All sorts of companies and people extend credit. Fixed income credit is essentially the activity of lending to groups other than governments, which generally refers to companies issuing corporate bonds. Investors are paid an interest rate over and above the government bond ‘risk free’ rate. Corporate bonds can be issued with fixed, floating or an inflation-linked rate of interest.

The dangers of sequencing risk

Investing in credit is likely to appeal to risk-averse investors and those investors looking to avoid sequencing risk.

Sequencing risk is the risk that your superannuation savings will be subject to the worst returns at the worst possible time, which is the final few years preceding your retirement. It has the potential to derail retirement plans.

Credit reduces sequencing risk as it has an important characteristic that distinguishes it from equities, namely interest payments, known as coupons, represent a contractual obligation of the underlying bond issuer. For investors, coupons represent a guaranteed cashflow by the issuer of the bond.

When a company borrows money it essentially promises to do two things, pay interest when due and repay principal at maturity. This contractual requirement of fixed income credit mitigates sequencing risk, since credit has a defined maturity date and provided there is no event of default, an investor will receive 100% of their principal on maturity, even if equity markets are significantly falling. Investors need to be aware that bonds can fall or increase in value before they mature and accordingly are different from bank deposits, but will naturally pull back to their face value as they approach maturity.

Also read: Is Now The Time To Look At Corporate Bonds To Boost Returns?

Credit is more defensive than equities

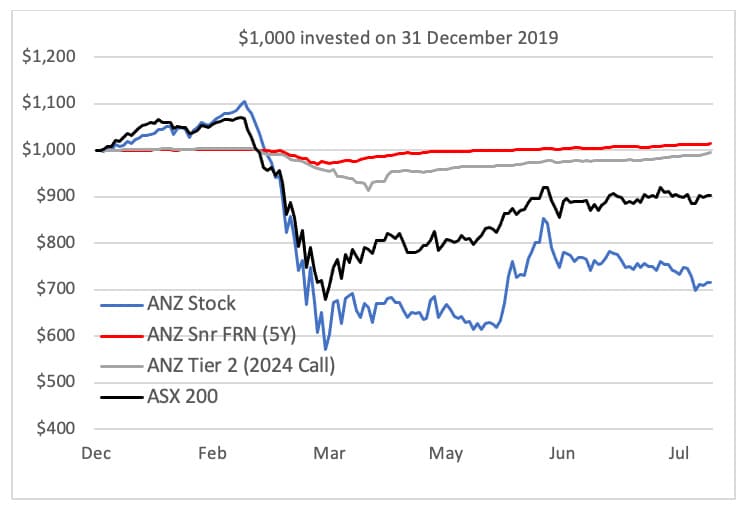

The chart below illustrates the most recent example of extreme market volatility and the defensive nature of credit versus equities. As concerns of the COVID-19 crisis loomed large in March 2020, there was a significant sell-off in equities. The graph below charts the price performance from December 2019 to July 2020 of a range of ANZ investments. Performance is all rebased as at 31 December and we assume $1,000 is invested.

The shares or equity, are represented by the blue line, performance of the ASX200 by the black line a subordinated bond with a first call of 2024 by the grey line and a senior floating rate bond by the red line.

There was a relatively modest fall in ANZ’s two debt securities, while the value of its equity dropped by around 42% to $580.

This recent example of market volatility illustrates the benefit of using credit in an investment portfolio. It helps to diversify away from equities and helps to avoid the risks of large drawdowns in retirement portfolios after a correction.

ANZ investment performance 31 December 2019 to July 2020

Managing the risks

Credit is not all created equal. Both duration and default risk need to be assessed and managed. Duration is the sensitivity of a bond’s price to changes in interest rates, and default risk is the risk principal and / or interest owing on a bond is not paid as and when due. A credit portfolio manager manages these risks. In addition to managing duration and default risk, the other benefits of a credit fund are:

- A fund provides a diversified portfolio of assets with just one transaction, and

- Investors can access over-the-counter bonds not available in the retail space and allows fund managers to take advantage of pricing inefficiencies created by being non-exchange traded with bid/offer spreads opaque particularly with less liquid securities.

Notwithstanding what equity brokers suggest, holding higher yielding equities are not a proxy for fixed income as dividends are at the discretion of a company’s board and are also subject to continued profitability.

There is a litany of examples of stocks held out as fixed income proxies (BHP, Telstra and the banks) but market volatility in March 2020 highlights the fact they do not trade like fixed income assets.

The benefits of compounding interest are well known, but not always considered with regards to fixed income. Excluding the payment of income tax on interest, if investors reinvest their 5.0% or 6.0% coupon every year, their capital will double in 14 years and 12 years respectively. Fixed income returns vis a vis equity returns will deliver most of the outcome via income, rather than capital gains, the opposite is generally true for equities.

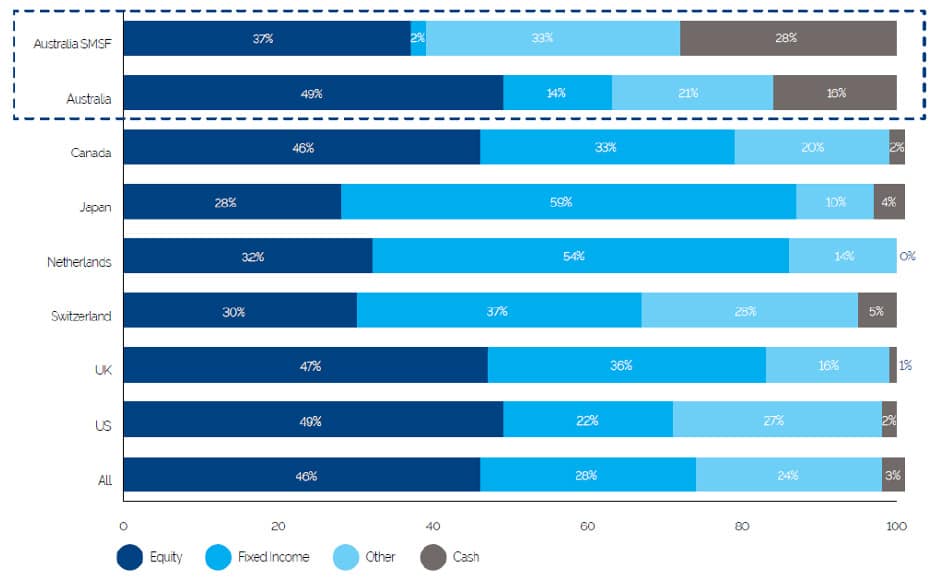

Australians are underweight fixed income relative to the developed world. Outside of real property Australians have a bias to shares and term deposits.

The large allocation to shares essentially owes itself to dividend franking and the success of major companies like CBA and Telstra. Allocations by SMSFs to fixed income is around 2% (see Figure 1) which makes Australia’s SMSF allocation one in the lowest of developed world, alongside Poland and Korea.

While difficult to generalise, as people move towards the later stages of their working life, a higher fixed-income allocation should help preserve capital. A rule of thumb is that an investors allocation to equities is 100 minus their age with the balance in fixed income. Accordingly, someone that is 70, should have 30% in equities and 70% in fixed income. Following this ratio would moderate sequencing risk.

Figure 1: Global Pension Fund Allocations and Australian SMSF Allocations – 2019

Source: Willis Towers Watson; ATO

Conclusion

Owing to the defensive attributes of credit, SMSF and retirees should consider an allocation to credit. Credit is likely to appeal to investors that do not like the volatility of equities, but want higher income compared to term deposits. Further, sequencing risk may be moderated with credit’s defined maturity date, which unlike equities is perpetual.