Shan Kwee, CFA, Portfolio Manager in the Janus Henderson Australian Fixed Interest Team, discusses how despite a tough 2022, opportunities still exist in credit markets for investors who know where to look.

With the La Niña weather pattern inundating us with rain this past year, it’s hard to imagine that a drought is looming, but as central banks continue to tighten, the abundant liquidity we’ve become accustomed to will dry up fast. As capital provision becomes more judicious around risk and compensation, some companies will struggle to survive. For credit investors, this means a focus on quality before price is paramount. It also means direct company engagement and an active approach to investing are more important than ever.

An outlier year for returns

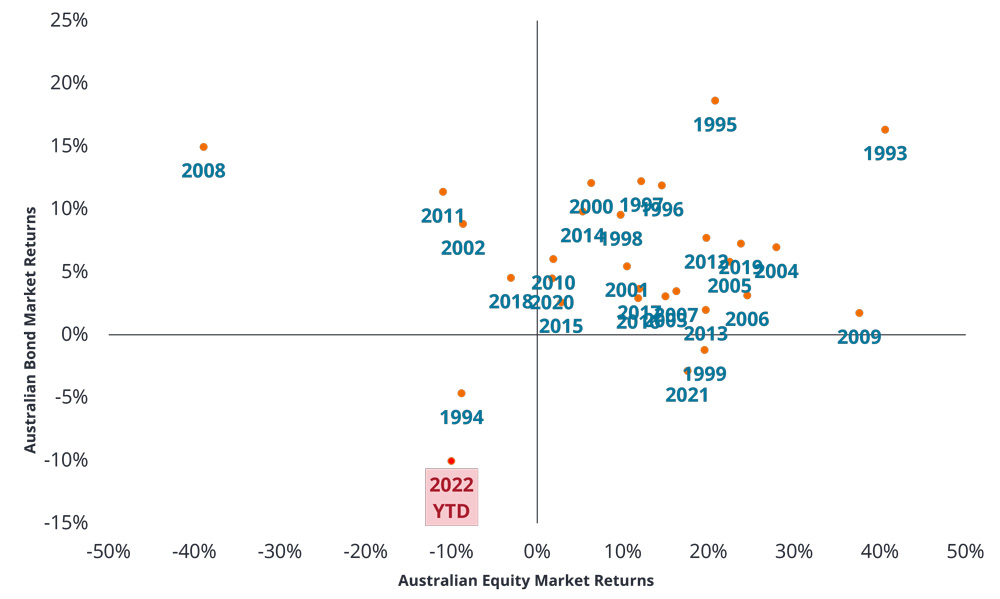

In a year where equity markets have been rocked by volatility and uncertainty, fixed income has shown uncharacteristic correlation to growth assets, leaving investors questioning its traditional role as ‘portfolio insurance’ in a diversified investment portfolio.

Chart 1 demonstrates the effect of a rapid tightening in monetary policy. While relatively rare events, in periods of swiftly tightening rates, bond returns turn negative and equities fall on expectations of recession. In 1994, 2.75 percentage points were added to the cash rate over a period of 4 months, while so far in 2022, we have already seen 2.50 since May. While we can’t predict that 2023 will exhibit a recovery like the one experienced in 1995, value in bonds is being restored. As markets acknowledge tighter policy is working to slow growth and inflation, bonds can exhibit their ‘portfolio insurance’ properties once again.

Credit ‘alive and well’ despite rising rates

Despite the rising interest rate environment, we believe that pockets of the Australian credit market are alive and well, offering good levels of compensation for risk. That being the case, our approach in these market conditions is to keep powder dry for when markets hit rough patches to capitalise on buying opportunities when quality goes on sale. Through various cycles we have observed that valuations overshoot fundamental fair value in periods of heightened uncertainty or acute needs for liquidity, one such example being the recent liquidation of assets from UK pension funds.

Also read: Altius Asset Management Releases Inaugural Impact Report

As we move into an environment of slowing growth, high rates and tighter liquidity, the risk of wealth destruction and the potential for permanent capital losses in the form of defaults is magnified. Like buildings in a storm, those with solid fundamentals are far more likely to survive, while the less solid, riskier and illiquid companies are more prone to feeling the severe pinch of more discerning capital allocation.

