Key takeaways:

- Fixed income is the only asset class that demonstrates a low to negative correlation to risk assets.

- Fixed income provides highly efficient returns per unit of risk.

- Fixed income is an effective tool to manage drawdown risk.

- A passive manager cannot express duration, curve, sector or security preferences in portfolio construction in the ways that an active manager can.

Does Fixed Income Still Matter?

Since COVID-19 impacted financial markets in Australia and abroad, Western Asset is often asked about the role of fixed income in investors’ portfolios.

Does fixed income still matter in this environment? And can it continue to provide the diversification and income benefits investors have looked to it for historically?

Our answer is an emphatic yes. And in our recent white paper, Why Fixed Income Still Matters, we review the reasons why fixed income, as an asset class, provides many important benefits across both broad asset allocations and fixed income portfolios.

Why Fixed Income Still Matters

1. Diversification – Fixed income offers a low to negative correlation to risk assets.

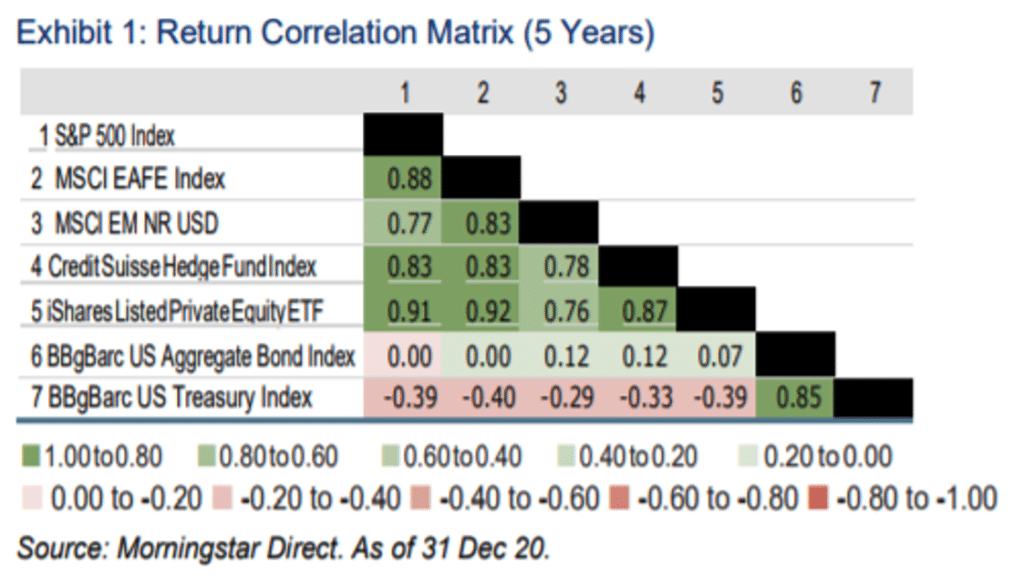

Using Morningstar Direct data for the last five years, two fixed income indices – The Bloomberg Fixed Income US Aggregate Bond Index and the Bloomberg Fixed Income US Treasury Index, compared to private equity and hedge funds, shows the only asset to demonstrate a low to negative correlation to risk assets is fixed income.

In this period, the range of correlations for traditional fixed income ranges from -0.40 to 0.00. This range suggests that fixed income is either not correlated (0.00) or negatively correlated (-0.40) relative to traditional risk assets. This underscores the importance of using fixed income as a diversification tool.

Effective risk management starts with appropriate diversification. And there’s no better diversifying asset class than fixed income.

