Are you thinking about investing in fixed income in 2021? Or perhaps, wondering what the experts think is the best place to invest? Well, the snippets below are a great place to start. We’ve compiled outlooks for the fixed income asset class for the year ahead.

There are some common threads – emerging market corporate debt and Residential Mortgaged Backed Securities seem to be on everyone’s wish list. But views vary when it comes to inflation, government bonds and only one of the outlooks mentions cash. That’s interesting given rates are practically zero but they believe there will be a few market dislocations and its worth holding onto cash to invest opportunistically in the year ahead.

Note: None of these sectors are recommendations please do your own research and consult your financial adviser before you invest.

Amundi – Investment Outlook 2021

Marked by the most severe recession in modern history, 2020 was an unprecedented year. With the global pandemic continuing, we enter 2021 with a mildly positive outlook for the upcoming recovery, but with the assumption that the path to pre-crisis growth levels will be long and uncertain. Against this backdrop, investors should be ready to play rotations in their portfolios, favouring cyclical themes but also keeping a strong focus on quality.

Move from fixed income to smart income. With the amount of negative yielding debt close to historical highs and interest rates expected to remain low in the short term, investors should build an income engine by searching for opportunities across the board, including emerging market bonds, private debt, loans, real assets (infrastructure, real estate) and high-income equities. Opportunities in credit markets remain, but the big theme for 2021 is what we call ‘the great discrimination’. What is sound and expensive will become even more expensive. Some areas of the market will likely deteriorate further, as the abundant liquidity injected by central banks is hiding weakening fundamentals. Selection will be key in 2021.

Consider govies for liquidity. Investors should consider allocating a portion of their portfolio to core government bonds, regardless of their valuations, primarily for liquidity reasons in case there are phases of liquidity shortages.

Play the recovery through emerging markets assets. In a still highly uncertain virus and economic cycle, the Chinese and Asian economies are emerging as the most resilient, having been able to effectively manage their outbreaks. So far, China has been the only country to recover to its precrisis GDP level. The outlook of EM countries in LatAm should also improve through 2021 as the virus cycle is improving in this area. These trends should support EM regional themes and EM bonds in local currency.

Include ‘true’ diversifiers. In a world of high correlation among risk assets, adding uncorrelated sources of returns may help balance the allocation. Absolute returns approaches, volatility, hedging strategies and gold may help improve overall portfolio diversification, as well as real assets, private markets and insurance-linked securities. Those asset classes show a lower correlation to traditional asset classes, and some, like real estate and infrastructure, can provide an hedge against inflation.

BNP Paribas – Investment Outlook for 2021

Corporate bonds – The search of yield and central banks help

As investors began to appreciate that the lockdown recession was going to be far more severe than that which followed the Global Financial Crisis, the worry was that defaults and downgrades would also be worse. Thanks to central bank intervention and central government stimulus, those fears have so far proved unfounded. While bankruptcies have certainly increased, they have remained well below the levels reached in 2008-09.

One would expect bankruptcies to rise further, particularly for those industries that still face constraints on activity (airlines, hotels, leisure, etc.), although state aid is likely to continue.

Governments have spent too much money already to let these businesses fail. The risk is rather the opposite, particularly in continental Europe, that too much support is provided and enterprises that do need to close are allowed to continue operating. These ‘zombie’ companies would not be able to remain solvent without extremely low interest rates. There is a risk that the increase in debt in 2020 leads to misallocations of capital and limits creative destruction. This would raise deflationary pressures through ever-weaker ‘demand-pull.’

As corporate profits collapsed and companies took advantage of central bank liquidity to shore up their balance sheets, credit metrics deteriorated sharply. Net leverage had been rising anyway post the Global Financial Crisis as low interest rates encouraged companies to borrow ever more money. That process accelerated during the first stages of the pandemic, but companies have begun deleveraging now. Thanks to low rates, however, the increase in the interest rate burden has been less than the increase in the debt burden, minimising the damage to the interest coverage ratio. In any event, both metrics are expected to improve in 2021 to near pre-recession levels as earnings recover. High yield is likely to continue to outperform investment grade debt in developed markets. This will be driven primarily by the carry, however, as there is little room for further spread compression, particularly in investment grade, as spreads have already returned to near pre-pandemic levels.

