Late November, the Australian Securitisation Forum (ASF) held its annual conference in Sydney. Asset Backed Securities (ABS) are much loved by institutional investors but not well known by others. Here’s an abridged discussion from the conference with five panelists:

- Peter Riedel from Liberty Financial

- June McFallon from Allied Credit

- Stephen Martin from Challenger Investment Management

- Tim Leham from Bank of Queensland

- James Austin from Firstmac

- Sharyn Le from NAB was moderator

Note: Graphs used below were sourced from Acting Head of Domestic Markets at the RBA, Carl Schwartz’s presentation at the ASF Conference.

Sharyn:

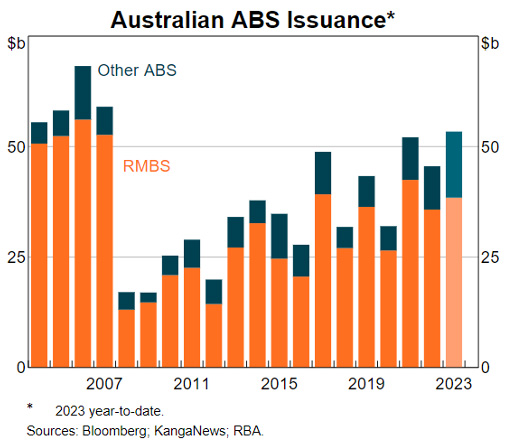

Notwithstanding the collapse of SVB, geopolitical tensions and inflationary pressures, securitisation issuers have still managed to raise over $30 billion in Residential Mortgage Backed Securities (RMBS) and a whopping $13 billion in Asset Backed Securities (ABS) this year, which is up on 2022.

[Note: Asset Backed Securities is the umbrella term for all securitisations. The Australian market is dominated by RMBS but has seen rising auto ABS in the last year. For more on ABS see Residential Mortgage Backed Securities – The Basics and a podcast with James Austin recorded in May 2021]

James, Firstmac has raised close to $3 billion in RMBS this year. How have you found the year compared to last? How do you think about securitisation funding FY24?

James Austin:

The financial year to 2023, was a pretty dysfunctional market. During that time, which was largely the start of the rate increase process, there were worries about house prices, worries about where unemployment might go, and the RMBS market largely dried up. So over that 12 month period transactions were largely club trades (club trades is a loose term used to describe private transactions only offered to a select group of investors).

You really have to have those relationships, to be able to go to investors and get the transactions done. Now, club trades then by its very definition means it’s pretty dysfunctional and that created quite a lot of angst amongst investors. But as an issuer, you would never choose to do a club trade, it’s not your preference, you would always much rather do a public transaction. If we wind forward now to the current market, it’s in a much better state. We’re back to the point where you can broadly raise in offered public trades. And that’s a good thing. To come back to the market, we haven’t seen much prime. So any prime out there has been really gobbled up.

Going forward there’s so many potential risks out there, global events that you could easily retreat back into a club style environment.

Sharyn:

Peter, how did Liberty go? How did transactions get executed? And what were some of the challenges you saw this year? And what’s in store for the year ahead?

Peter Riedel:

The year started off being tremendously positive, we issued our first public issue at $1 billion, had well over $2 billion of real money interest and that was really very surprising actually, so we got off to a terrific start. The second quarter was challenging for the reasons, you mentioned. And then to connect them with James’s comments, we had two deals calling in June and every single issuer are always going to want to meet investors’ needs. And so, we too tapped into reverse inquiry (investors approaching the issuers). And like James articulated, got some pretty robust feedback from investors that had been crowded out and so we’ve been successful in bringing another three transactions to market.

We’ve ended up very proud of the fact that we’ve issued six ABS transactions, one in term note and raised $5.8 billion across the calendar year, which is a record for us as an organization. So we’re pretty chuffed have to say including a record auto ABS, and a record SME ABS transaction. But I think what it tells us is that whereas we started cautiously optimistic, I think the year ended really very well. In terms of investor allocation, for us, typically it’s a 50/50 mix between offshore and domestic investors with a very much an overweight allocation ideally to real money investors.

But I think, if you’ve looked at each transactions that has come to market, particularly in the second half and you look at the allocation, I think that’s a cause for again, continued optimism or perhaps a bit of nervousness if you’re an issuer that’s relied on the bank bid because I don’t foresee a scenario in 2024 where there’ll be as much bank demand than there was this year.

I think we’re leaning into a possibly more challenging period in 2024 than we saw in 2023.

