Over the last decade, Australia’s lending landscape has transformed. Gone are the days when the “big four” controlled the vast majority of Australians’ credit needs. We’ve seen an influx of Non-Bank Lenders (NBLs) to the market, increasingly providing technology-driven lending solutions that traditional banking models have difficulty competing with. NBL’s are usually focused on a specific area of lending; they may provide personal loans, home loans, equipment finance or auto loans. NBLs’ risk management processes, while rigorous, have greater allowance for the varied reasons someone may require a loan. In comparison to large banks, NBL’s often have significantly shorter loan approval timeframes, which may also be more attractive to a borrower.

For these reasons, it’s expected the demand for NBLs will continue to grow, and with it their need for financing. While some changes in the banking sector may prove to be cyclical, NBLs are expected to play a valuable role in Australia’s expanding lending landscape.

However, as their business grows, NBLs are faced with the unique difficulty of acquiring capital to support their clients’ demands without the backing of billions in consumer deposits that the banks have the benefit of.

As they are not Authorised Deposit-Taking Institutions (ADIs), NBLs rely on funding from the investment community (financiers) to finance their loans. These financiers typically consist of superannuation funds, specialist fund managers and (ironically) major banks. Understandably, these investors require a certain level of comfort and quantification surrounding the risk and return of their investment. This is often solved by funding through a warehouse structure rather than loaning money to the NBL directly. Think of a warehouse as a trust with clear and defined rules as to what types of loans the NBL can use the money for.

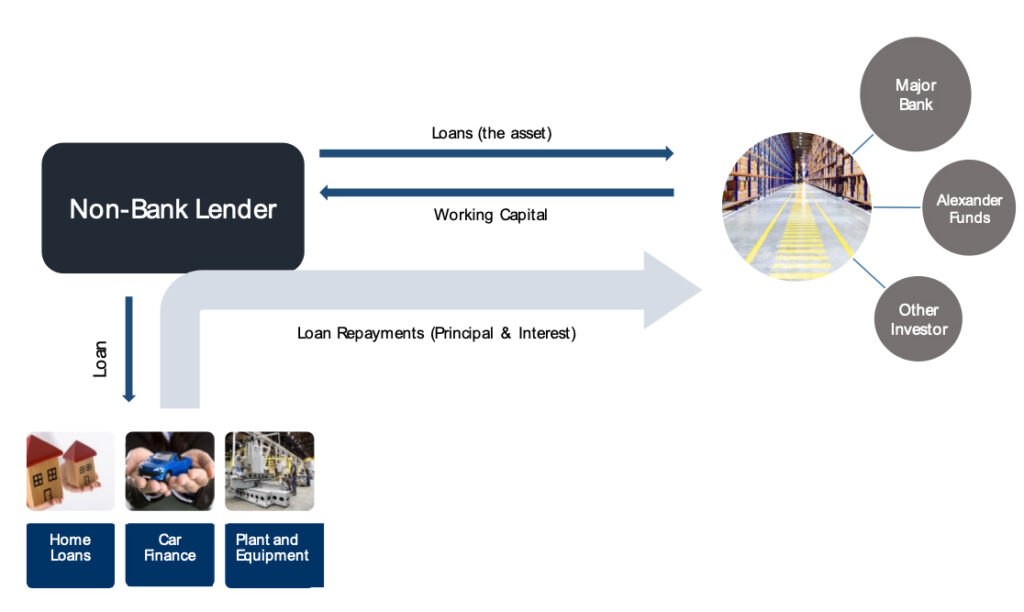

In a warehouse structure, individual loans are serviced by the NBL, with interest payments being provided to the financiers at an agreed rate. In simple terms:

- Financiers/investors place the ‘working capital’ in the warehouse for the NBL to on-lend to various borrowers within the constraints of the warehouse agreement

- The assets (loans) sit within the warehouse,

- The principal and interest repayments from the borrower are made to the warehouse rather than directly to the NBL

- The warehouse uses the principal and interest repayments it receives to pay its investors an agreed rate of interest, with the residual returning to the NBL.

WAREHOUSE FUNDING – HOW IT WORKS

The warehouse is the holding vehicle for the loans (assets) as opposed to these sitting inside the NBL directly. The significant benefit to financiers and ultimately their underlying investors is that the loans are held separately to the operations of the NBL itself.

The warehouse structure is beneficial to financiers because it provides them with significant control over the parameters of the loan portfolio and the types of loans which can be added to the warehouse. It also allows for far greater diversification as oppose to lending to a single entity – the financier is essentially accessing investments in potentially thousands of underlying loans issued by the NBL. This further mitigates the impact of a default on a single loan.

Major banks often provide warehouse financing and are quite often the largest funder in any given warehouse. In recent years the changing legislation around capital requirements for banks in Australia meant that certain types of lending became increasingly attractive (such as residential mortgage lending) while others, such as commercial real estate lending, were seen less favourably. As a result, banks were motivated to reign in their lending in many market sectors. Warehouse structures are a convenient way for banks to gain exposure to a diversified loan pool, without the added capital requirements and without needing to undertake extensive work at the individual loan level.

Also read: What is a Credit Spread?

A bank does not typically fund an entire warehouse on its own, which is where specialist fund managers come in. Often these specialist fund managers will take a small portion of the warehouse at a higher rate of interest and higher risk as they may rank behind banks in the event of default. This is not to say that warehouses are inherently risky, as with the right warehouse agreement in place risks can be heavily mitigated.

Warehouse investing is a valuable opportunity for both credit fund managers and their clients given the significant challenges of the current environment. Credit spreads (the difference between the rate at which institutions can borrow and the risk-free rate) have tightened making it more difficult for investors to generate the levels of income they need or have gotten used to. Despite this, the appetite for income has not diminished. The investor is faced with the reality that there are now fewer options available to construct their portfolios without taking on more risk in this lower return environment. So what are some potential alternatives?

One option is to buy credit securities with longer maturities, which increases credit duration risk. However, should credit spreads widen, the chance of a portfolio losing value increases. A second option would be to move down the capital structure and take on greater default risk, potentially altering a fund’s risk profile as the rating and quality of such investments will likely be lower.

Alternatively, if the manager has the necessary expertise and flexibility, they could invest in private credit – specifically warehouse financing – a growing sector of the credit market with tremendous diversification benefits. A great opportunity, however, one that does require specialist skills.