In the current environment, the search for yield in fixed income will likely underpin valuations in corporate debt markets. The primary concern for credit investors is to differentiate between those industries that will be permanently damaged by the pandemic and the lockdown recessions and those that are only temporarily out of favour. It is equally important to avoid those sectors whose prices have been bid up as investors seek out safe havens, but which are at risk of significant underperformance – primarily in the US – as the economy recovers and fiscal stimulus boosts growth and inflation expectations.

FIIG Securities – 2021 Credit Outlook

At a high-level, we expect supportive monetary policies will continue to see spreads tightened with the yield curve likely to steepen. This is because the short end of the curve is now broadly anchored to what central banks have determined and the longer end will respond to (hopefully) positive renewed sentiment and large fiscal stimulus.

While historically rising interest rates was a trigger to favour floating rate securities, the new norm of unconventional monetary policies means there will continue to be value in fixed rate securities. Our other key takeaways include moving down the capital structure for quality issuers, target long dated inflation securities, capture value in Residential Mortgage Backed Securities market and maintain a high diversification in selective high yield securities. But, more than ever given the uncertainty that will no doubt continue over the coming months (not to mention an upcoming equity correction which attracts a growing number of predictions), being selective and maintaining a high degree of diversification (across maturity, issuer, rating, currency and instrument type) continues to be the key to a well-balanced fixed income portfolio.

We continue to believe there is value in a number of sectors and instruments, including bank and corporate hybrids or residential mortgage backed securities.

