Global Asset Allocation Viewpoints and Investment Environment by T. Rowe Price Australia Investment Committee, as at 31 March 2023.

MARKET PERSPECTIVE

- Lagged impacts of central banks’ tightening to weigh on growth and earnings outlook in the back half of the year with expectations of lower inflation, but still above central bank targets.

- Recent banking crisis and unexpected oil supply cuts complicate inflation and financial stability puzzle for central banks, which could keep interest rate volatility elevated.

- While consensus builds for slower growth outlook, China reopening and resilient growth in Europe offer balance to otherwise negative sentiment.

- Key risks to global markets include central bank missteps, resilient inflation, steeper growth decline, broadening banking crisis, and geopolitical tensions.

Also Read: When Markets Twist and Turn, Flex Your Fixed Income

MARKET THEMES

It’s Complicated

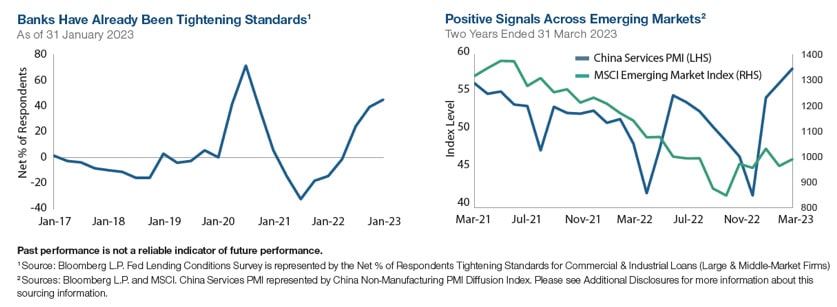

In light of the recent banking crisis, global central banks’ narrow focus on combating inflation has gotten more complicated as they are now faced with the added task of maintaining financial stability. In an effort to thread the needle in reinstating price stability while shoring up confidence in the banking system, the U.S. Fed announced a 25bps increase at its March meeting—an apparent compromise between a 50bps hike and no move at all, while at the same time swiftly launching a new emergency lending facility, the Bank Term Funding Program. This move is not unlike the Bank of England’s hurried rescue of the gilts market back in October while still pursuing a tighter monetary policy. While rescue measures have seemed to quell a broader contagion for now, the immediate impact may be a further tightening of credit within the banking industry, which was already occurring prior to the crisis. This added dimension has only made central banks’ mandates more complex, given the already limited visibility into the lagged impacts of their own tightening measures.

Finding the Sweet Spot

With consensus calling for an economic slowdown in the back half of the year as tighter financial conditions take hold, it is increasingly challenging to find areas of optimism amid the impending gloom.

However, emerging markets are one area that has done well recently— up over 17% off October’s bottom—that could continue to benefit from a lessening of headwinds. The recent outperformance was largely triggered by China’s surprise reopening from COVID lockdowns last fall, and while some of the euphoria has faded, recent data continues to show momentum and China policy makers are committed to stable growth, potentially providing a further boost. And while global growth is expected to slow, this should come with an easing of inflation pressures, lower rates, and further weakening of the U.S. dollar, all of which could be supportive for Emerging Markets. So unless global growth surprises significantly to the downside, emerging markets could find themselves in a sweet spot as we enter a period of slower, but not “off the rails” growth.

PORTFOLIO POSITIONING

- We remain underweight equities in favor of bonds and cash. Equities vulnerable to weaker growth and earnings backdrop, and still aggressive central banks could weigh on bonds as they continue to battle inflation, while cash continues to offer safety and attractive yields.

- Within equities, we neutralized the value overweight following the stresses in banks and the lower yield environment

- Within bonds, we are cutting our overweight to Australian bonds after the sharp drop in local yields in the past month. We are adding duration with US Long Term treasuries as risk hedge.

Note: T. Rowe Price’s Australia Investment Committee comprises local and global investment professionals who apply views from the firm’s Global Asset Allocation Committee to make informed asset allocation views from an Australian investor perspective. The Committee is led by Thomas Poullaouec, Head of Multi-Asset Solutions APAC, based in Singapore.