By Barclays Investment Bank Analysts: Jeff Meli, Anshul Pradhan, Joseph Abate & Zornitsa Todorova

The world of fixed income is undergoing rapid and profound changes. New technologies are transforming the landscape of trading, at a time when record issuance of US Treasuries – the bedrock of global debt markets – is posing new risks to financial stability. Our Research analysts explore five seismic shifts affecting fixed income assets and markets in the next five years.

1. Treasury tsunami

America’s government bond market is braced for a deluge of issuance. Budget deficits are very wide and are likely to remain so, no matter what political configuration emerges from the elections in November. That has significant consequences for fixed income markets, and not just in the US.

For one thing, it means long-term yields in the US are likely to remain elevated, even if the Fed embarks on a rate-cutting cycle. Studies suggest that a 1 percentage-point increase in the projected deficit/GDP ratio leads to an increase of about 20 basis points in the 10-year Treasury yield, as investors demand compensation for an inferior fiscal profile.

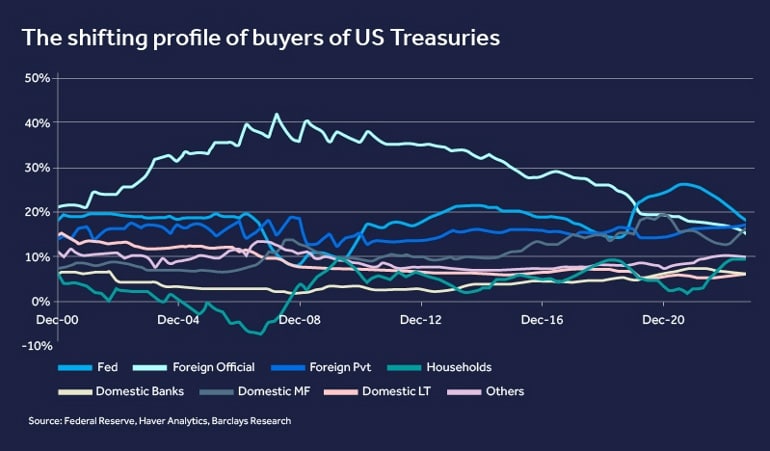

Our Research team also notes big shifts in the composition of Treasury buyers. Foreign central banks used to be the backbone of the market, but their appetite for US debt has faded as their pools of foreign-exchange reserves have shrunk or flatlined over the past decade. The US Federal Reserve has retreated from the market too, as it sought to shrink its balance sheet to fight inflation. In short, the baton has passed from those who need to buy to those who choose to buy, such as mutual funds and hedge funds.

That implies higher yields, and higher volatility, in the future.

2. When the US sneezes …

What does this mean for debt markets globally? The omens are not necessarily encouraging.

Also read: Market Evolution: Investing in Asset Backed Securities

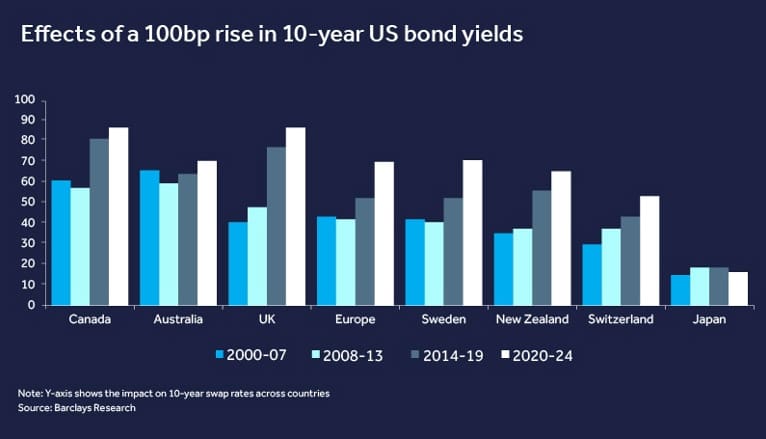

Major bond markets around the world often move in sync. Common characteristics of those markets – such as openness and reasonably free flows of capital across borders – mean that a sharp movement in interest rates in one jurisdiction can get transmitted quickly across others, even if the sizes of those markets are very different. In this context, the US has tended to matter more than fundamental links between markets and economies might imply. Spillovers appear to be amplified by the dominance of the US dollar and the enormous influence of the US Treasury market, where prices serve as benchmarks for trillions of financial assets.

However, the degree of this synchronicity is not constant. Our analysts find that it varies across geographies and points on the yield curve. Specifically, domestic factors can either soften or exacerbate the response of a specific bond market to gyrations in US Treasuries. Levels of sensitivity also vary over time, changing as macro conditions evolve.

But one thing is clear: any tremor in US Treasuries is likely to be felt far and wide.

3. A more fragile future

For regulators, watching over these rapidly changing fixed income markets will not be easy. Our analysts see something of a “trilemma”: authorities can try to create systems that function well, are low-risk and are free of moral hazard. But they probably cannot achieve all three aims at once.

The huge extra supply of US Treasuries set to wash over the market is likely to create new strains on intermediaries such as dealers. And vulnerabilities may not be obvious until they are exposed by events. Recent episodes such as the 2019 blow-up in repos, a market for interbank lending, and the COVID-induced “dash for cash” in early 2020 suggest that markets are increasingly prone to instability.