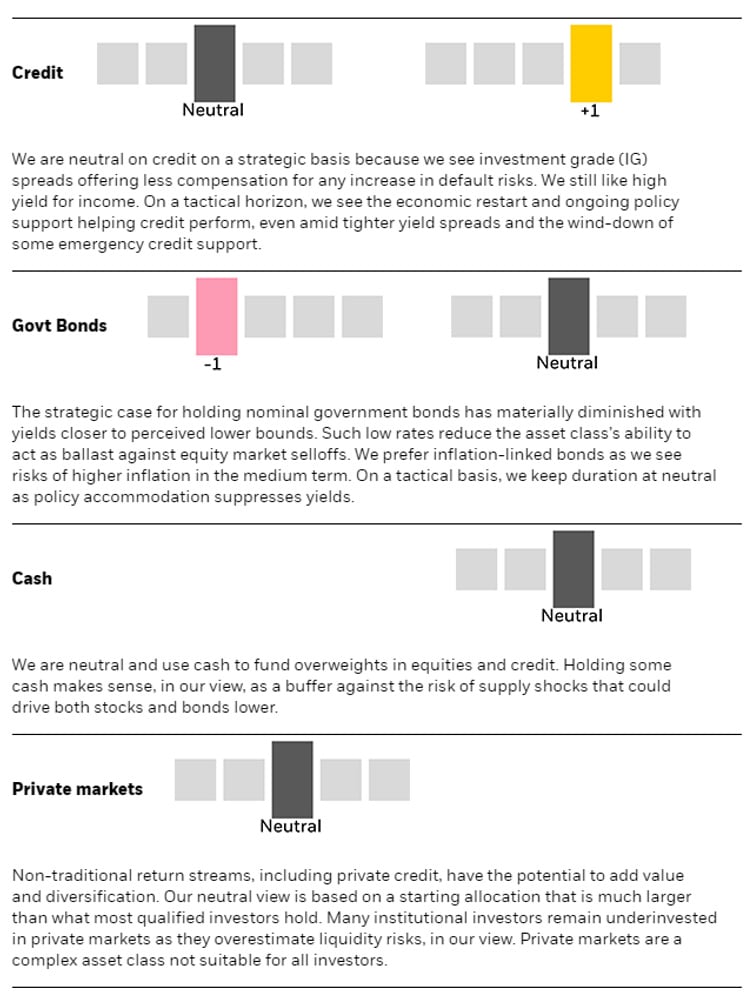

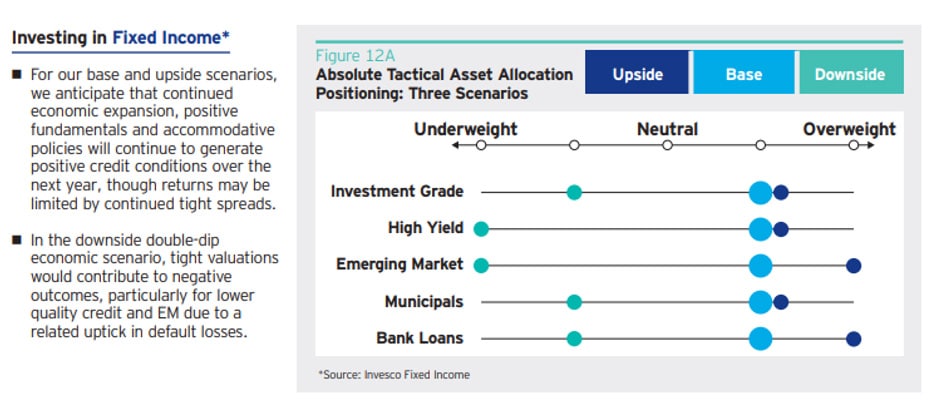

Investco – 2021 Investment Outlook

In fixed income, we believe credit markets have room for additional spread compression and may offer attractive risk-adjusted returns. Global yield curves may steepen with gradually rising bond yields but remain well-anchored by asset purchase programs and low inflation expectations. Real assets are expected to do well with low and stable inflation.

Janus Henderson

Outlook for Australian Fixed Interest

Within fixed interest markets, this is an environment that suggests bond yields will remain anchored or test slightly higher levels, and we believe there is little risk of materially lower yields from here. In this context, investors remain well-compensated for moving further along the relatively steep yield curve.

Inflation expectations are likely to continue to lift as economic activity gains momentum, with a gradual reduction in output gaps. A knock-on impact of declining output gaps is the potential for companies’ prospects and financial health to improve, which could see a flatter default cycle than first anticipated in the depths of the crisis.

The three biggest opportunities we see for fixed interest are:

- Active duration management as markets mis-price central bank activity

- Allocations to high and mid quality corporate debt

- Inflation protection

J.P. Morgan

Matthew Jozoff, Co-Head of Fixed Income Research, favors spread product heading into 2021 as fundamentals and technicals are supportive. J.P. Morgan’s 2021 Year Ahead U.S. fixed income investor survey shows that ESG, high yield and high grade credit and EM are seen as the top asset classes to increase risk. Jozoff believes fixed income net issuance will remain at record levels and approach $4 trillion led by U.S. Treasuries, but the share of spread product will fall from 50% to just 30% or to $1.2 trillion compared to $1.9 trillion in 2020.

Duration supply excluding Fed purchases is set to more than double in 2021 to exceed $2 trillion. Jay Barry, Head of USD Government Bond Strategy, expects 10-year U.S. Treasury yields to rise to 1.25% by Q221 and to end the year at 1.45%. Steve Dulake, Global Head of Credit Research, sees spreads possibly overshooting near term but ending 2021 flatter or slightly tighter across the board although current spreads (125 basis points for U.S. high grade corporates) have already tightened past January 2020 levels. Even without further spread tightening, corporate carry plus roll-down on the spread curve should generate about 50 basis points per quarter. Record cash accumulation by high grade companies in Q220-Q320 could end up being used for M&A, share buybacks and dividends instead of deleveraging. U.S. dollar downside is likely to be limited as the great interest rate convergence of 2020 that accompanied much of this past year’s dollar weakness is now complete.

