2022 will see global sovereign debt rise by 9.5%, up by US$6.2 trillion (AU$8.53 trillion) to a record US$71.6 trillion (AU$98.4 trillion), according to the second annual Janus Henderson Sovereign Debt Index. The increase will be driven by the US, Japan and China in particular, though almost every country is expected to borrow further.

2021 saw sovereign debt levels hit new records, with Australia adding US$107 billion (AU$147 billion)

Global government debt jumped to a record US$65.4 trillion (AU$89.9 trillion) in 2021 with some countries taking on more debt than others as they continued to meet the pandemic’s challenges. On a constant-currency basis, public debt levels rose 7.8% as governments borrowed an additional net US$4.7 trillion (AU$6.5 trillion). Since the pandemic began, global sovereign debt has soared by over a quarter, up from US$52.2 trillion (AU$68.4 trillion) in January 2020 to today’s record.

Every country Janus Henderson examined saw borrowing rise in 2021. China’s debts rose fastest and by the most in cash terms, up by a fifth, or US$650 billion (AU$894 billion). Among large, developed economies, Germany saw the biggest increase in percentage terms, with borrowing rising by one seventh (+14.7%), almost twice the pace of the global average.

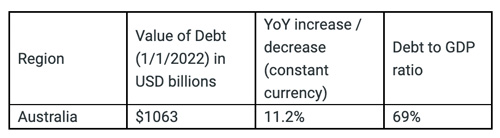

In pursuit of Australia’s continued zero-Covid policy, the country’s debt burden rose by over one tenth (+11.2%) in 2021, amounting additional debt worth over a fifth (22%) of its GDP. However, because Australia entered the pandemic with an exceptionally low debt/GDP ratio compared to its international peers – it remains one of the least indebted among the major industrialised nations.

Despite surging levels of borrowing, debt servicing costs remained low. Last year, the effective interest rate on all the world’s government debt was just 1.6%, down from 1.8% in 2020. This brought the total cost of servicing the debt down to $1.01 trillion, compared to $1.07 trillion in 2020. The strong global economic recovery meant the global debt / GDP ratio improved to 80.7% in 2021 from 87.5% in 2020 as the rebound in economic activity outpaced the increase in borrowing.

Also read: Australian Economic View – April 2022: Janus Henderson

2022 will see debt servicing costs significantly increase – and continue to rise in the coming years

The global interest burden is set to rise by around one seventh on a constant-currency basis (14.5%) to US$1,160bn (AU$1,595bn) in 2022. The biggest impact is set to be felt in the UK thanks to a rising interest rates, the impact of higher inflation on the large amount of UK index-linked debt, and the cost of unwinding the quantitative easing (QE) program. As interest rates rise, there is a significant fiscal cost associated with unwinding QE. Central banks will crystallise losses on their bond holdings which have to be paid for by taxpayers.

Although Australia’s debt interest costs rose only slightly in 2021, the costs are set to accelerate in the coming years as interest rates rise. For this, Australia will also see its borrowing rise faster than the UK or Europe in 2022.

Bond market divergence signals opportunities for investors

During the first couple of years of the pandemic, bond markets around the world converged. Now, the theme is divergence. The US, UK, Europe, Canada and Australia are focused on tightening monetary policy to squeeze out inflation – both through higher interest rates and with tentative steps towards unwinding quantitative easing programmes. By contrast, the Chinese central bank is stimulating the economy with looser policy.

Rising inflation meant a bad year for bond-market returns, but at a time of global risk, bond markets offer opportunity for investors by picking the right geographies and maturities.

Janus Henderson sees asset allocation opportunities in shorter-dated bonds as they are less susceptible to changing market conditions. Janus Henderson believes markets are expecting more interest rate hikes than are likely to materialise and this means shorter-dated bonds will benefit if the tightening cycle ends sooner.

Jay Sivapalan, Head of Australian Fixed Interest at Janus Henderson said: “Australia entered the pandemic with an exceptionally low debt/GDP ratio by comparison to its international peers – 47%. Over the past two years, the government has borrowed significantly to support the economy, amounting to additional debt worth over a fifth (22%) of its GDP. This puts Australia at the top end of the global response over the past two years, taking on a larger additional debt burden than the UK and US (20%) and France and Germany (18% and 17% respectively).”

Bethany Payne, portfolio manager, global bonds at Janus Henderson said: “The pandemic has had a huge impact on government borrowing – and the after-effects are set to continue for some time yet. The tragedy unfolding in Ukraine is also likely to pressure Western governments to borrow more to fund increased defence spending. Despite recent volatility, opportunities exist for investors in sovereign bonds markets. During the first couple of years of the pandemic, the big theme was how bond markets around the world converged. Now, the theme is divergence; regime change is underway in the US, UK, Canada, Europe and Australia, which are now focused on how to tighten monetary policy to squeeze out inflation, while other regions are still in loosening mode. Regarding Asset Allocation, there are two areas of opportunity. One is China, which is actively engaging in loosening monetary policy, and Switzerland, which has more protection from inflationary pressure as energy takes up a much smaller percentage of its inflationary basket and their policy is tied, but lagging, to the ECB.

“As well as picking the right geographies, we think shorter-dated bonds look attractive at present relative to riskier long-term ones. When inflation and interest rates are rising, it is easy to dismiss fixed income as an asset class, particularly since bond valuations are relatively high by historical standards. But the valuation of many other assets classes is even higher and investor weightings to government bonds are relatively low, so there is a benefit in diversifying. Plus, the markets have largely adjusted for higher inflation expectations, so bonds bought today benefit from higher yields than a few months ago, meaning they are better value.”

The Janus Henderson Sovereign Debt Index tracks the borrowing of governments around the world and identifies the investment opportunities this presents.