential downside risk compared to stocks, while also generating attractive current income. US floating rate senior loans are currently yielding around 6.5% and paying a coupon of around 5.8% compared to their post GFC average of 4.7%. That level of income could also rise if the Fed continues to raise rates while focusing on taming inflation. As many of these assets begin to migrate back to par, they will likely remain compelling investment opportunities.