Guest author Phil Strano from Yarra Capital Management illustrates why it’s important for bond investors to understand if they are investing in a holding or an operating company. He cites recent issues from Aurizon and Charter Hall and explains Yarra Capital’s strategy.

Robust primary corporate issuance in the Australian Medium Term Note (AMTN) market has been a key feature of 2021, with a bumper $6.3bn of bonds/notes issued in the five months to the end of May, across REITs, Infrastructure, Utility and Industrial issuers. Judging by their strong performance in secondary markets, most of these deals were priced attractively (or at least fairly), though opinions vary on the overall attractiveness of some of these primary issues and the perceptions of risk and adequate returns.

Two deals thus far in 2021 have been especially noteworthy in illustrating just how widely investor opinion and pricing can vary in a marketplace, and how perceptions of risk can splinter when issuing out of Holding Company (HoldCo) vs. Operating Company (OpCo) corporate structures.

Holding companies typically do not hold any assets and are thus structurally subordinated to operating companies that do hold assets, in the event the company goes into liquidation. As an investor, it’s important to understand the company structure, which of the subsidiaries holds the assets and then make a relative judgment call between companies that issue similar featured bonds. Investors need to make sure they are being rewarded sufficiently for the risks involved.

Aurizon

Firstly, let’s look at the Aurizon Operations (AZJ) 7-year $500m bonds issued in early March at a credit margin of 175bps. Having established a new corporate structure in 2018, AZJ’s holding company now issues debt from its OpCos separately:

- Networks (below rail),

- Operations (above rail).

We internally rate each OpCo at BBB, or one notch below Moody’s at Baa1.

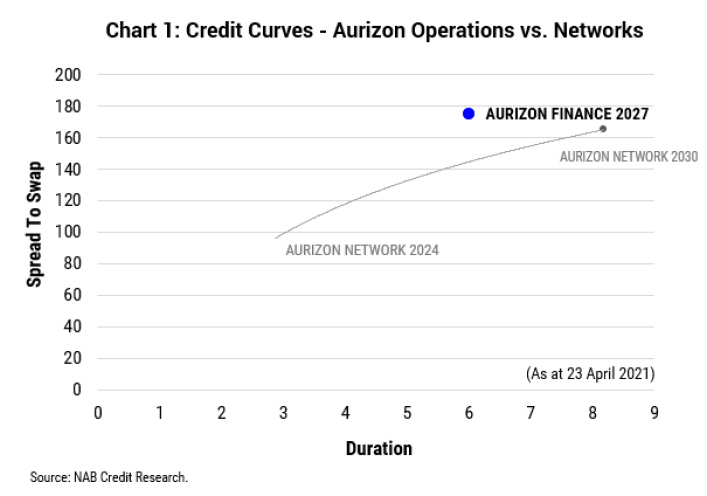

Despite Networks and Operations having identical credit ratings, the inaugural AZJ Operations 7-year bond priced at an attractively wide spread premium (+50bps) to its sibling AZJ Networks (refer Chart 1).

In our opinion, while a spread premia of sorts was justified given Operations is more industrial like (i.e. backed by rolling stock assets) and Networks is instead more infrastructure like (rail track and associated assets), a 50bps spread differential appeared very generous. Both OpCos have optimized debt levels to maintain strong investment grade credit ratings and share the same parent, business mix and destiny.

Charter Hall

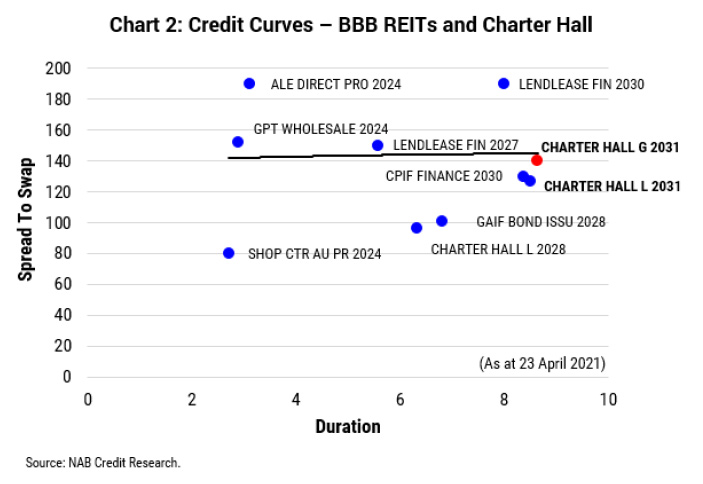

Now, let’s look at the Charter Hall Group’s (CHC) inaugural $250m 10-year bond issued in April at a credit margin of 140bps vs. the existing Charter Hall Long WALE REIT 2031 bonds (CLW). In this instance, the CHC bonds were issued out of the HoldCo and backed by minority equity stakes (generally less than 15%) and the CLW bonds were issued out of the OpCo.

As with the Aurizon notes deal, both CHC and CLW issuers have identical internal and external investment grade credit ratings, BBB+ and Baa1 (Moody’s) respectively. However, unlike AZJ, the distinctions in the risk profiles of the two securities, in our opinion, were not adequately priced in, with the spread premium for the CHC bonds over the CLW bonds a modest 15bps higher (refer Chart 2).

Moreover, the recent merger between the $5bn AMP Capital Diversified Property Fund and a Dexus wholesale fund provides an example of why the underlying risks associated with CHC’s HoldCo debt issuance needed to be priced higher. In these cases, management fee revenue can be transferred by investors from the HoldCo to a new manager with little or potentially no compensation. While Charter Hall’s hold on its assets is not under any near-term threat, we do believe their lack of direct ownership control over their HoldCos needs to be factored into any assessment of value.

The Yarra Absolute Credit Fund’s strict focus on maximizing risk-adjusted returns led us to participate in AZJ’s bond issue in March and decline CHC’s April offer. The Fund, which pays distributions monthly, has an average investment grade credit rating and currently offers a running yield of 3.77% p.a*.

A worst case scenario – Axxesstoday

One of the more recent examples in the Australian market was the respective HoldCo and OpCo bond issues by ASX listed finance company Axsesstoday. Both issues were priced at similar credit margins and time periods, but with very different risk profiles. The company subsequently got into difficulty in 2018 and defaulted. The asymmetric risk profile between the Holdco and Opco was borne out in administration:

- Holdco investors lost approximately 65 cents in the dollar, recovering 35 cents

- OpCo investors issued within the warehouse (secured against collateral) achieved full recovery

Both securities issued at roughly the same credit margin and with similar terms to maturity but, as it turned out, had very different risk profiles.

*as at 31 May 2021.

Glossary

Holding Company – A holding company is a business entity. Typically, a holding company doesn’t manufacture anything, sell any products or services, or conduct any other business operations. Rather, holding companies hold the controlling stock in other companies.

Although a holding company owns the assets of other companies, it often maintains only oversight capacities. So, while it may oversee the company’s management decisions, it does not actively participate in running a business’s day-to-day operations of these subsidiaries.

A holding company is also sometimes called an “umbrella” or parent company.

Medium Term Note – A medium-term note (MTN) is a debt that usually matures in five to 10 years. A corporate MTN can be continuously offered by a company to investors through a dealer with investors being able to choose from differing maturities, ranging from nine months to 30 years, though most MTNs range in maturity from one to 10 years.

Operating Company – A company that makes a good or provides a service that it then sells to customers or clients. An operating company contrasts with a holding company whose main function is to own other companies.