Verdict

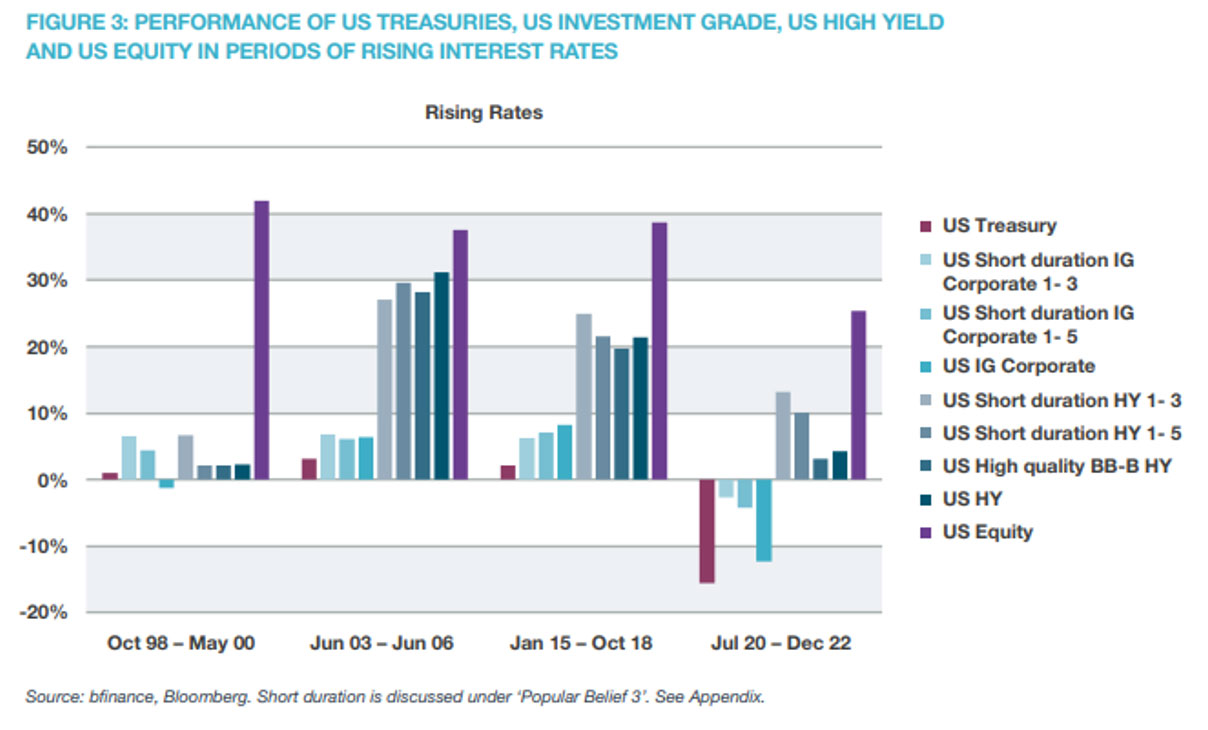

US Treasuries (UST) and US Investment Grade often generate flat to negative performance in periods of rising yields. But a number of fixed income sub-sectors have provided moderate-to-strongly-positive returns during rising-rate periods, though the factors supporting performance are changing over time.

Periods when UST yields are rising (used here to define a rising-rate phase) tend to be accompanied by strong equity market performance, at least in their early phases. In many cases rising yields signal an improving economy, such as we experienced in 2015- 18 with Trump’s tax cut and infrastructure spending.

The performance of fixed income securities, by contrast, has historically appeared weak in these periods, with the important exception of floating rate Leveraged Loans. Yet a rising-rate period does not always produce significant losses in fixed income, such as those we’ve recently witnessed in US Treasuries and Investment Grade Credit (Figure 3).

A number of factors influence the extent to which fixed income performance will withstand rising interest rates. These include duration (higher-duration securities are more sensitive than lower-duration), spread compression (which can offset the damage of rising rates) and coupons (which offset the loss in price). There are changing dynamics around these three variables, which should be understood and viewed with care.

Duration

Investment Grade Credits tend to suffer more than High Yield when rates are rising due to their longer average maturity (average duration has ranged from 6 to 8.5 years over the past 20 years). In contrast, junk issuers must typically borrow over shorter-term periods and thus these securities feature lower duration (around 4-5 years over the past 25 years) and lower sensitivity to interest rate risk. Shorter term IG credit provided notable protection against the recent losses, as shown in Figure 3, and also meaningfully outperformed the IG index in 1998- 2000. Duration tends to decrease as yields rise, such that potential losses of further rate rises are diminished: a positive note for the present climate.

