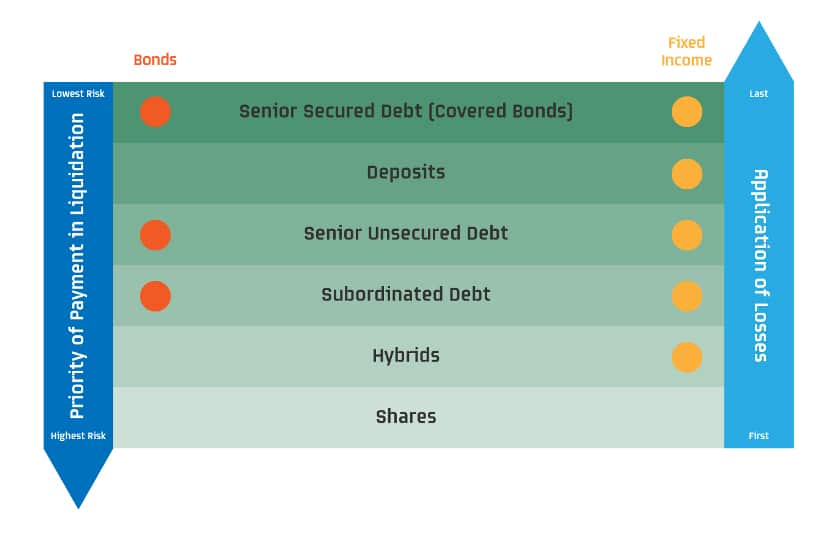

There are different levels of debt or bond investment in companies. The level that you invest in will be dependent on the risk you are prepared to take and the return you want to achieve.

The lowest risk and highest quality investment in any single company is secured senior debt (senior secured bonds). This debt has defined security and if the company has difficulty meeting interest or principal repayments, the security is sold and the proceeds are used to repay this secured debt investors first.

Any remaining funds are returned to senior unsecured debt holders (senior bonds). These investors lend without any specific security covering the debt. Investors at this level take on more risk but can achieve greater returns than secured debt investors.

The third level is known as subordinated debt (junior bonds known as sub-debt) as it’s junior in the structure to senior unsecured and senior secured debt. It is an important level as investors take on even more risk but can achieve higher returns if the company continues to perform and pay all its liabilities.

Financial institutions and insurance companies are big issuers of subordinated debt. Aside from raising valuable funds for operations subordinated debt helps meet regulatory requirements.

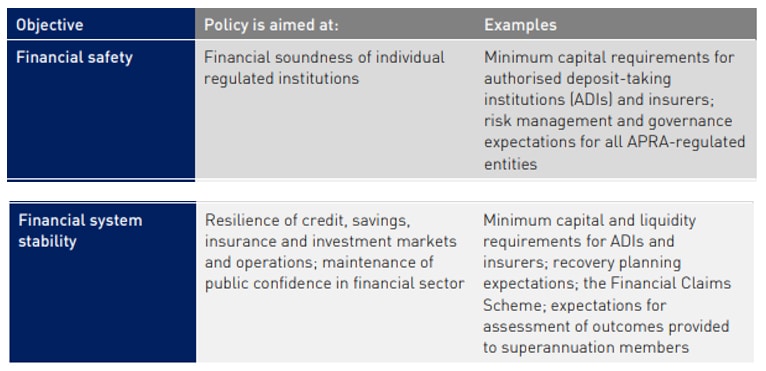

Financial regulator, APRA deems that financial institutions and insurers must set aside funds to help lower the risk of the company and protect the stability of our financial system.

Issuing subordinated debt helps companies meet APRA’s prudential standards. Two of APRA’s objectives – financial safety and financial system stability are detailed below.

Source: APRA’s policy priorities 31 January 2018

Tier 1 and Tier 2 Capital – Confusing but worth understanding

In order to protect depositors from the risk of a bank becoming insolvent, APRA requires banks and other authorised deposit-taking institutions to fund themselves with a minimum amount of capital. To determine the minimum amount of capital that banks must have, APRA sets minimum capital adequacy ratios.

APRA’s capital requirements also come in different levels. The most important to financial institutions is Common Equity Tier 1 capital which includes share capital, other capital and reserves. Importantly, this is considered the highest quality capital as it does not carry any obligation to pay a dividend or be repaid at any time – it’s a perpetual investment.

Tier 2 capital, from an institution’s perspective, is not as good a quality as Common Equity Tier 1 capital as it has obligations – Tier 2 debt must pay agreed interest payments (known as coupons) and the debt has a maturity date. Subordinated debt is part of Tier 2 capital.

Subordinated debt features

Subordinated debt has important features that help can help a financial institution if it gets into financial difficulty:

- It is issued for longer terms compared to senior debt. For example, bank subordinated debt is usually issued for 10NC5 terms (10 years non call 5), whereas senior debt typically has five-year terms. After five years, banks have the option to repay subordinated debt investors but not the obligation, so can defer repayment until finances have improved.

- Subordinated debt has a ‘non viability’ clause. APRA, at its discretion can deem a bank is ‘non viable’. If that happens, then subordinated debt is converted to shares, the lowest level in the capital structure and losing its rights to income and principal payments.

In a liquidation scenario, subordinated debt is not repaid until all senior debtholders and unsecured creditors are paid first.

Bendigo and Adelaide Bank example

In November 2020, Bendigo and Adelaide Bank issued a $150 million subordinated bond. The bond has a first call in November 2025 and maturity in November 2030. It is a floating rate bond and was priced at 3 month BBSW +195 basis points (100 basis points (bps) = 1%).

For more information see ‘Simplified Bank Capital Structure – Being on Top Gives You The Best View’, and ‘The Basics – Some Fixed Income Terms Explained’ .