Sharyn:

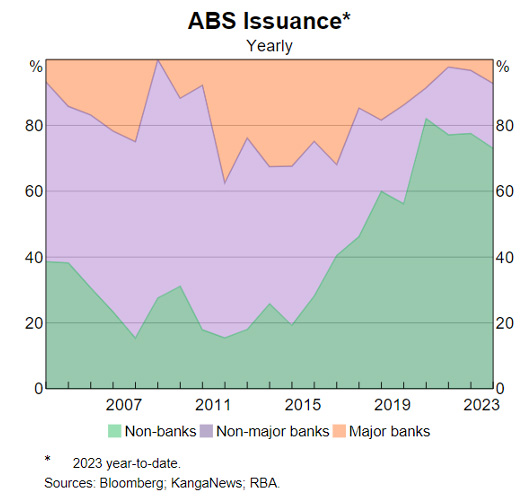

Tim, we saw this year the Authorised Deposit taking Institutions (ADIs) come back after a very quiet year last year. What are you thinking in terms of securitisation funding for the year ahead? And given that ADIs do have more funding options, how do you see it as a funding tool versus capital relief transactions?

Tim Leham:

Last year was a volatile year. It was a difficult year and banks do have other alternatives. We can obviously raise deposits, we can use our senior and secured programs both on shore and offshore. And from our point of view, we’ve got four securitisation programs, so we can choose between asset classes, et cetera. We actually did a medical finance deal in early 2022. With the repayment to the Term Funding Facility (TFF), we obviously last year were keen to get a transaction away in the domestic securitisation market, but again, rising interest rates, the volatility was causing a little bit of dysfunction in terms of being able to get a couple of trades away from an ADI’s point of view.

It’s important for us to get capital relief. If we’re not getting capital relief, we might as well do a covered bond transaction. Which is what we did earlier in the year and then waited for a number of transactions to come to market. The numbers didn’t add up for us until July. It was a market trade from AAAs down to the first loss notes, we got good support across the market.

The market has come back well, periods of volatility caused some ingestion in the capital stack at some stages, but from our point of view it was a strong year.

Sharyn:

ABS had a massive year. Compared to last year, issue volume tripled. So how have you gone about issuing this year, June?

June McFallon:

It has been a tremendous year for ABS, I think I did my first ABS transaction around 2011 after a career in RMBS. And back in 2011 I think there were around about three issuers doing ABS, and we look at this year and we’re well into double digits. Most of that has come from the transition of auto financing from the banks to the non-banks. And obviously Allied, we’ve been around for 13 years, we started as a financial of recreational vehicles and then over the last few years, starting around 2018, we saw the opportunity in auto and we started financing auto through dealer networks and then in 2021 Macquarie and Westpac made the decision to get out of the auto market and that gave us the opportunity to buy their Macquarie Bank wholesale portfolio. Our CEO, Jon Moodie had previously been the MD at Macquarie listing, so it was just a natural progression and we did that through a bilateral arrangement.

Allied now own the Macquarie portfolio and Angle Auto Finance who acquired the Westpac St. George portfolio, bringing programs to the market. As non-bank lenders we’re absolutely more dependent on the securitisation market. So, between us bringing these big deals, and I think we’ve done about $1.2 million in ABS since this time last year and I know Angle have done a couple of very large transactions. In addition, the early other non-banks who were initially in the mortgage space have expanded into auto financing as well. We’ve had all these transactions, around $12 billion year to date and the difference probably this year is that we have seen a lot of support from the banks.

And I guess it raises the question is that real money? As an issue, we go through the same process as we do with any other funding partners. So for us it’s no different and the expectation for us is they’re there to support and hopefully that will continue. There’s definitely been over subscription across the stack, so that’s from AAA right down to equity in some cases.

So, what has been the challenge?

Probably the biggest challenge has been in that engagement with the domestic AAA. There’s definitely a lot of players out there, investors who are still very much focused on the RMBS market. We would really like to see more engagement in the ABS, there’s some support there, but there was the support from the banks and then you’ve got offshore, mainly the Euro, UK, Japanese markets, which is great.

If those markets hadn’t supported our transactions, I don’t think we’d have seen the volume that we have seen this year. And it does bring challenges, not so much challenge, but it does bring another layer of complexity and work to get the deals done. You’ll see that most transactions have satisfied the risk retention regulations, the European UK reporting requirements, so it does add more to the deal. The difference now in ABS, is you’ve got mainly the non-banks bringing deals to market, they’ve got that higher reliance on the term markets, so I think it justifies doing the work, ABS is good value, for some reason it’s still price is wider than RMBS, that’s something else for discussion. I think that will change. The walls are shorter, there’s no extension risk, so I think it’s a really good product.

