A Biden win in the US presidential election, and vaccines with 90% plus efficacy have lifted financial markets and sentiment has changed to a ‘risk on’ mentality.

All boats rise on an incoming tide, including high yield bonds. Purchases in the US to the week ending 11 November were US$3.3 billion. That same week, the average yield on the Bloomberg Barclays US High Yield Index fell to 4.56% below the previous record of 4.83% in June 2014. The contraction was the steepest since April when the US Federal Reserve expanded its corporate bond-buying program to include some high yield debt.

Interest in this asset class has hit new highs as investors search for yield in a zero interest rate environment.

Markus Mueller, Co-Founder at the Australian Bond Exchange (ABE) said: “The RBA is buying bonds and buying the yield curve to reduce rates across the board.” Investment-grade bonds, including companies like Qantas, which was not so long ago rated sub-investment grade, are being sold to even more investors as they are repo eligible.*

Mueller is happy Australians are discovering the asset class and the benefits on offer but also concerned that in the search for yield, some investors are overlooking the risks. He cautions investors to do their research before they invest and commented: “We do our homework at Australian Bond Exchange, we don’t want clients paying too much to get into the market or at the end of the day, for them to lose money.”

Also read:

Westpac Launches A New Hybrid – Westpac Capital Notes 7

Australian Bond Exchange Opens Another Door To Access Bonds

A great example of a successful high yield bond is NextDC which Mueller strongly supported over the past couple of years. Unfortunately for bond investors, the company has been too successful and it has been able to refinance its debt via a diverse set of new and existing banks which means all the outstanding bonds have been called early and will be repaid on the 9th of December. This wall of cash, of course, will put further upward pressure on prices of existing high yield offerings and the search for yield continues to challenge investors to acquire existing bonds at a reasonable price.

Change is coming as new structures emerge to offer the sorts of yields investors are seeking and the recent Pallas Capital bond paying 7.5% per annum over four years is a good example. See the recent FINA article here.

At the moment high yield bonds, that is bonds that are rated below investment grade BBB- or are unrated, are yielding around 4% plus.

* The Reserve Bank applies minimum eligibility criteria to purchase securities under a repurchase agreement (repo). A security’s eligibility for purchase by the Reserve Bank under repo and the margins applied depends on the type of security, its maturity and/or its credit rating.

Direct high yield bond investment

Investing in high yield bonds direct gives you complete control over exposures to various companies. For example, if you don’t like oil, you can chose to avoid the sector. Here are some tips when investing direct:

- Invest a small amount in many bonds

- Read widely about the company and its strategy

- Do you think the company can survive for the term of the bond?

- Check the company’s debt maturity profile, are there any bonds maturing before the bond you invest in? What liquidity does the company have access to so that it can meet its repayment schedule?

- Is there an opportunity for a credit rating upgrade or downgrade that can impact pricing positively or negatively?

- What assets does the company have it can sell to make sure you get repaid?

- Are there any covenants helping to protect your investment? For example, limiting further debt incurrence or maintaining certain financial ratios such as interest cover

- Expect to incur losses

- Read the prospectus and understand what the company think are the risks to the investment

ABE buys bonds in the wholesale over the counter market in $500,000 parcels, then fractionalise them into $10,000 parcels. Investors can buy the bonds through their financial adviser or accountant who transact using the IRESS platform. The platform brings a new transparency to pricing and simplifies the process – there is no need to set up an account with a bond broker. Investing this way negates the high minimum overall investment requirements of many other bond brokers. Minimum investment is $10,000 per bond and the market is open to retail investors as long as the bond is ‘seasoned’, that is, has been trading for 12 months.

ABE’s custodian is Perpetual who Mueller says “Is a fantastic partner to help extend the market” and they also use Australian Money Market to help buy bonds.

Investing in high yield bond funds

For those of you that prefer to invest via a fund, there are many high yield funds on the FINA platform.

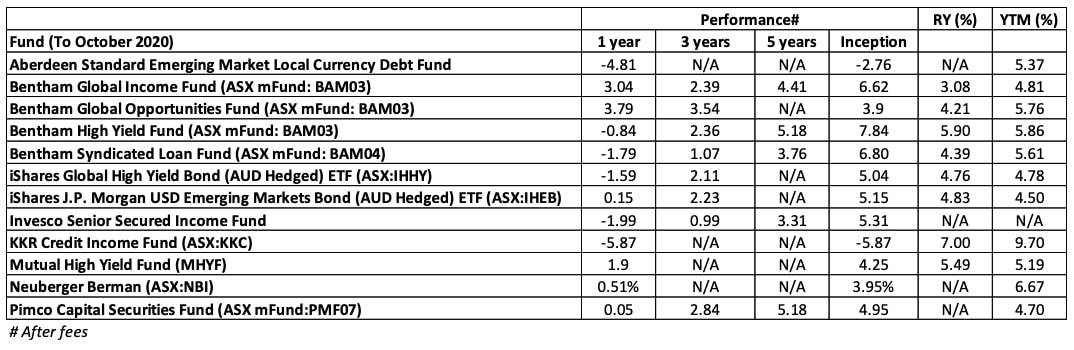

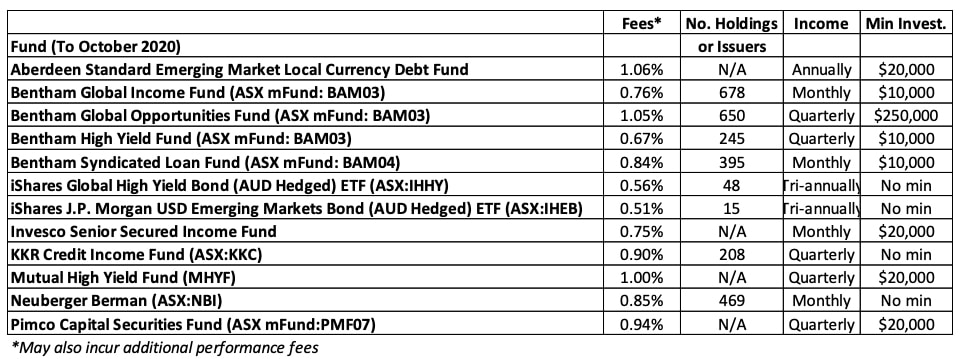

A sample of high yield bond funds can be found below. For the year to 31 October 2020, half reported negative returns the highest being KKR Credit Income Fund (ASX:KKC) at -5.87%. This fund has a high proportion of its portfolio invested in CCC rated bonds, implying the portfolio is very high risk. This is also borne out by the high yield to maturity figure of 9.7%, far exceeding many of the other funds on the list. KKC is a listed investment trust and trading at circa $2.11, despite listing at $2.50.

KKR Credit Fund price since listing

While one-year returns look low, more recent returns of one and three months have risen. For example, the Aberdeen Standard Emerging Market Local Currency Debt Fund which had a -4.81% return to 31 October 2020, had a one-month return of 2.28% and three months of 1.59%.

Things to look for in high yield bond funds, in addition to the points mentioned above:

- Transparency of underlying holdings, including individual exposure, credit rating, sector etc. Some funds are funds of funds, are they taking fees on both funds? What is the level of arrears or credit impairments? How did the fund do during the GFC or has it not been operating that long?

- Diversity of sub sectors and geographical location

- Performance over time, how consistent have they been?

- Fees, management and performance

- Yield to maturity and running yield

- Is there any skin in the game?

Note: None of the investments mentioned in this article are recommendations, but are for educational purposes only.