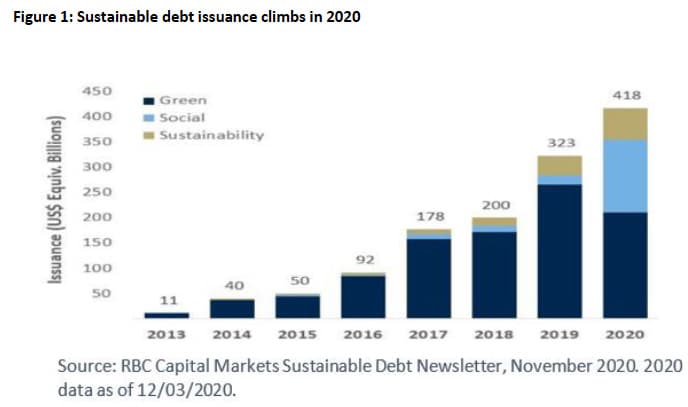

The green finance market, similar to almost every other aspect of 2020, was shaped by the COVID-19 pandemic. According to Calvert Research and Management, in the first half of the year, alternative forms of sustainable finance flourished as both governments and corporations sought to combat the effects of the pandemic with social and sustainability offerings. Notably, $75 billion of debt with a “pandemic” label was issued in the first half of 2020.1

Brian S. Ellis, Calvert Fixed Income Portfolio Manager says: “Although the impact of COVID can be seen in the growth of social debt versus other sustainable debt categories in 2020 (Figure 1), green bond issuance (debt issued by governments, banks, local governments and corporations to finance climate change and other environmental solutions) also experienced a steady recovery as 2020 progressed.2 “

According to data from ING, the third quarter (Q3) of 2020 marked the highest recorded level of green bond issuance for any previous Q3, and continued growth led to cumulative global issuance of $1 trillion by mid-December. Use-of-proceeds remains the most common form of green bonds issued, comprising 87% of all issuance since first offered by the World Bank in 2008. In 2020, use-of-proceeds bonds, which finance projects related to energy, transport, building and water, among others, accounted for 84% of total green bond issuance.

Ellis says: “The green bond market has grown to levels not many would have imagined at the beginning of this decade. In our view, this trend will likely continue as global demand grows for debt that supports environmental and other sustainability-focused projects.

“Despite early concerns about a potential shortfall in 2020 issuance, $223 billion of green bonds was brought to market by mid-December, with the yearly total set to fall just shy of the market’s 2019 high-water mark of $255 billion. Looking ahead in 2021, many analysts project the strong recovery in green bond issuance to continue — estimates range from $300 billion to nearly $500 billion.3

So, what are the catalysts behind this growth and recovery?

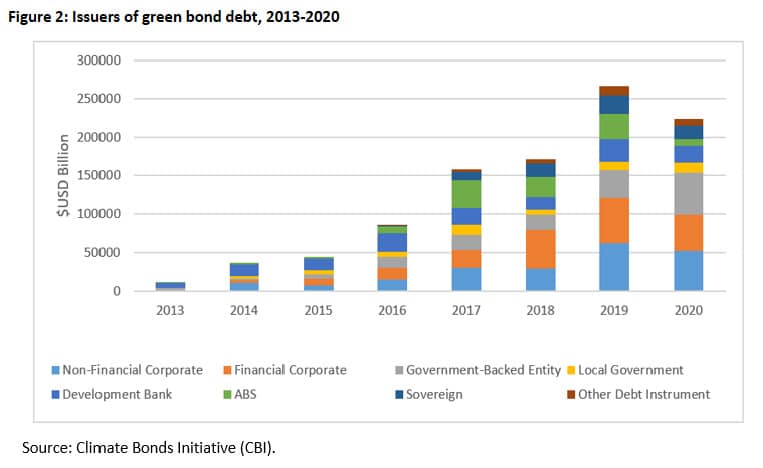

Ellis notes: “Early in 2020, the growth story revolved around corporate issuers, both financial and nonfinancial, which had replaced early green finance leaders, such as development banks. As corporate issuance of green bonds slowed, in part due to COVID, other issuers such as government-backed entities grew their market share.

“Later in 2020, sovereign issuers that had previously concentrated their efforts on pandemic recovery began to shift their attention back toward environmental impact. Germany and Sweden alone issued a combined $9.4 billion USD of green bonds over the span of a single week in September. By the end of 2020, the list of sovereign green issuers grew to 17.

“State-level and other international support for the green market is expected to grow further in the coming months, with the UK, Canada, Spain — and potentially up to 11 other sovereigns — set to issue inaugural green bonds in 2021.

“Most significantly, the European Union (EU) announced in September that it will sell 225 billion euros ($267 billion) of green bonds as part of its pandemic recovery fund, making up about 30% of the EU’s €750 billion rescue package.4”

Notes:

1. Climate Bonds Initiative (CBI) Green Bond Market Summary H1 2020, August 2020. To be classified as “green” by the CBI, 100% of a bond’s net proceeds must be dedicated to financing or refinancing “green” assets including renewable energy, low-carbon transport, low-carbon buildings, sustainable water and waste management, sustainable land use and climate change adaptation measures such as flood defenses.

2. RBC Capital Markets Sustainable Debt Newsletter, November 2020.

3. Bloomberg, “Sustainable finance debt to top $1 trillion in 2021, SEB says” by Frances Schwartzkopff, December 10, 2020.

4. Bloomberg, “EU plans to sell $225 billion euros of green bonds for stimulus” by John Ainger and Lyubov Pronina, September 16, 2020.