Over the last year we’ve seen new hybrid issues from the four major banks: ANZPI, CBAPJ, NABPH and WBCPJ.

The four hybrids all had slightly different terms including the initial margin, and first optional exchange date and the size of the transaction. Demand for the new issues was high and all were upsized to provide relatively cheap funding for the banks and to satisfy retail investors.

Notably, the issue margin has compressed for all four hybrids, see the table below. The two higher issue margin hybrids NABPH (3.50%) and WBCPJ (3.40%) have delivered solid price increases to those that bought them at $100 face value with the hybrids trading at $104.91 and $104.62 respectively at the end of trading on 5 August 2021.

| Major Bank Hybrids | ||||||||

| ASX Price | Option Exchange Date | Distribution Rate | Initial Margin | Trading Margin | Yield to optional exchange | Issue Size ($m) | ||

| ANS Capital 6 Notes | ANZPI | $102.29 | 20/03/2028 | 2.12 | 3.00 | 2.65 | 3.6 | 1500 |

| CBA PERLS XIIII | CBAPJ | 101.5 | 20/10/2026 | 1.94 | 2.75 | 2.52 | 3.27 | 1180 |

| National Bank Capital Notes 5 | NABPH | 104.91 | 17/12/2027 | 2.47 | 3.50 | 2.72 | 3.64 | 2386 |

| Westpac Capital Notes 7 | WBCPJ | 104.62 | 22.03.2027 | 2.40 | 3.40 | 2.58 | 3.40 | 1400 |

Source: Bell Potter at at 6 August 2021.

The CBAPJ has had the least price appreciation given its tight 2.75% issue margin but has still compressed since first issue trading at 2.52%. Some of the lower margin will be because of its shorter expected term to first optional exchange, five months ahead of WBCPJ and 12 months ahead of NABPH. Further, as CBA is viewed as the best credit quality/ lowest risk major bank, it’s little wonder it has the tightest margin.

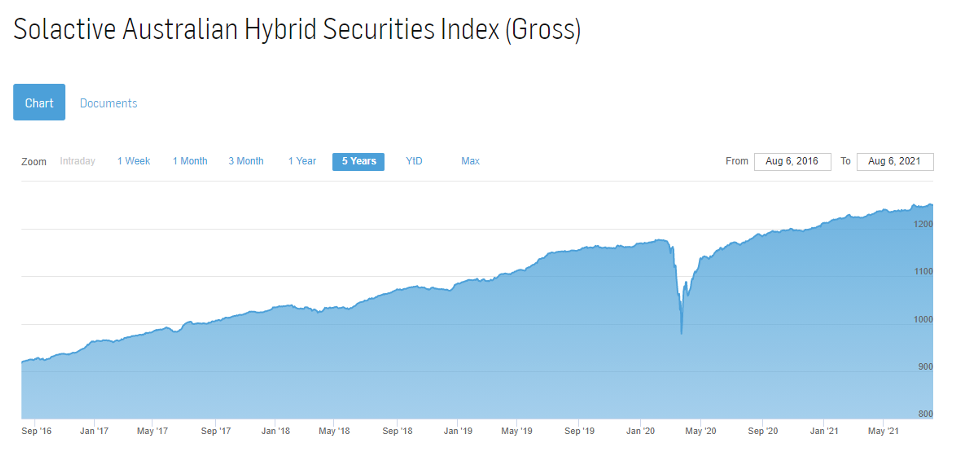

Some readers will find this security the most attractive, but in a very stressed market, all hybrids will lose capital value. See the chart below showing the steep drop in the Solactive Australian Hybrid Securities Index (Gross) in March 2020, dropping circa 200 index points.

Which hybrid is the ‘best buy’?

In such a tight market and with little separating the four majors, my preference would be for the highest trading yield option. I’d prefer to stick with the major banks securities as they are lower risk than the others available.