2. Efficiency – Fixed income’s modest risk profile allows for efficient returns per unit of risk.

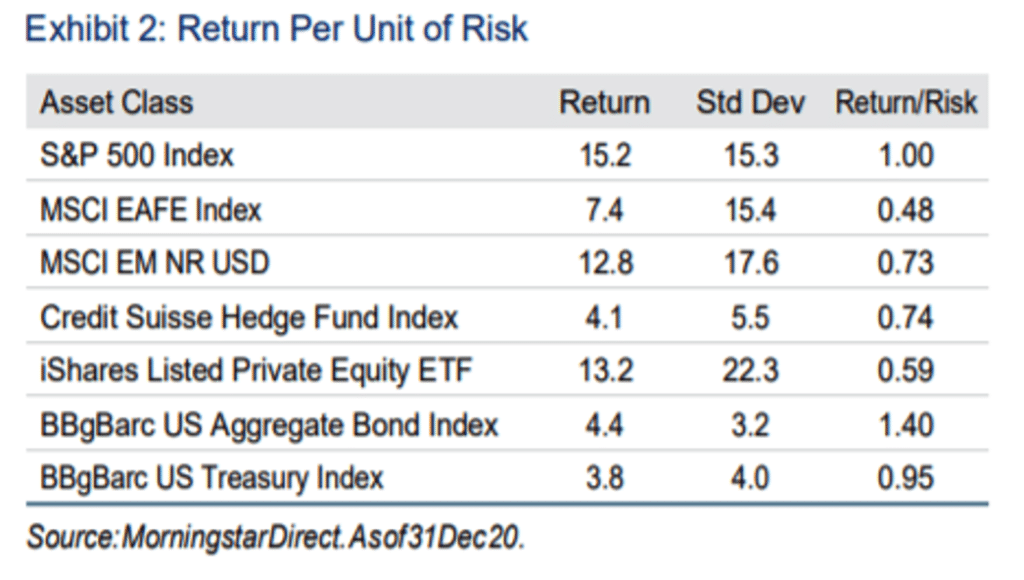

While we acknowledge that potential returns for fixed income may appear to be limited in the current market environment, investors should consider whether designating some capital to fixed income is an efficient allocation considering the modest risk profile of the asset class (i.e., standard deviation of annual returns).

Exhibit 2 illustrates the return/risk ratio for various asset classes for the trailing five years (all returns annualised). The return/risk ratio for the Bloomberg Fixed Income US Aggregate Bond Index is 1.40, this is the most efficient allocation across the major asset classes.

3. Underlying Return Potential – While fixed income yields may be the top line indicator of returns, they may not tell the full story.

It’s worth keeping in mind that uncertain markets can translate into volatility that, in turn, can produce returns well above what a security may be yielding at the time.

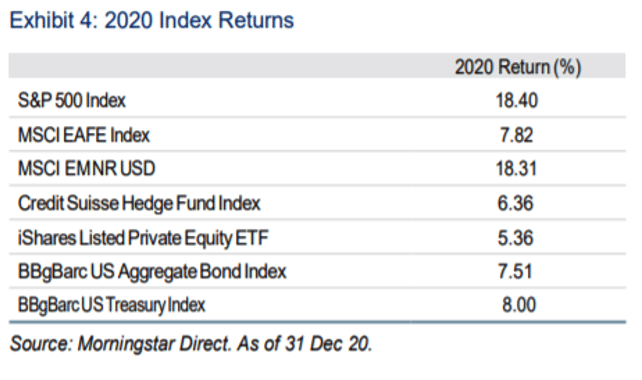

In 2020, when many investors questioned the return prospects for The Bloomberg Fixed Income US Aggregate Bond Index, it returned 7.51%, and clearly outpaced private equity and hedge funds.

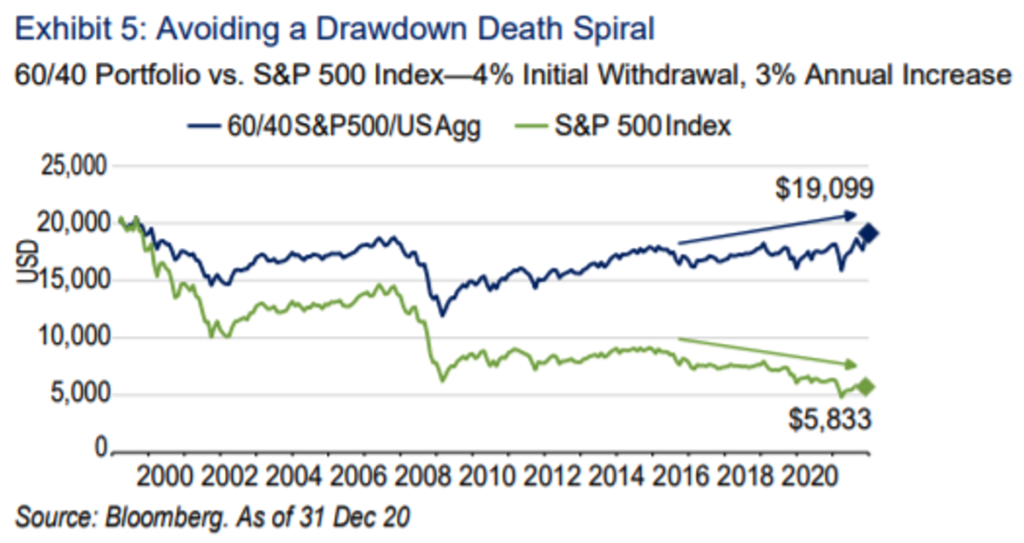

4. Drawdown Risk Mitigation – Fixed income can serve as an effective tool for investors in retirement or decumulation phase.

