In this educational article, Elizabeth Moran shows how Credit Default Swaps can forewarn investors of trouble ahead.

Large institutional investors with significant bond holdings will sometimes take out insurance against default and these contracts are known as Credit Default Swaps (CDS).

The buyer of the CDS will pay a fee on a regular basis to the counterparty. In return, the seller of the CDS pays out a certain amount if something goes wrong, just like an insurance payout.

CDS are quoted as a credit spread, which is the number of basis points that the seller of the derivative charges the buyer for providing protection. The greater the perceived risk of a credit event, the wider that spread becomes.

For example, the owner of a CDS quoted at 100 basis points would have to pay $1 to insure every $100 of bonds that they hold.

These contracts are typically only for very large institutions.

Also read: Investing Direct? My Top Tips for Assessing Bonds

The CDS market is worth around US$3.8 trillion, according to the International Swaps and Derivatives Association (ISDA). But the market is well below its 2008 peak of US$33 billion, based on ISDA data.

The CDS market is small relative to the size of the global bond markets, where there are more than US$120 trillion bonds outstanding.

Trading in CDS can be thin and the market illiquid but CDS are important as they provide insight into how the market perceives the chance of default of specific issuers.

Credit Suisse is a good example of how CDS can forewarn investors about heightened risk.

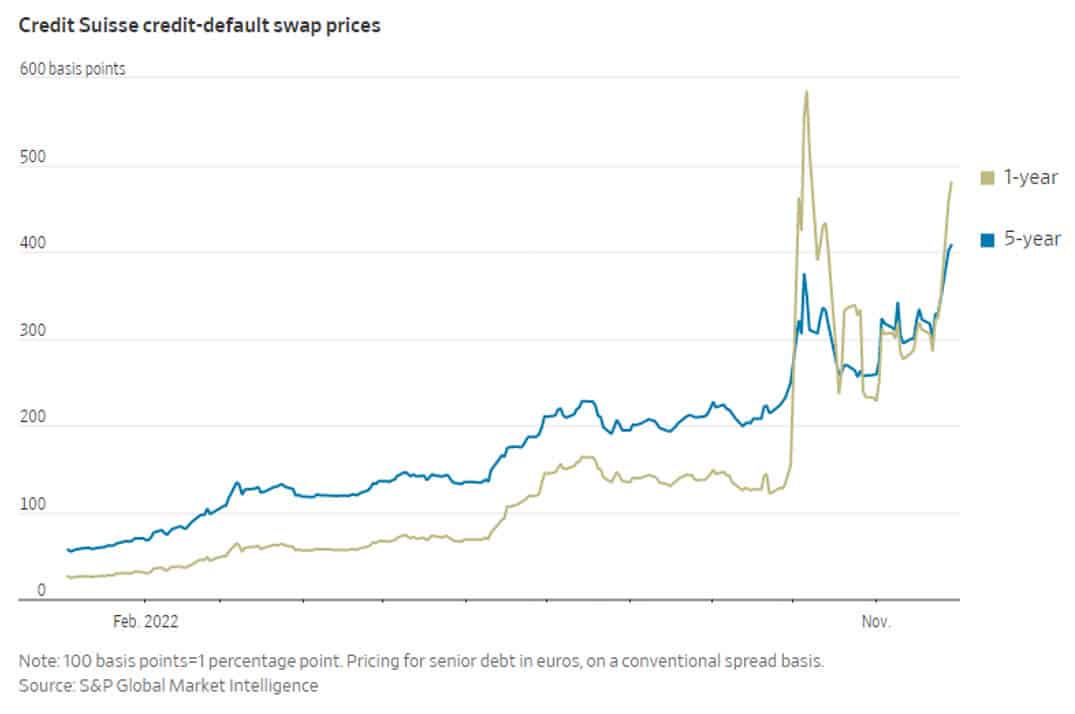

In November 2022, one year CDS spreads for Credit Suisse were over 400 basis points where they had been less than 100 basis points earlier that year.

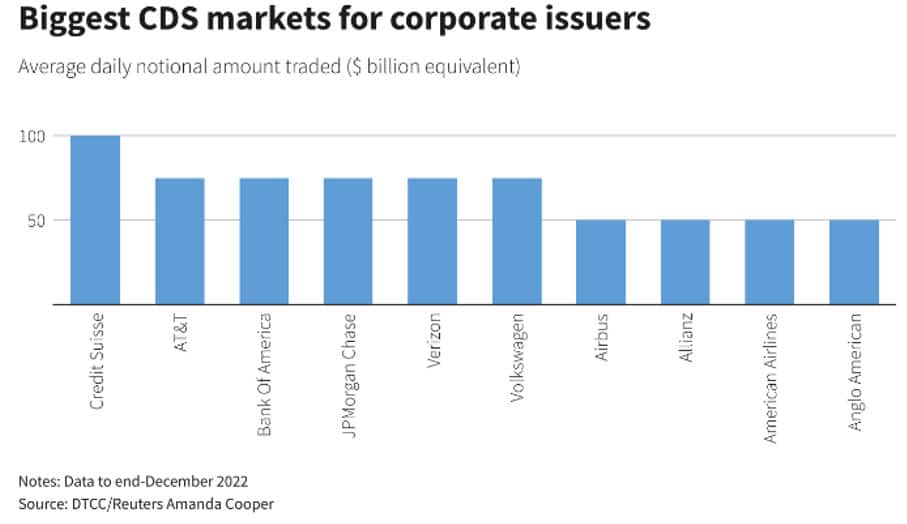

Further, 4Q22 Credit Suisse CDS volumes were high compared to other significant company CDS volumes. The chart below shows the high volume of Credit Suisse CDS, trading US$100 million per day, roughly 25% more than AT&T, Bank of America, JPMorgan Chase, Verzion and Volkswagen to the end of December 2022.