Spread compression

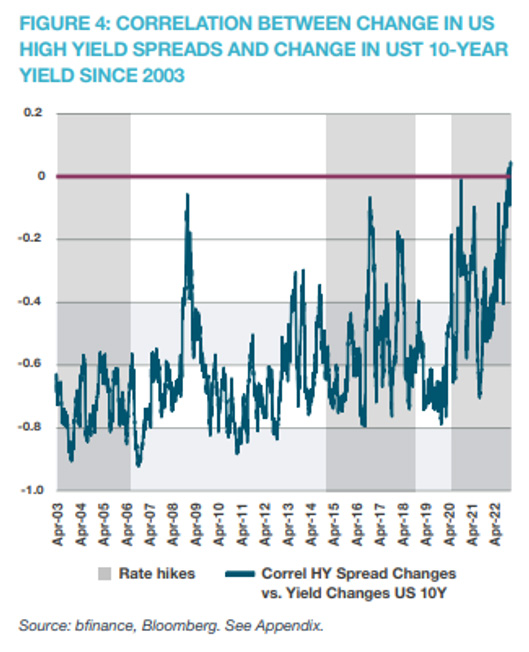

Spread compression can often compensate for rising rates: changes in spreads and changes in yields have historically tended to be negatively correlated (since rising yields often signal an improving economy). This is particularly true in High Yield credit, which (unlike Investment Grade credit) is essentially a spread product: in US High Yield we note an average correlation of -0.6 over rolling 60-business-day periods since 2003. Although correlation increases in periods of rising rates, it has still tended to remain— in the vast majority of cases—in negative territory.

This was not, however, the case in 2022

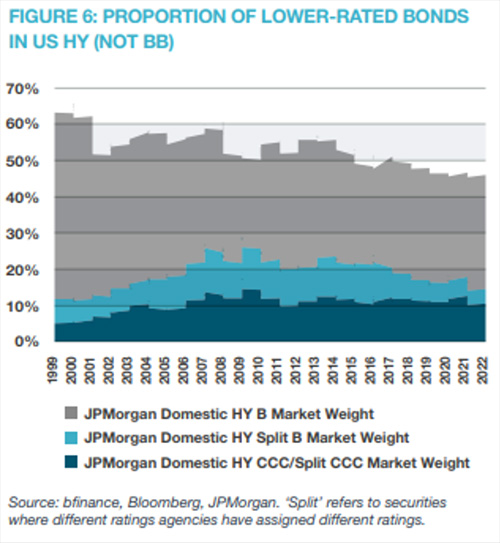

See Figure 4: the correlation between changes in US High Yield (HY) spreads and changes in the UST 10-year yield hit positive territory. There are two main reasons for this change. Firstly, spreads were already quite compressed at the outset of the latest rate rise cycle: tight spreads have less room to decrease further (as would be necessary to produce a negative correlation when yields move upwards). When considering the current climate, it’s also important to be aware that, while yields have improved (particularly in Investment Grade credit and Emerging Market debt), spreads have not significantly widened. Secondly, the quality of US HY has improved, as shown in Figure 6 and discussed in the subsequent section: higher-quality HY debt means lower spreads and less potential compression.

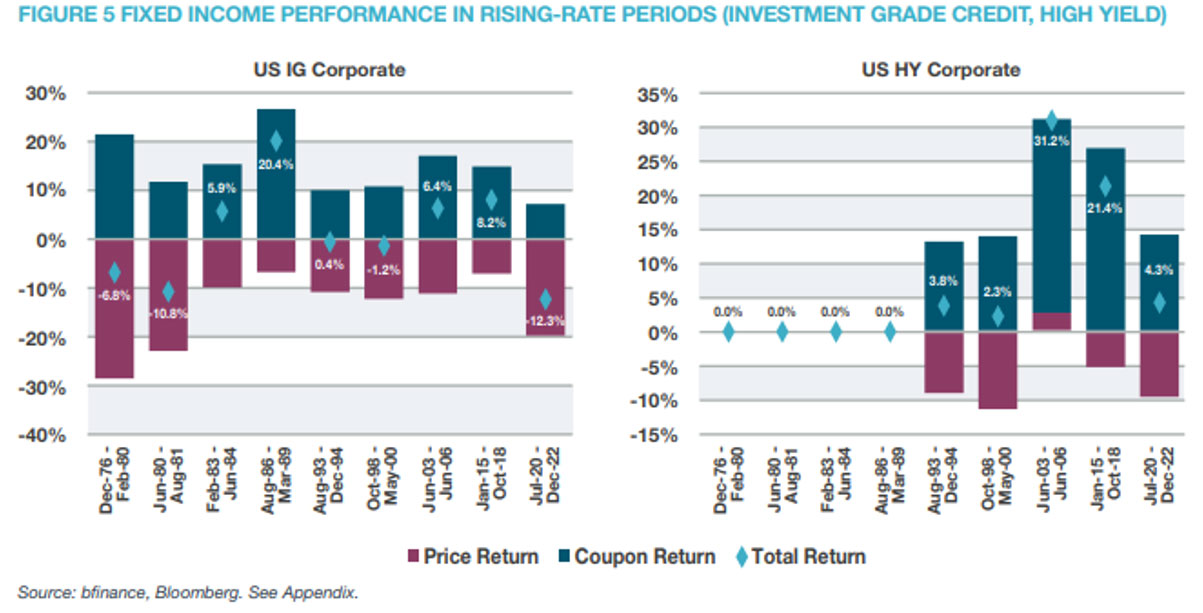

Coupons

Coupon returns can meaningfully offset negative price movements. Low coupon returns in investment grade credit have played a significant role in the overall poor performance seen during the latest cycle, as shown in Figure 5. The improving quality of the HY segment (see Figure 6) should also be considered when looking at Figure 5, since lower-quality credits tend to have higher coupons.

Popular Belief 2 Investment grade bonds outperform high yield bonds during recessions.

Popular Belief 3 Short-duration assets are less volatile than long-duration assets.

This is part of a series of articles from London-headquartered specialist consultant bfinance, based on their whitepaper: Recessions, Rising Rates and Received Wisdom in Fixed Income Investing.