Bryan David, Multi sector Portfolio Manager, Principal Asset Management

Markets opened the year with enthusiasm over the prospect of forthcoming policy rate cuts after the Federal Open Market Committee (FOMC) signaled a policy pivot in their final meeting of 2023. However, as 2024 has progressed, that excitement has given way to measured skepticism due to surprisingly healthy U.S. economic data and stubbornly high inflation readings, leading the market to quickly call into question the depth, timing, and certainty of rate cuts. Yet, it’s likely too early to entirely discount rate cuts in 2024. The FOMC has been consistent in their messaging of data-dependency (albeit, erring on the side of caution) and key leading indicators still suggest that the evolution of inflation and economic data over the year may yet be supportive of a policy pivot.

Support for a policy pivot

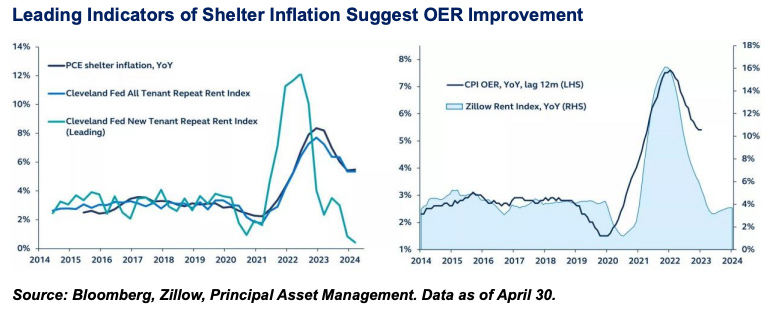

Deconstructing the FOMC’s preferred measure of inflation, Personal Consumption Expenditures Price Index (PCE), shows that Core Services, especially Shelter and specifically the Owner’s Equivalent Rent (OER) component of shelter, has been the least responsive during rate hikes. OER seeks to measure the amount of rent that could be paid to substitute an owned house for an equivalent rental property. As it accounts for roughly a quarter of the overall CPI basket, it is one of the key indicators for inflation.

While OER has been noisy over 1Q, other leading indicators of shelter inflation (primary rents, new lease signings, median home prices, home price appreciation, Cleveland Fed New Tenant Repeat Rent Index) all suggest that there is a significant amount of improvement to come in the year ahead.

OER receding in the coming months would likely facilitate a return to the more convincing downward trend in inflation witnessed heading into 2024. In turn, this would present the FOMC with more compelling empirical evidence that their restrictive policy is having the intended impact on inflation and open the door to prospective rate cuts.

Also read: Defeating Inflation Will Take The Fed Longer Than It Expected

What this means for fixed income investors

Against this backdrop, fixed income returns appear poised to benefit both from an attractive yield and a duration tailwind. The income generated from fixed income today is markedly improved from what investors could find from the asset class only a few years ago, while the FOMC’s prospective shift in policy will benefit duration. Investors should consider the opportunities presented by the evolving Fed cycle.

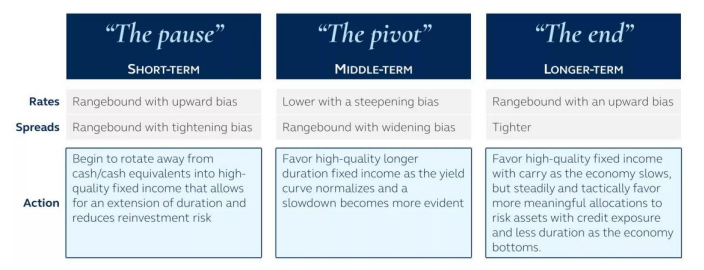

1. The Pause: In the near term, while the Fed is keeping policy rates on hold, a rotation away from cash and cash equivalents (e.g., money market funds, certificates of deposits, etc.) into high-quality fixed income that allows for a relative extension in duration and mitigates reinvestment risk is opportune. With a greater likelihood for the lasting path of front-end rates to be lower versus higher, increasing duration (or interest rate sensitivity) now will better position a portfolio to take advantage of falling rates. In addition, locking in yield (or income) for a longer period will reduce the risk that an investor sitting in cash and cash equivalents today will have to reinvest that money at a lower rate in the future.

2. The Pivot: As the FOMC begins to cut rates, high-quality longer-duration fixed income should outperform on a risk-adjusted basis as the inverted yield curve steepens and an economic slowdown becomes more apparent. With more conviction surrounding the depth and timing of rate cuts, fixed income instruments with more duration should benefit as yields on the front end of the curve fall below the yields on the long end of the curve. Holding investment grade paper should position portfolios better to weather an economic downturn and help reduce default risk.

3. The End: As evidence of a recovery becomes more evident and the Fed approaches the end of its rate cutting cycle, reducing duration and adding incremental risk may be rewarded. Fixed income instruments that offer a heightened risk/reward profile should benefit as the economic cycle bottoms and regains momentum. Tactically reducing duration will help to mitigate interest rate risk and offset headwinds from potential policy rate increases.

The Fed’s path has caught many investors off-guard this year and continues to create uncertainty and debate. Yet, with leading indicators showing that shelter inflation is likely to decline over coming months, investors should now prepare their portfolios for the coming stages of Fed policy. In the near-term, shifting to a longer duration position and a bias towards higher quality credit will enable investors to take advantage of the rate cutting cycle and should also help provide downside risk mitigation as the economy softens. However, in the longer-term, as the economic activity starts to show signs of bottoming and the Fed approaches the end of its rate cutting cycle, investors should make their own pivot towards shorter duration and incremental risk.