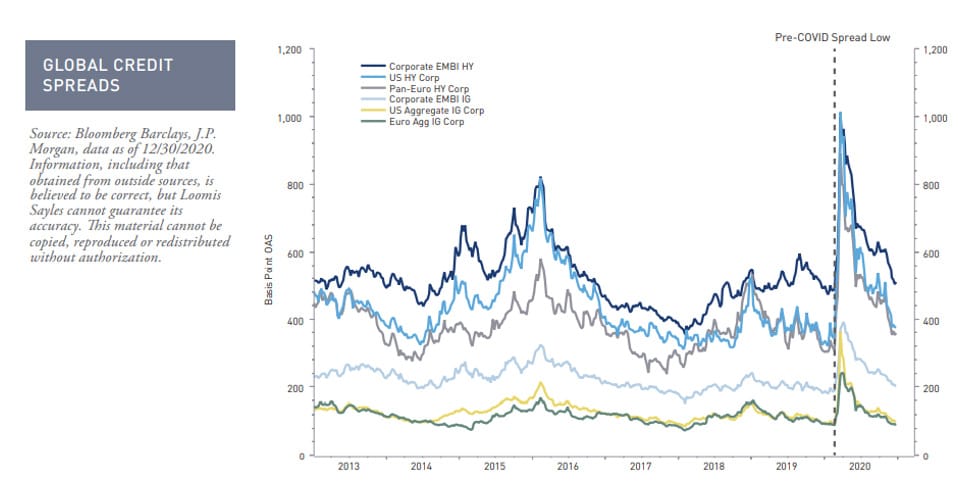

Loomis Sayles

Global credit spreads may not tighten much from current levels

- Near-record low interest rates, sizable liquidity and strong demand for yield should help keep credit market volatility at bay.

- US, Europe and Sterling investment grade spreads are likely to remain in a fairly tight range near pre-COVID lows given the stimulative policy mix and anticipated fundamental improvement.

- Lower-credit-quality fixed income performance tends to be highly correlated with economic activity. We believe US high yield spreads have room to tighten a bit more as the credit cycle likely progresses through the recovery phase in 2021.

- US-dollar-denominated emerging market (EM) corporate credit looks relatively attractive because spreads have only retraced 75% of the COVID-induced spike. The sector should see positive momentum as long as the global economy, and Asian economies in particular, continue to improve.

- The US dollar appears likely to weaken during the recovery phase, which could relieve a certain degree of funding pressure in strained areas of the EM dollar-pay sector.

- US housing market strength should continue to support RMBS In consumer ABS, fiscal stimulus could help contain any weakness. In CMBS, the future of commercial real estate and current fundamentals represent challenging hurdles, but signs of a bottom may be emerging.

- We believe realized default rates within the US levered loan sector may be notably lower than what the market was pricing last spring. We expect loan prices to move higher going forward.

UBS Asset Management – Panorama – Investing in 2021

The era of negative bond yields in developed markets has continued to present challenges for fixed income investors with approximately USD 15 trillion or the equivalent of 24% of the investment grade fixed income universe yields currently zero or below.

A recent JPMorgan study also found that 76% of all developed market sovereign bonds had a negative real yield.

Lower yields for longer

The trend of ultra-low yields in developed markets is likely to persist for three main reasons.

Firstly, with developed market central bank policy rates at or near the lower bound, longer-dated government bonds have become a policy tool for central bankers – now active across the yield curve.

Although the Bank of Japan was the first to enact yield curve control and set a zero percent target for 10-year Japanese Government Bonds (JGB) in 2016, other central banks such as the Fed and the Reserve Bank of Australia seem likely to do so albeit at the front end of the curve.

Given the dramatic expansion of fiscal policy across many developed markets, governments will need bond yields to remain low and therefore bond purchases via quantitative easing to stimulate economic growth seem likely for the foreseeable future.

Active fixed income investors can pull on several levers such as interest rate management, asset allocation and security selection in an effort to achieve attractive returns despite low entry yields.

Secondly, central banks are trying to get more creative in moving inflation, and inflation expectations, above target. If successful, and if nominal yields are well anchored, then real yields (yields after inflation) could move even lower.

The Fed recently indicated that it would hold rates at very low levels even as prices start to rise to allow inflation to run above target. We believe other developed market central banks will likely follow.

