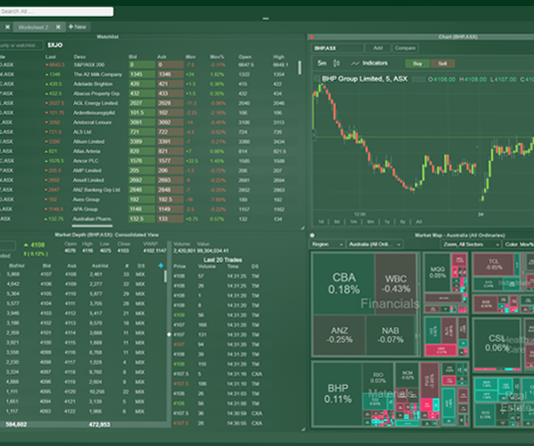

IRESS Clients Get Access To Australian Bond Exchange (ABE) Platform To Digitally Trade Corporate Bonds

Ben Ready

A new partnership between bond broker Australian Bond Exchange (ABE) and financial markets software and services group Iress will enable Australian investors to digitally...

As investors move through life, their appetite for risk and reward changes. It’s common for older investors to choose lower risk investments as they...

It was a quiet end to the week in the US as most Americans started to leave work (home) for Memorial Day holiday, which...

Donald Trump largely stuck to his script on Friday when talking about Hong Kong and China, so investors collectively breathed a sigh of relief....

Corporate watchdog ASIC is warning of a fake Qantas corporate bond scam targeting Australian investors.

ASIC said it was aware Australians have been directly offered...

Liquidators have been appointed to the two companies behind the XTB range of corporate bond ETFs following Equity Trustees suspending redemptions last month according...

Facebook's parent company Meta Platforms Inc. asked Morgan Stanley, JPMorgan Chase & Co., Bank of America Corp., and Barclays Plc to canvas investors for...

Afterpay buy now pay later rival Zip has successfully priced an A$400m senior unsecured convertible notes offer.

The notes are set to mature in April...

VisionFund International (VisionFund), the mission-focused microfinance subsidiary of children's charity World Vision, today announces it has raised AUD20 million with its first bond issue.

In...

Evolve Education (ASX: EVO) has successfully priced an issue of A$35 million 7.5% senior secured Australian medium-term notes in a wholesale offering.

The notes are...