Verdict

A risk-off stance in fixed income is broadly beneficial during recessions, minimising exposure to defaults. However, High Yield performance is not far behind Investment Grade, with the HY market typically recovering significantly earlier than the real economy.

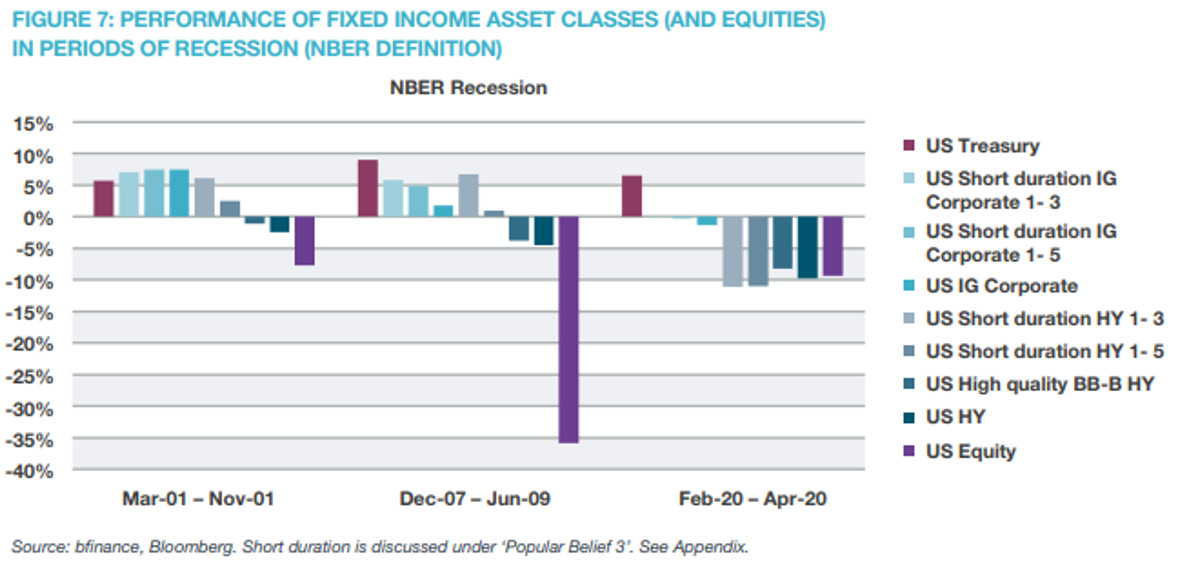

Received wisdom for recessionary investing is to favour higher quality, longer duration asset classes. Indeed, the very brief recession of 2020 saw US HY underperform US stocks. Yet historical data suggests that the performance of High Yield bonds is not as bad as one might suspect: it is not necessarily true that this sector will suffer heavy losses during periods of economic decline.

As shown in Figure 7, HY debt resilience is largely due to stronger performance during the later stages of recessions. Recessions tend to consist of an earlier period when risk assets are broadly in retreat (a shift which, nowadays, tends to start long before an extended economic decline is seen, let alone declared) and a period when risk assets, including High Yield bonds, are resurgent. The risk-on shift tends to take place well before the real economy emerges from recession. It is often linked to central bank rate cuts that are designed to encourage growth; investors should be cautious of inflationary conditions that obstruct central bank stimulus. Just as investors can theoretically benefit from a recession-oriented approach long before the recession is visible, a recovery-oriented approach is typically helpful before the recovery is evident.

Also read:

Popular Belief 1. Fixed income does poorly in periods of rising interest rates.

Popular Belief 3. Short-duration assets are less volatile than long-duration assets.

This is part of a series of articles from London-headquartered specialist consultant bfinance, based on their whitepaper: Recessions, Rising Rates and Received Wisdom in Fixed Income Investing.