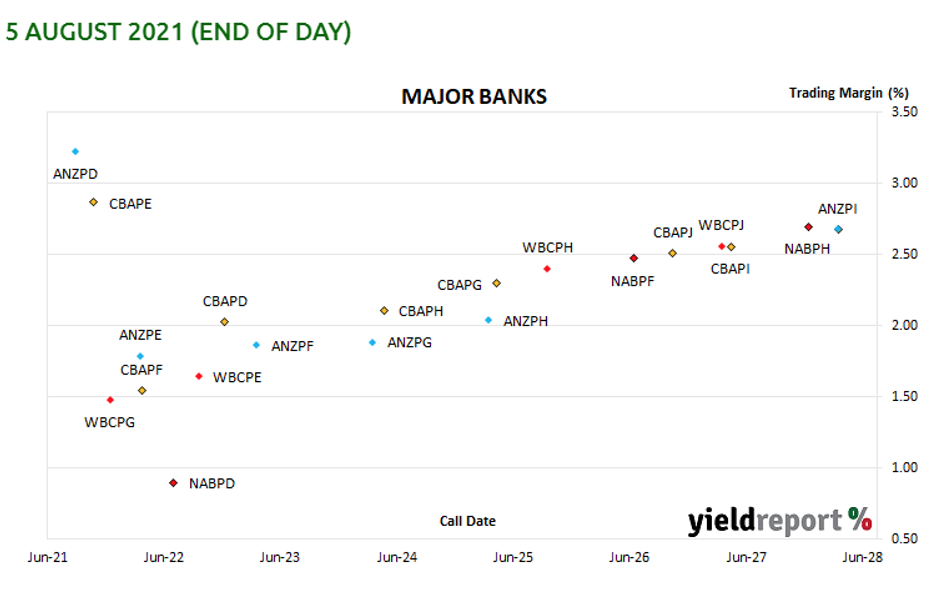

The chart below from YieldReport shows the trading margins of the major bank hybrids.

The ANZPD and the CBAPE have the highest margins, but the ANZPD has been called, that is, will be redeemed on its first optional payment date of 1 September 2021 and the CBAPE will almost certainly be called and redeemed on 15 October 2021. With such short terms, there’s little point in investing, even assuming the holders would be willing to sell so close to redemption!

Aside from these two securities, there are a few outliers such as the CBAPD, that had a very low margin of 2.80% when first issued as so is less attractive to investors looking for income, while the NABPD was issued with a high margin of 4.95%, so has been relatively more attractive, reducing the trading margin.

If you then drew an ‘average’ line starting at WBCPG out to ANZPI we would have a rough ‘yield curve’.

NABPH with its slightly higher trading margin of 2.72% and optional yield to call of 3.64% offers the best returns of the four major bank hybrids issued over the last year and would be my pick.

Why are major bank hybrids attractive?

- Interest income is at a floating rate. If inflation rises, income on the securities will likely rise as well.

- Implied investment grade credit ratings. While the credit rating agencies do not rate Australian major bank hybrids, they provide a methodology which allows us to deduce an investment grade credit rating.

- Major banks continue to meet first optional call conditions, supporting intentions to continue meeting investor expectations.

Risks

Hybrids are risky, complex securities that are structurally subordinated in the capital structure see Simplified Bank Capital Structure – Being on Top Gives You The Best View. In stressed markets they do not provide downside protection and act more like the underlying shares. In certain circumstances, the hybrids convert to shares to protect the ‘survivability’ of the issuing financial institution.

Hybrids are perpetual investments. They do not have a maturity date. While they have call dates, certain conditions need to be met for them to occur.

This article does not constitute investment advice and is general in nature. The information does not take into account your objectives, financial situation or needs. It is not specific to you, your needs, goals or objectives. Because of that, you should consider if it is appropriate to you and your needs, before acting on the information. If you don’t know what your needs are, you should consult a trusted and licensed financial adviser who can provide you with personal financial product advice. In addition, you should obtain and read the product disclosure statement (PDS) before making a decision to acquire a financial product. Please read our terms and conditions for further information.