As the US President Joe Biden and House Speaker Kevin McCarthy reach an in-principle agreement to finalise a budget agreement to raise the $US31.4 trillion ($A48.1t) debt ceiling, Stephen Dover, Head of Franklin Templeton Institute presents his views on the current US debt challenge and the long-term implications for...

By Daleep Singh, Chief Global Economist and Head of Global Macroeconomic Research, PGIM Fixed Income

The first half of 2023 was just the latest reminder that we have entered a period of elevated macroeconomic volatility where regime shifts are likely to occur with greater frequency and consequence than experienced in...

Franklin Templeton's global investment outlook: a broadening opportunity set

Markets have defied expectations—performing well in the face of economic challenges.

"But as we head towards the end of this year the question is whether the investment climate will begin to turn bleak," asks Stephen Dover, Chief Market Strategist at Franklin Templeton...

Capital Group’s Jared Franz, Robert Lind and Pramod Atluri dissect the outlook for the global economy in 2024.

Under the weight of elevated inflation and high interest rates, the world’s major economies are diverging. Surprising resilience in the United States, Japan and India is helping to boost the global economic...

Commentary from Insight Investment's Head of Global Credit, Adam Whiteley, on the outlook for bonds / global credit.

How bonds are faring in the new inflationary environment

Despite a backdrop of nagging recessionary fears and persistent inflation, global credit is looking more attractive to investors now than at any stage over the...

From Insight Investment

The Fed took a modestly more hawkish tone at the latest FOMC meeting. It announced it will begin slowing its pace of quantitative tightening. We still project rate cuts this year and believe it remains a compelling time to add exposure to fixed income.

The Fed Continues to...

How Current Markets Are Influencing Fixed Income Asset Allocation – Fidante Panel Part 1

Elizabeth Moran

Fidante recently hosted a Q&A panel of their fixed income asset managers, which included Teiki Benveniste from Ares Australia Management, Alex Stanley from Ardea Investment Management, Victor Rodriguez from CIP Asset Management and Daniel Siluk from Kapstream.

The four asset managers provide an outstanding insight into current markets. There is...

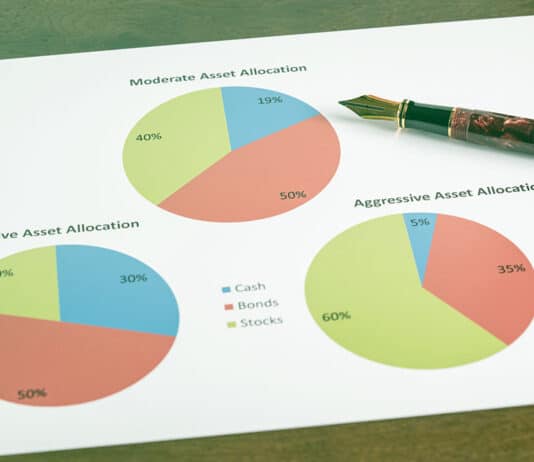

If you are thinking about investing direct, then there are a number of factors you’ll need to assess.

While many of the metrics will be similar to shares, they are some important differences. For example, growth is a crucial assessment when investing in shares. However, bondholders do not care if...

Interest rates rises are starting to slow and many economists are suggesting we are nearing peak rates. If you agree, then it’s time to start thinking about adding interest rate risk, also known as duration.

Once interest rate expectations start to reverse, fixed-rate bonds will outperform.

Last week I looked at...

Bad monetary policies often lead to economic and financial turmoil

While today's banking crisis is of a different scale than the global financial crisis, it could accelerate the pathway to recession

The stress caused by the unwinding of years of bad policy may create significant opportunities to generate...