New regulatory constraints could exacerbate frictions. Take the central-clearing mandate from the Securities and Exchange Commission, due to be phased in from 2025. This looks set to relieve some strains on intermediaries but will likely introduce new ones in their place, which could add new costs as the size of the Treasury market increases. Each new requirement like this has the potential to add complexity and subtract flexibility, raising the chances of severe dislocations. Those, in turn, would require interventions from policymakers to restore stability – which could remove incentives for market participants to guard against risk.

The result: fixed-income markets are likely to become more fragile, subject to more regular bouts of illiquidity and heightened volatility.

4. The Equitification of credit

Advances in technology, products and protocols are shaking up the traditionally rigid world of fixed income, affording investors greater flexibility and a wider scope of strategies to fit different investment styles.

The rapid rise of exchange-traded funds, for example, has allowed investors to gain cheap exposure to benchmark corporate bond indices. In the US, the trading volumes of the largest investment-grade and high-yield ETFs are up by a factor of ten over the past decade and now account for about one-fifth of the total cash market.

The upshot is that credit markets are becoming much more like equity markets, where electronic trading and automated strategies took hold a long time ago. There will be limits, of course. Unlike the world of equities, where companies tend to be embodied by a single, fungible security, each issuer of bonds tends to have a variety of instruments that differ in ways that make them harder to trade and harder to track. Plenty of deals will still be struck the old-fashioned way, by calling up a broker-dealer.

But the broader “equitification” trend looks well entrenched. Our analysts expect investors to continue to benefit, chiefly by having a much wider array of trading and investment options.

5. A one-stop shop for Europe

These changes are coming at a dramatic moment for markets in Europe, where regulators are soon to mandate much more rapid and uniform disclosures of trades in corporate bonds. The establishment of a so-called “consolidated tape” will provide a single source of reference for prices, volumes and timings across all venues.

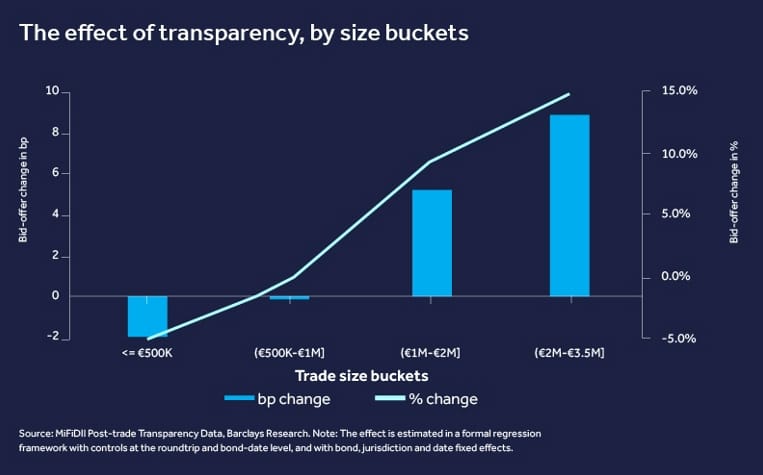

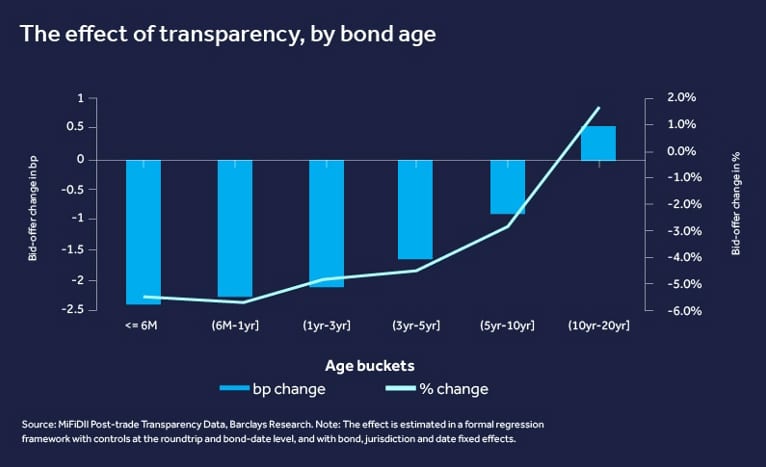

A centralised repository promises to bring Europe up to speed with the US, which has had a similar system for more than 20 years. Our analysts think the new framework will radically improve trade transparency on the continent, increasing the number of transactions reported without delay from about 8% to more than 80%.

Their analysis suggests, however, that the effects on transaction costs will be mixed, cutting expenses for small trades and for newly issued bonds, but raising them for larger trades and older instruments. That’s the flip side of greater transparency: If the entire market can see the details of trades, dealers are likely to charge more for the risk that prices move against them.

These findings contrast with studies in the past, which have tended to conclude that extra transparency leads to quicker and cheaper trades across the board. But those studies were done mainly before the Global Financial Crisis made dealers much more wary of committing their balance sheets. The effects of Europe’s revolution in disclosure are likely to be more nuanced than previously thought.