Rising cash rates’ silver lining

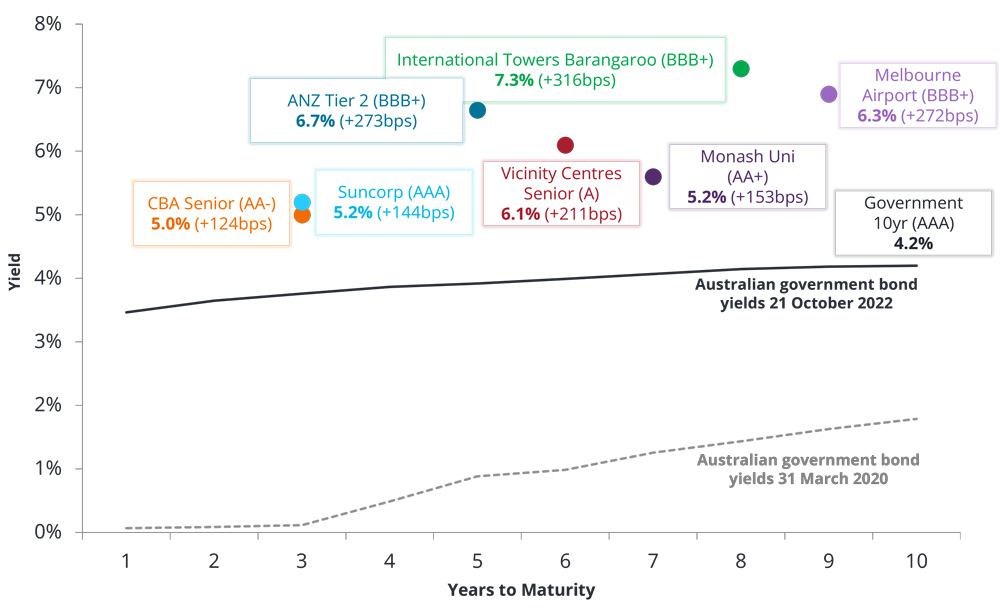

A silver lining for investors with the swift rise in cash rates is that the yield available from the highest quality and most liquid parts of the fixed income markets now offer some attractive levels of income. We believe attractive yields on high quality credit securities are seeing demand return from defensive income investors as they provide some shelter in these blustery market conditions.

We remain attentive to the slowing growth environment and the potential for weakening credit fundamentals, which put downward pressure on credit ratings. As depicted in chart 2, our ‘quality before price’ approach aims to identify industries and companies that are well prepared and able to remain stable and sustainable in credit quality. In our view, relative to Australian government bond yields, these credit securities offer attractive total and excess credit returns over the coming cycle.

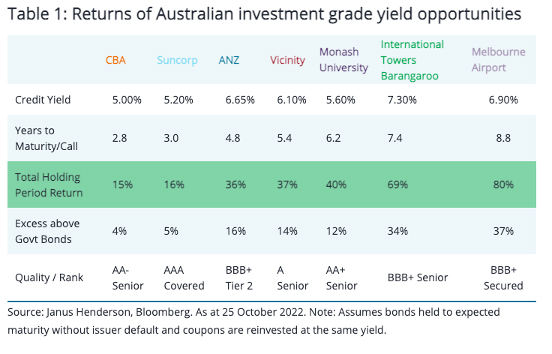

Looking at the compounded income return available from these investment grade securities, they produce healthy total returns on a hold to maturity basis (As shown in Table 1 in the Total Holding Period Return row). This provides investors a reasonable cushion and compensation into a slowing growth environment across the forward-looking fiscal years.

Beware the great repricing

Commitment to tackle high inflation through tightening global liquidity will continue to generate volatility in credit markets. To navigate the environment ahead, investors should look for improved compensation for risk. We observe that the repricing across different pockets of credit and risk premia have not been simultaneous, providing outperformance opportunities through active rotation.

In our view, the more illiquid, structured, and levered sectors of the market are yet to adequately reprice. This is a process that will occur in due course as earnings outlooks weaken. We anticipate that as conditions tighten further, global spreads will suffer decompression, where high quality liquid credit outperforms lower quality as compensation for default risk and illiquidity needs to increase. In our view, a focus on mitigating downside tail risk, mismatches in underlying liquidity, and bottom-up understanding of security complexity will produce a more robust portfolio.

A simple, but proven approach

Our approach in these conditions is simple – we continue to favour being positioned up in quality and seniority in capital structures, leaving powder dry for when compensation for investors escalates.