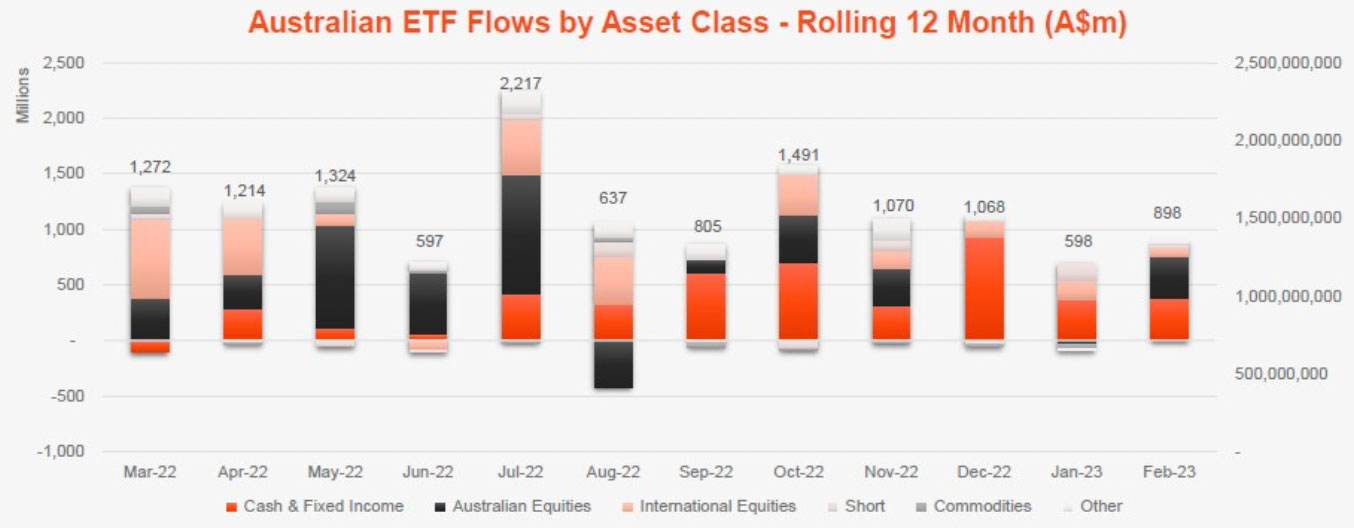

Investor flows have pushed the ETF industry to a new high even as markets decline according to the latest ETF review from Betashares.

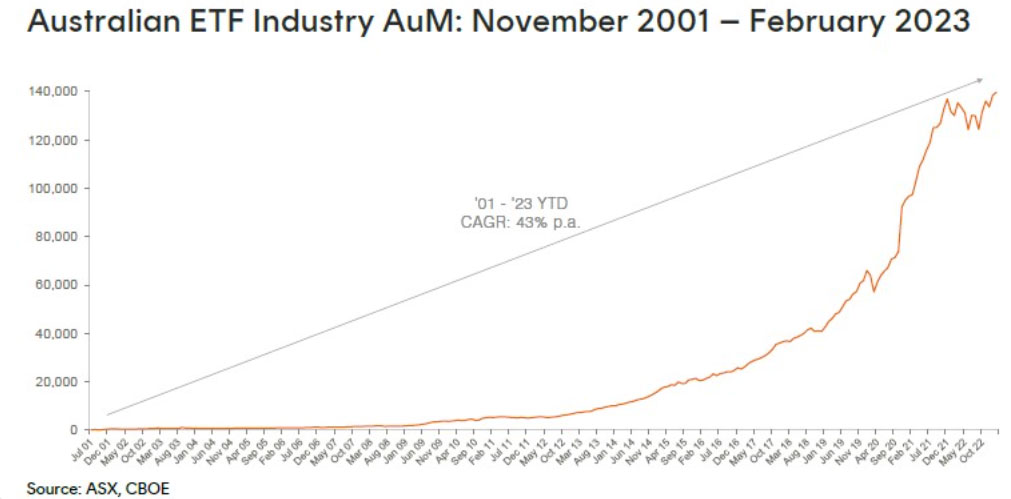

In February 2023, the Australian ETF Industry funds under management growth was 0.9% month-on-month for a total monthly market cap increase of $1.3 billion.

A new all-time high Australian ETF market cap (ASX + CBOE) of $139.7 billion was reached. Market cap growth for the last 12 months was 7.4% or $9.7. billion.

According to Betashares: “Notwithstanding falling sharemarkets investors continued to allocate to ETFs, with net inflows causing the industry to once again set a new all-time high in funds under management.”

Inflows to fixed income ETFs were just marginally lower than to Australian equities – $370m to $375m.

“Unlike January, this month we saw considerable interest in broad market Australian equities ETFs ($375m inflows), with investors seemingly taking the view that the ‘lucky country’ remains in a better position economically than other developed global markets. Fixed income exposures continue to remain popular receiving $370m of net flows.”

Top 5 category inflows (by $) – February 2023

Broad Category |

Inflow Value |

| Australian Equities | $375,829,518 |

| Fixed Income | $370,424,766 |

| International Equities | $71,242,183 |

| Short | $28,663,192 |

| Listed Property | $25,880,628 |