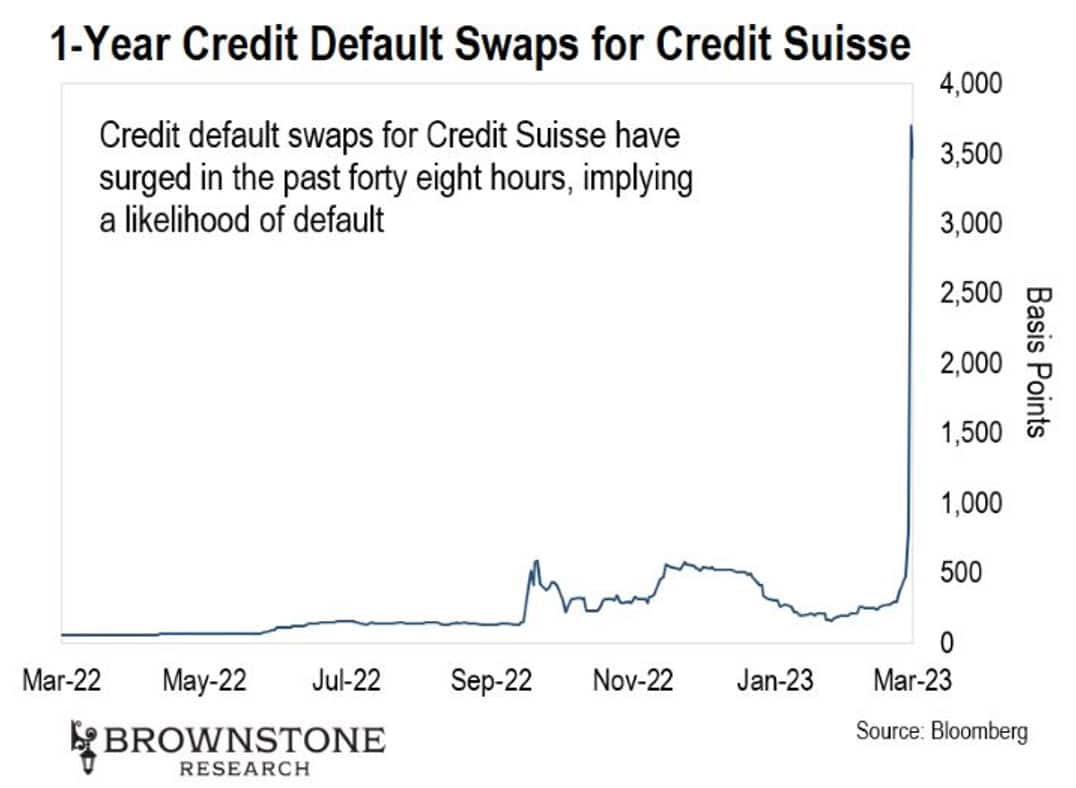

Credit Suisse’s CDS soared in March 2023 to 3,460 basis points. Anything at 1,000 basis points or above implies a high chance of default.

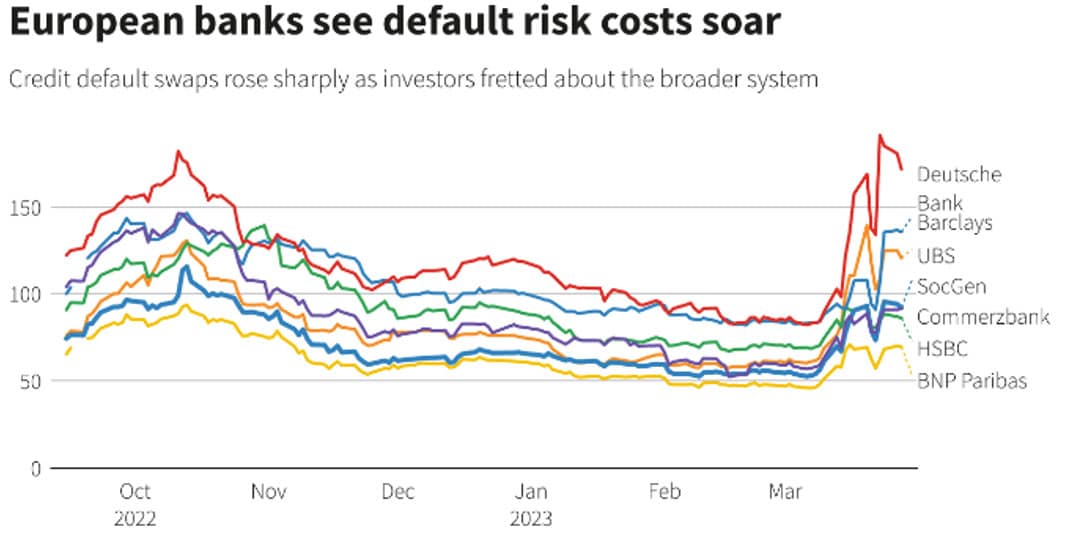

The perceived risk of broader European banking sector also rose with the possibility of contagion, and the CDS of major European banks rose sharply.

Ultimately the Swiss government along with UBS orchestrated a takeover for Credit Swiss and quelled fears of a wider European Bank crisis. See Capital Notes Holders Wiped Out in Credit Suisse Debacle.

It’s important to note, larger investors often trade in credit default swaps instead of the underlying bonds.