There are few asset classes that can mitigate drawdown risk while providing income/return potential and liquidity. For example, commodities such as gold offer no income source. Alternative asset classes such as real estate or private credit may offer long term return potential, but these come with difficulties related to estimating valuations and are often highly illiquid.

With public fixed income, investors can use US Treasuries as ballast in portfolios or Treasury Inflation Protected Securities (TIPS) to hedge against rising rates—both of these markets are deep and liquid. Investors with a greater risk tolerance may choose an allocation to floating rate corporates or bank loans, both of which offer income as well as some degree of protection in a rising rate scenario.

A stark reminder of stock market drawdown risk is the performance of the Dow Jones Industrial Index over 2020. The index’s high point early in 2020 was at 29,511 on February 12 but it closed at 18,591 on March 23—a 37% drop in about 40 days.

Conversely, the 30-year Treasury yield hit its 2020 peak of 2.38% on January 9, 2020. This may have seemed unattractive to the novice investor, but in terms of diversification and return potential, holding the 30-year Treasury bond was a winning proposition. It hit an all-time low of 0.99% on March 9, 2020, which netted more experienced investors a handsome 32% return.

5. Income Generation – Fixed income still has the potential to deliver attractive relative returns.

Over the last 10 years, the Bloomberg Fixed Income US Aggregate Bond Index has generated a cumulative total return of 45.76%. A little-known fact behind this number is that the cumulative contribution from the income component is 36.73% (or 80% of the total return).

Any investor (retail or institutional) needs repeatable income to meet ongoing expenses, pension payments, etc. As part of their asset allocation exercises, investors often compare the yield on the 10-year Treasury (currently at 1.07%*) to the dividend yield of the S&P500. While it’s true that the current dividend yield of the S&P 500 is 1.60%*—roughly 50% more than the yield on the 10-year — we expect that fixed income should continue to produce much-needed income regardless of the market environment, yield and spread levels.

What’s more, despite the low levels of yields on a historical basis, income remains a big driver of overall total return. These are all critical variables for investors at or near retirement age and for large institutions meeting their obligations.

Summary

With most major stock and bond markets sitting near all-time highs, investors face difficult portfolio allocation decisions. In this context, it is more important than ever to look beyond headline numbers and think deeply about combining assets in ways that produce well diversified portfolios.

At Western Asset, our research and long-experience tell us that fixed-income remains a key element of a diversified portfolio. And further, that in such an environment active management of fixed income portfolios will be key.

For more information, see the full report Why Fixed Income Still Matters.

*As at 31 December 2020

Issued by Legg Mason Asset Management Australia Limited (ABN 76 004 835 849 AFSL 240827) which is part of Franklin Resources, Inc. Any reference to ‘Legg Mason Australia’ is a reference to Legg Mason Asset Management Australia Limited.

These opinions are subject to change without notice and do not constitute investment advice or recommendation. Past results are not indicative of future investment results. This publication is for informational purposes only and reflects the current opinions of Western Asset. Information contained herein is believed to be accurate, but cannot be guaranteed. Opinions represented are not intended as an offer or solicitation with respect to the purchase or sale of any security and are subject to change without notice. Statements in this material should not be considered investment advice. Employees and/or clients of Western Asset may have a position in the securities mentioned.

This publication has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider its appropriateness having regard to your objectives, financial situation or needs. It is your responsibility to be aware of and observe the applicable laws and regulations of your country of residence. The representative portfolio is an account in the composite we believe most closely reflects current portfolio management style for the strategy. Performance is not a consideration in the selection of the representative portfolio. The characteristics of the representative portfolio shown may differ from those of the composite and of the other accounts in the composite. Information regarding the representative portfolio and the other accounts in the composite is available upon request.

Past investment results are not indicative of future investment results. The value of investments and the income from them may go down as well as up and you may not get back the amount you originally invested.