Sharyn:

James, you’ve got an auto deal in market at the moment. How are you finding the investor base RMBS versus ABS?

James Austin:

I think it’s really good that there’s a lot of new issuers coming to ABS that are well known by many, but what probably what’s not so well known is that there’s a lot of investors from the RMBS side who are amending mandates and coming across to look at ABS. So, it’s a good rich market. I think it’s great for our industry and there’s great variety amongst the issuers.

Stephen Martin:

It’s kind of interesting, there’s a couple of comments that I can pick up on. First one is one that June mentioned about the growth in the ABS space. It’s been really interesting and exciting, something we’ve looked at over the last three years, if you look at demand, what’s the mezzanine ask, it’s something like 50% higher than what it was. So even though the overall issue and numbers tick up and down, that demand or that requirement has ticked up a lot in the mezz space.

I can see some faces of my competitors around the room and that’s a good thing, there’s a lot more people out there. It does make it tricky, I think though in time to bundle us into one group. And so the guy that’s buying your junior AAAs is not the guy that’s buying your G1 notes and I don’t envy the issuers next to me on the panel by having to manage all those different competing voices. I believe they paint a slightly rosier picture than some of the other panelists on the ability of the securitisation market to weather 2023. It was another crazy year with kind of shocks hitting the domestic market, but as you alluded to at the start, we’re still tracking towards what’s going to be a record issuance and if you put AAA to one side for a second, very much a record as it relates to mezzanine requirement.

In terms of what we’re looking for in 2024, there’s a couple of key things.

- We’re seeing non-banks wanting to widen the funnel of what they write. Now, whether that be through prior adjacencies or whether that be through pushing the creditor spectrum a little bit, that’s definitely happening. In the warehouses that we provide, we’re definitely seeing those requests coming through and so we’re watching for 2024 to see whether that’s going to have a following impact on collateral quality and credit quality.

- It’s hard out there for non-bank members in particular. Particularly those that are unable to achieve the economies of scale you need to have an ongoing public securitisation program. And I think as whilst we might’ve expected more about the shakeout in 2023, I think we will start to see some of the shakeout in 2024.

Sharyn:

One of the themes that came out from a lot of the issuers this year is the mezz port, the securitisation. It’s been a little bit inconsistent throughout the year.

Stephen Martin:

We still did a lot of ABS, so maybe I characterize it as maybe the price being something my fellow panels don’t like rather than the provision of capital. But it has been volatile. I think the driver that we are a bigger seat of people, gone are the days of the Australian securitisation market, being able to call three guys and that’s going to cover your mezz requirement for the whole year. I think that’s ultimately a good thing, but there’s going to be a transition period and that it much harder than it used to be.

Sharyn:

Pete, your perspectives on how you balance your mezz investors to ensure that they keep coming back?

Peter Riedel:

I think what’s important is to offer all the mezz notes publicly all the time and especially, if you can, don’t replace anything because that gives everybody opportunity to participate, to consider an opportunity to do the work that is necessary, knowing that it’s a level playing field coming in. And we always aspire to essentially straight line allocating anybody who wishes to participate from double A to single B and we’re in a fortunate position to be able to provide that to investors. And I think in doing so you’re engendering both loyalty, participation and continuation of engagement.

Stephen Martin:

I think that you’re right that you are in a fortunate position, you’re one of the big guys, so you can do that. I think trying to get 10 mezz guys to look at your first inaugural issue on the prospect of getting scaled, 10 to zero doesn’t work for some.

James Austin:

There’s more coming. There are more new issuers coming and the market can be much bigger. It’s a case of if you build it, they will come and that is happening. As I say, we’ve got the benefit in Australia of a deep RMBS market and investors naturally flow over from that structured credit into ABS structured credit. And we’re doing some work in the ASF at the moment to create benchmarks for comparability to make it better known and understood. But when you start looking into the transactions in detail, no pool is the same as another pool, they’re really quite varied, whereas RMBS, each prime deal is pretty consistent and non-conforming, is pretty consistent, but there’s so much more variety for ABS.

And so, I would think that for investors, therefore they’d want to really go in and do that detailed analysis, there’s much richer rewards available for them. I think it’s a really good positive for our industry. And let’s say the more it grows, the better it’ll be. And to Pete’s point, it’ll attract more offshore investment as well.