Central banks have committed to buying corporate bonds and ETFs, effectively crowding out private capital. While their interventions in corporate bond markets have diminished recently, their role as market makers of last resort could continue. Additionally, ageing populations in developed countries mean increased savings and demand for fixed income assets are driving yields down even further.

Active fixed income investors can pull on several levers such as interest rate management, asset allocation and security selection to achieve attractive returns despite low entry yields.

So, with yields back down to sub-zero levels and income now scarce, where should investors be looking in their search for yield in 2021?

We believe pockets of opportunity exist in emerging markets where only 17% of sovereign bonds are negative yielding after adjusting for inflation.

Asia offers growth – and unrivalled yield

In Asia, many economies are already in recovery mode, with China leading the way.

This is largely due to Asian countries pursuing a multi-tiered response, including credit support, fiscal stimulus, and well-designed pandemic response measures.

On the monetary policy side, Asian governments have been more reluctant to cut rates − opening a substantial yield margin to take advantage of in Asian high yield markets compared to Europe and the US.

We believe this presents an excellent investment opportunity as yields remain attractive; and investors may further benefit from spread compression. Asian high yield is also less exposed to commodities and consumer cyclicals than European and US high yield.

[Also read: Investment Grade Supply – The 2021 Story]

China remains a standout

But looking deeper into Asia, China’s onshore bond market remains a standout opportunity, and particularly Chinese government bonds given the attractive real yields, low correlation to global markets and backing from one of the world’s few remaining net creditor nations. We believe this is a compelling risk-reward trade off.

Chinese government bonds yields troughed in 2Q20. However, China is now tightening credit expansion and this, combined with a challenging outlook for the global economy, means China’s rapid rate of growth may slow from mid-2021. We think further rate cuts are likely in 2H20.

Focus on Asia for 2021

These segments of the rapidly-growing Asian fixed income universe are just two of many yield opportunities in Asia. An Asia allocation can provide investors exposure to a region poised to bounce back in 2021, as well as strategic long-term positioning as Asia evolves as the world’s key growth driver.

Vanguard – Economic and Market Outlook 2021

Global inflation: Modest reflation “yes”; a return to high inflation “no”

In 2021, we anticipate a cyclical bounce in consumer inflation from pandemic lows near 1% to more realistic rates of close to 2% due to base effects and as the recovery continues. A risk is that markets could confuse this modest reflationary bounce in inflation with the start of a return to a 1970s-type high-inflation era. Mounting debt loads, extraordinarily easy monetary policy, and, in the case of the United States, an explicit assurance that policy will remain accommodative longer than it had in the past have all led to concerns about resurgent inflation. Our baseline projections show that such concerns are premature and unlikely to materialize in 2021. More profligate fiscal spending has the potential to influence inflation psychology, but any such influence would have to more than counteract high levels of unemployment and technology influences to drive up inflation expectations. We maintain our long-held assessment that inflation rates persistently above 3% are difficult to generate across many developed markets.

The bond market: Interest rates staying low in 2021

Interest rates and government bond yields that were low before the pandemic are now even lower. Our expectations are for short-term policy rates targeted by the U.S. Federal Reserve, the Reserve Bank of Australia, and other developed market policymakers to remain at historically low (and, in some markets, negative) levels into 2022 before eventually beginning to normalize to pre-COVID levels. Yield curves may steepen slightly as long-term rates in our baseline forecast rise modestly. But given our outlook for inflation and central bank policy, bond yields are unlikely to move markedly higher. In our view, central banks would be inclined to fight a sharp rise in bond yields in 2021 through additional quantitative easing purchases or other measures should such a situation be viewed as counterproductive to the economic recovery.

Wellington Management – 2021 Outlook

More positives than negatives – A moderately pro-cyclical risk posture

As of this writing, broadly speaking, we somewhat favor higher-yielding fixed income sectors. We believe that over the coming year, default risk is likely to fall, potentially helping spreads to tighten in many credit sectors. Despite this generally positive outlook, we have recently suggested that clients modestly reduce credit risk and add portfolio liquidity, because some of the spread tightening we had anticipated has already occurred. We believe it prudent for investors to maintain a larger reserve of high-quality, liquid assets for the purpose of exploiting market dislocations that may occur in the months ahead.

A downside surprise with regard to a COVID-19 vaccine, a delay in additional US fiscal stimulus measures, and uncertainty around the direction of policy under a Biden administration are some catalysts for potential spikes in volatility that we will be watching closely.

Our mosaic of cycle indicators is currently sending more positive than negative signals, with extraordinary monetary and fiscal stimulus, along with reasonable asset valuations, somewhat offset by challenged economic and corporate fundamentals. As we look across the various fixed income sectors, we see a few pockets of attractive value for investors to consider.

Bank loan spreads were recently in the top quintile versus their history and represent one of our highest-conviction investment ideas for multisector portfolios (Figure 1). The near-zero interest-rate environment this year has pushed down these loans’ total yield, causing them to fall out of favor with many investors. Furthermore, as default rates have increased, a handful of high-profile loans have defaulted lately, with expectations of very low recovery rates.

However, we believe these concerns are more than adequately priced into today’s attractive loan spreads. On average, loans still tend to experience higher recovery rates than comparable bonds, while also typically offering similar or better credit spreads. … We currently see the best opportunities in higher-quality, US-focused loan issuers in less cyclical industries.

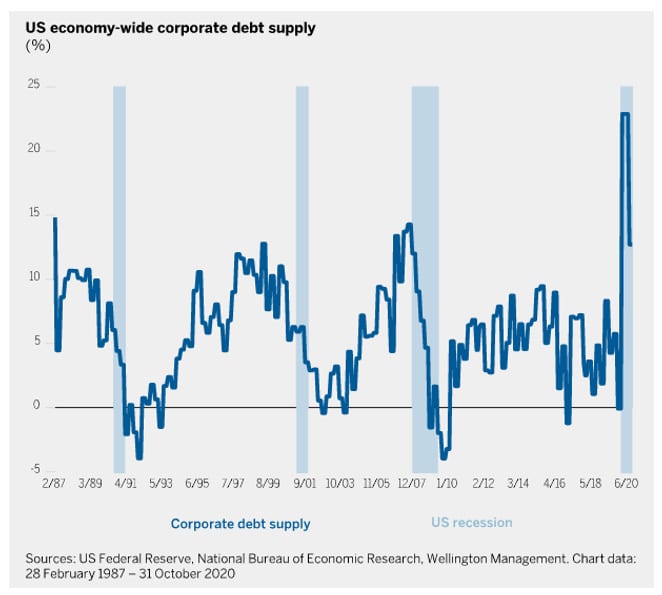

Many bond-market participants have warned about the massive expansion of corporate debt that has taken place during the pandemic. In the past, elevated levels of debt growth predicted subpar returns for corporate credit. Historically, we have viewed rapid debt growth as driven primarily by speculative behavior on the part of corporate managements — for example, debt-financed expansions that later proved to be poor capital allocation decisions. Today’s debt growth, however, has not been fuelled by mergers and acquisitions, but mainly by a judicious desire to improve liquidity in today’s highly uncertain business environment.

We therefore do not view the current increase in corporate debt in a wholly negative light as it is indicative of precaution rather than risk-taking. Moreover, the bond-market technical backdrop looks very strong: The rising debt supply has been met by a commensurate increase in demand, as central bank bond purchases have enabled the market to absorb more corporate debt. We suggest that investors focus on those issuers best positioned to quickly deleverage their balance sheets as the global economy mends.

The brightest spots in securitized credit are primarily securities exposed to residential housing. Housing prices remain buoyant amid continued low mortgage rates, fiscal stimulus, and a favorable supply-demand dynamic that has persisted since the global financial crisis.

Stay long credit, keep some cash ready

As we navigate between two powerful forces — supportive government policy and healthy bond-market technicals on one side, juxtaposed with a turbulent economic landscape on the other — we steer more toward the positive side, because we still see a number of attractive investable opportunities, including US bank loans, EM corporate debt, and residential housing-linked securities. Cash and other liquid assets may also be worth considering now, especially for clients who want optionality to invest elsewhere as market dislocations arise.